| | |

| | |

| | |

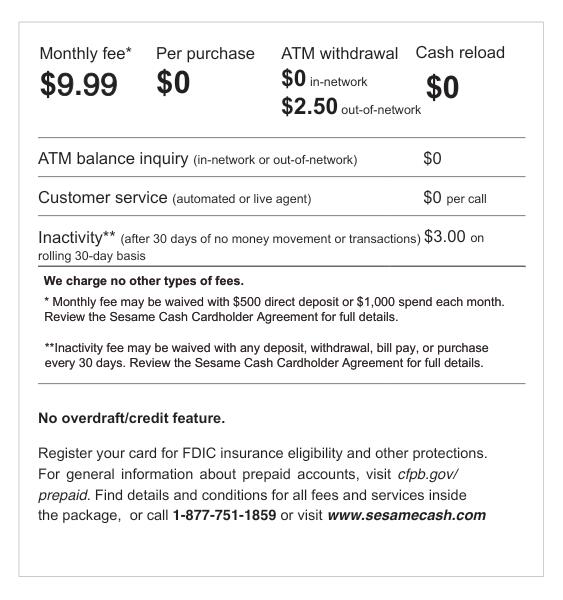

| | *Monthly Fee: The fee listed in the table above may be waived depending on how your Card is used. To qualify for fee waiver, you must either deposit $500 into your Card account via direct deposit or spend $1,000 each month. Spending can be satisfied either through bill payment or point of sale (“POS”) transactions. This fee does not apply within the first 30 days of account opening. Credit Sesame will review its records of your Card activity for a given 30-day cycle to determine fee waiver eligibility. By way of example, on or around September 1, we will review your purchases and deposits for your August cycle to determine whether or not the $9.99 fee will be charged. If you are charged a fee, it will be deducted from your Card account the following month and appear as a transaction in your online statement. For the avoidance of doubt, using the same example above, you will see a $9.99 charge reflected in your September transaction log for your August cycle. If your Card account has insufficient funds to process the charge, your Card account will go into a negative balance of up to $25 (The $25 negative balance cap would occur if you are charged a fee multiple months in a row. For clarity, the cap to the negative balance only applies to these fees and not any other charges incurred. |

| | |

| | |

ACH Transfer from your U.S. bank account | | This is our fee. Your bank may charge you an ACH transfer fee. To avoid this fee, set up direct deposit to your Card. |

| | |

Signature and PIN purchases | | |

| | |

ATM withdrawal (in-network) | | “In-network” refers to the Allpoint ATM Network. Locations can be found at https://www.allpointnetwork.com/index.html#where. |

ATM withdrawal (in-network) | | “Out-of-network” refers to all the ATMs outside of the Allpoint ATM Network. You may also be charged a fee by the ATM operator, even if you do not complete a transaction. To avoid this fee, request cash back at point of sale or withdraw cash from an Allpoint ATM. |

Cash Back at Point of Sale (Select “Debit” and enter your PIN to get cash back when making purchase at retailer) | | |

Customer Service and Account Information |

Customer service (automated) | | No fee for calling our automated customer service line, including for balance inquiries. |

Customer service (live agent) | | No fee for calling our automated customer service line, including for balance inquiries. |

Replacement/Secondary Card – Standard Delivery (7-10 business days) | | |

ATM balance inquiry (in-network) | | “In-network” refers to the Allpoint ATM Network. Locations can be found at https://www.allpointnetwork.com/index.html#where. |

ATM balance inquiry (out-of-network) | | This is our fee. “Out-of-network” refers to all the ATMs outside of the Allpoint ATM Network. You may also be charged a fee by the ATM operator. |

Using your card outside the U.S. |

International transaction | | This is our fee. If you withdraw cash or make a purchase in a foreign country in a currency other than U.S. dollars, the amount deducted from your funds will be converted to U.S. dollars by Mastercard using a rate selected by Mastercard based on the date the transaction is processed, which may be different than the rate on the date you made the transaction. |

International ATM withdrawal | | This is our fee. You may also be charged a fee by the ATM operator, even if you do not complete a transaction. To avoid this fee, request cash back at point of sale. |

International ATM balance inquiry | | You may be charged a fee by the ATM operator. |

| | |

| | **Inactivity Fee: The fee listed in the table above will be charged when there is no money movement or transactions made on your Card account within a 30-day rolling period. This fee does not apply within the first 30 days of account opening. As mentioned above, the fee will be charged and appear on the following month’s statement. ATM (defined below) usage does constitute money movement or transactions for the purposes of this inactivity fee. This fee will be deducted from your Card account. If your Card account has insufficient funds to process the charge, your Card account will go into a negative balance of up to $25. (The $25 negative cap is only applicable if you are charged a fee multiple months in a row. The $25 negative cap includes other fees stated in the table as well.) |