- Credit Score

- Free Credit Report Summary

Free credit report summary

By clicking on the button above, you agree to the

Credit Sesame Terms of Use and Privacy Policy.

See more with your FREE credit report summary

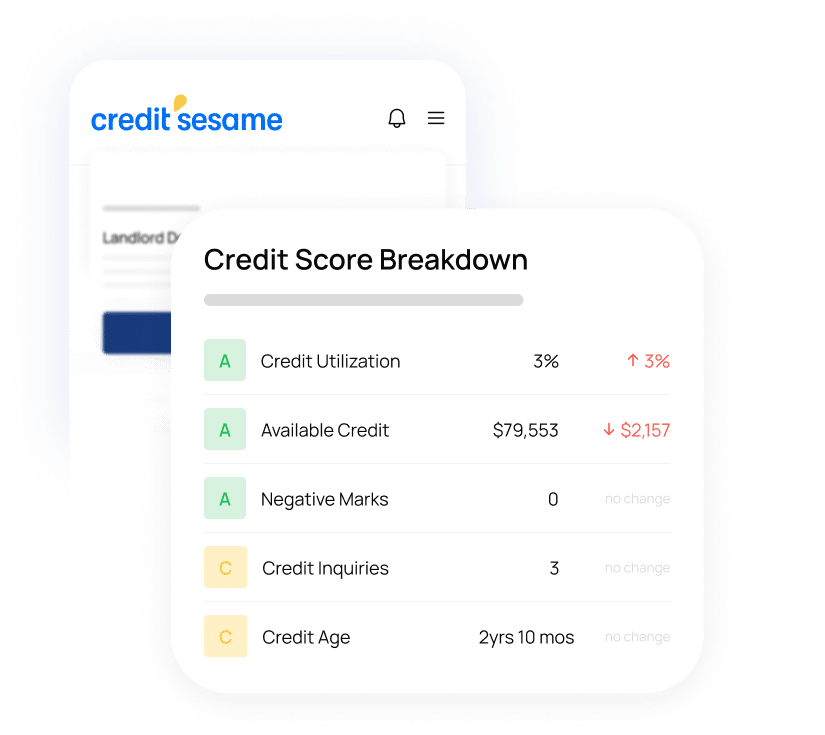

Your credit report breakdown

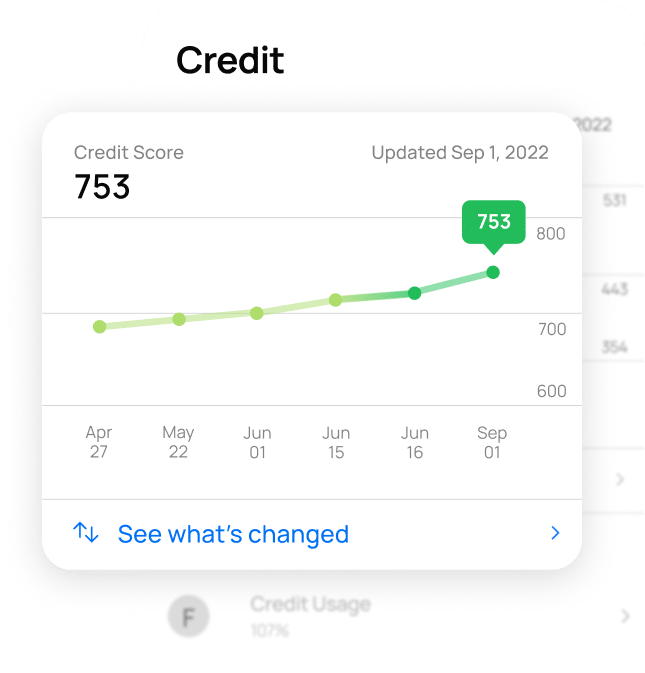

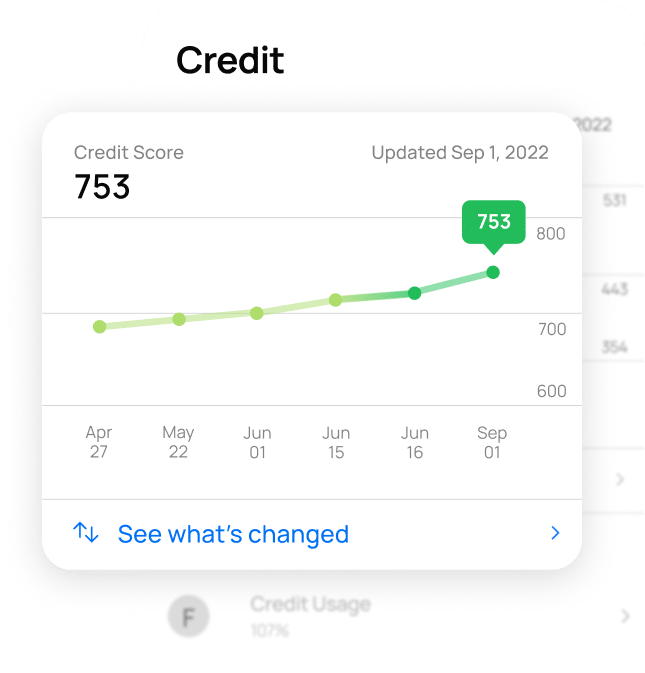

Refreshing your credit score daily for free with Credit Sesame shows you when that three-digit number has changed. Your free credit report summary is a record of your TransUnion credit history and personal information.

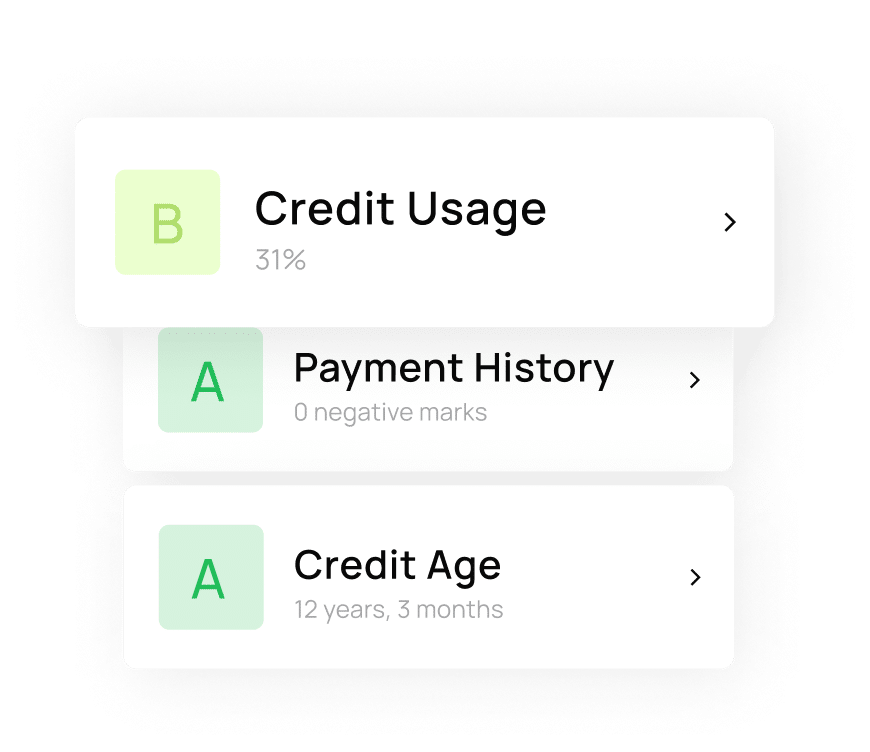

Factors impacting your credit

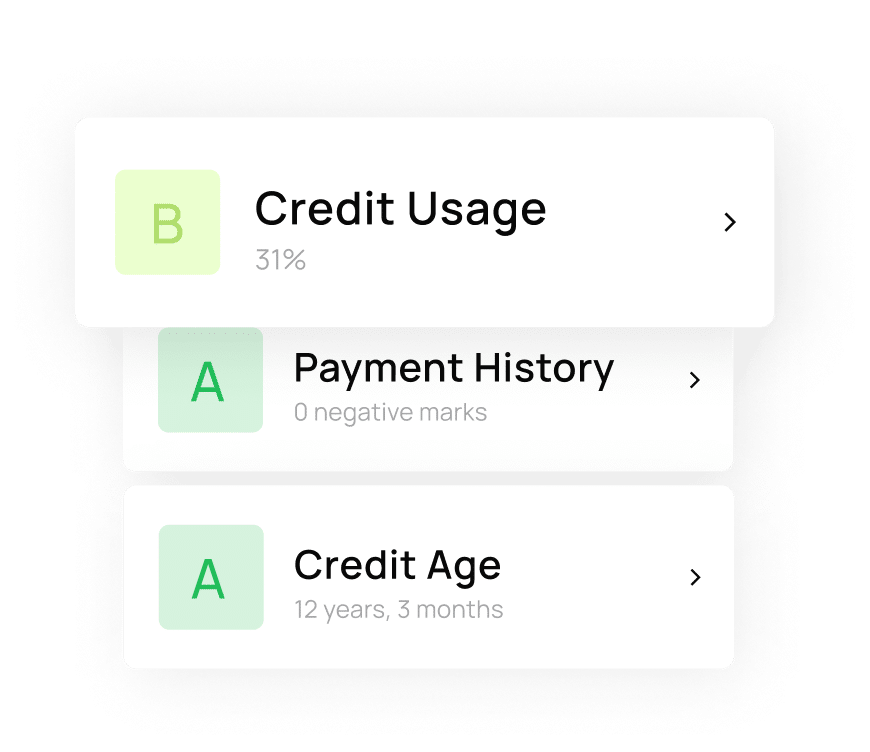

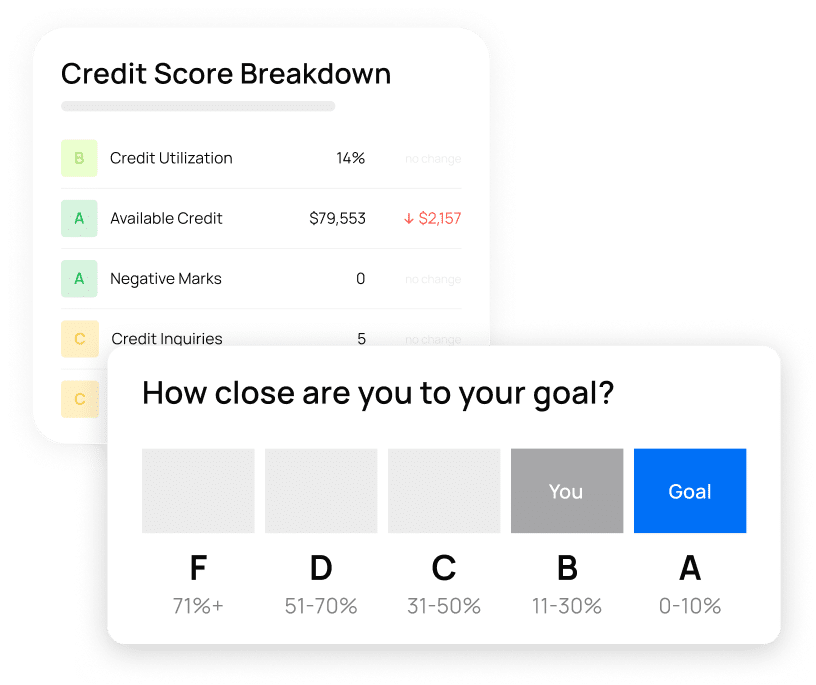

Your free credit report summary gives you a letter grade for five factors that can impact your credit score. This includes your payment history, credit usage, new inquires, open accounts, and the age of your accounts.

A breakdown of each factor

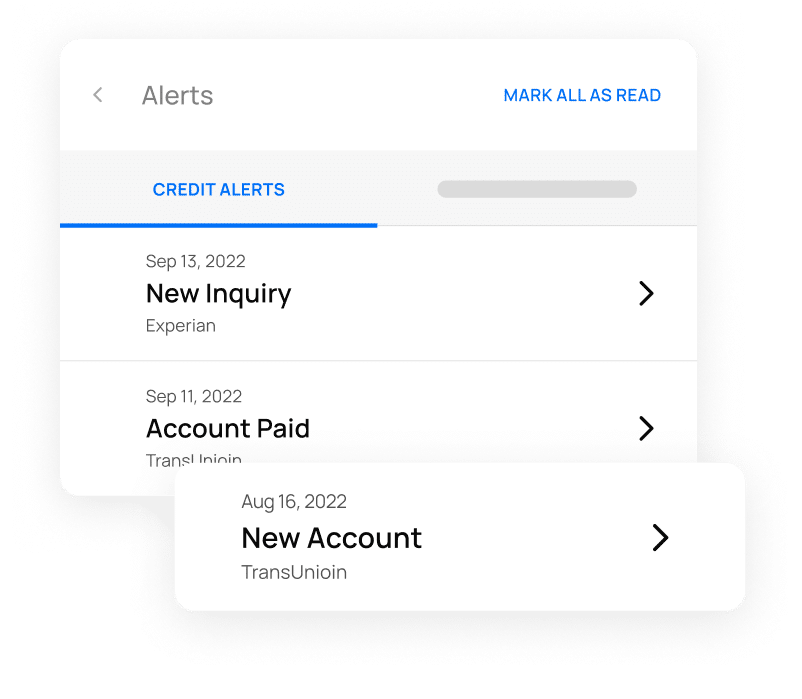

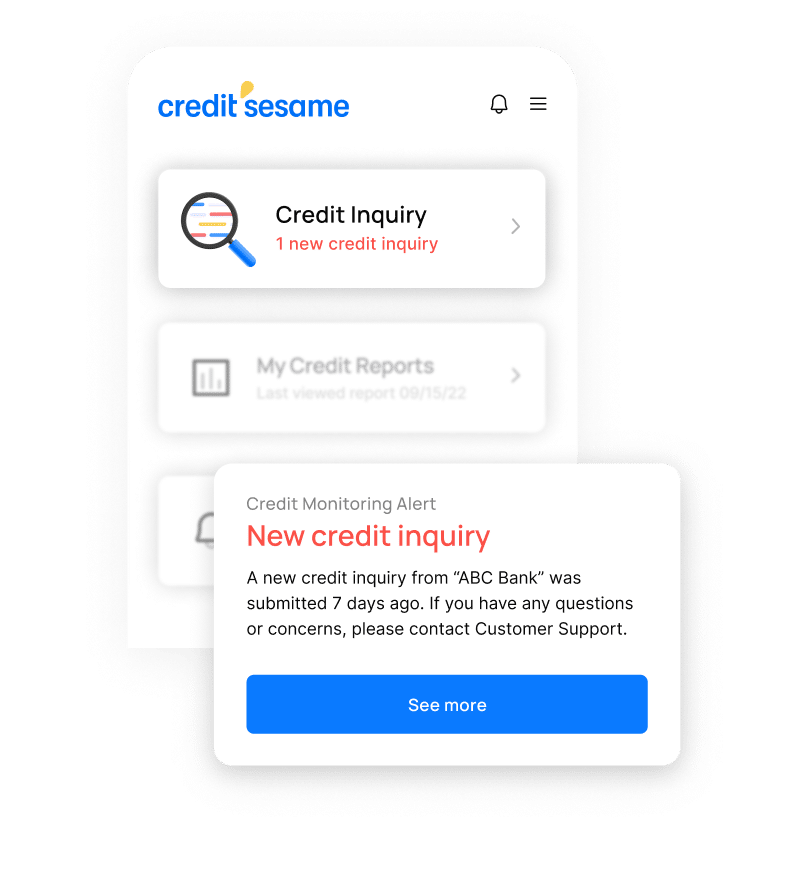

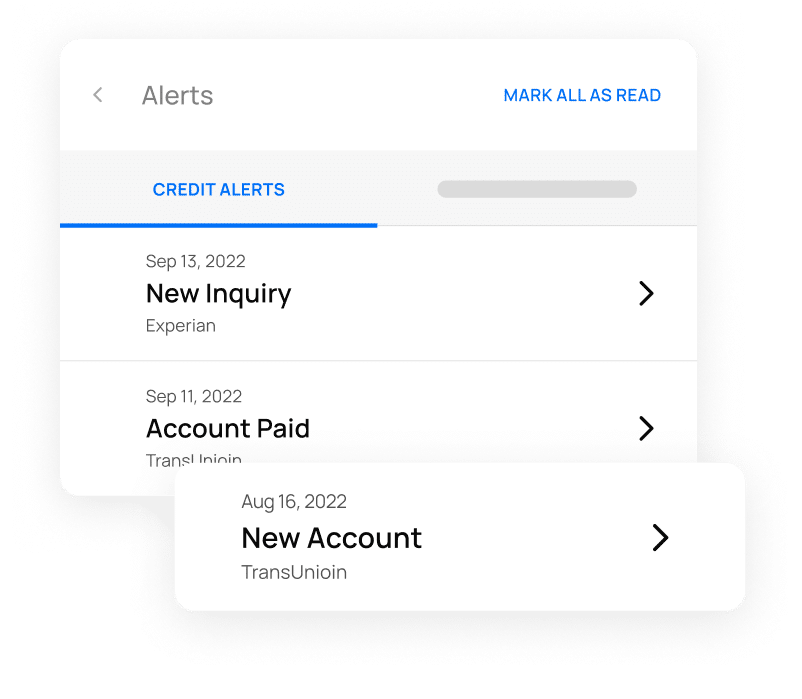

We monitor your TransUnion credit file and alert you about important changes like new accounts or negative marks.

Steps to build credit history

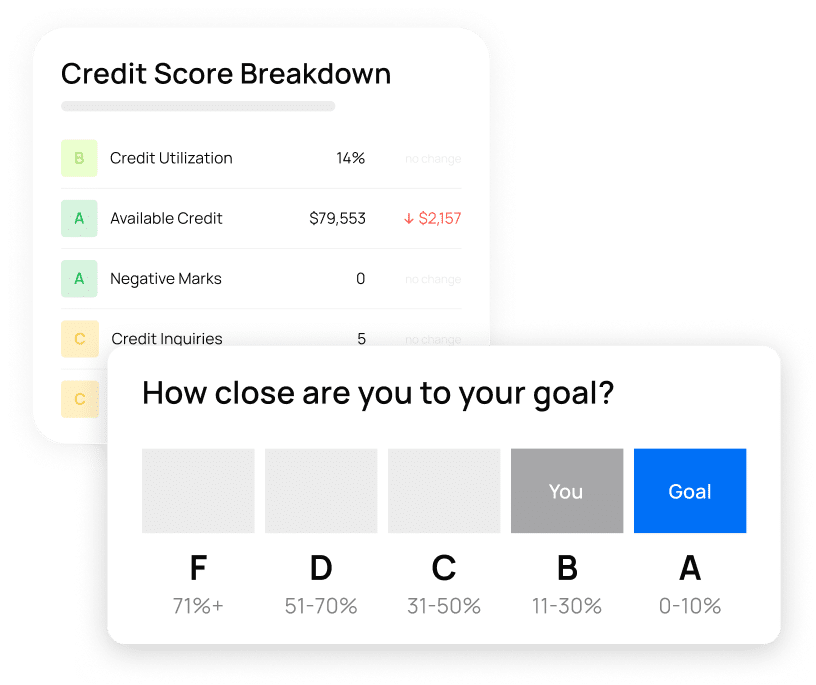

Your letter grade helps you quickly identify any factors you should focus on. We analyze each factor and provide personalized recommendations that can help you establish, build, or maintain positive credit history.

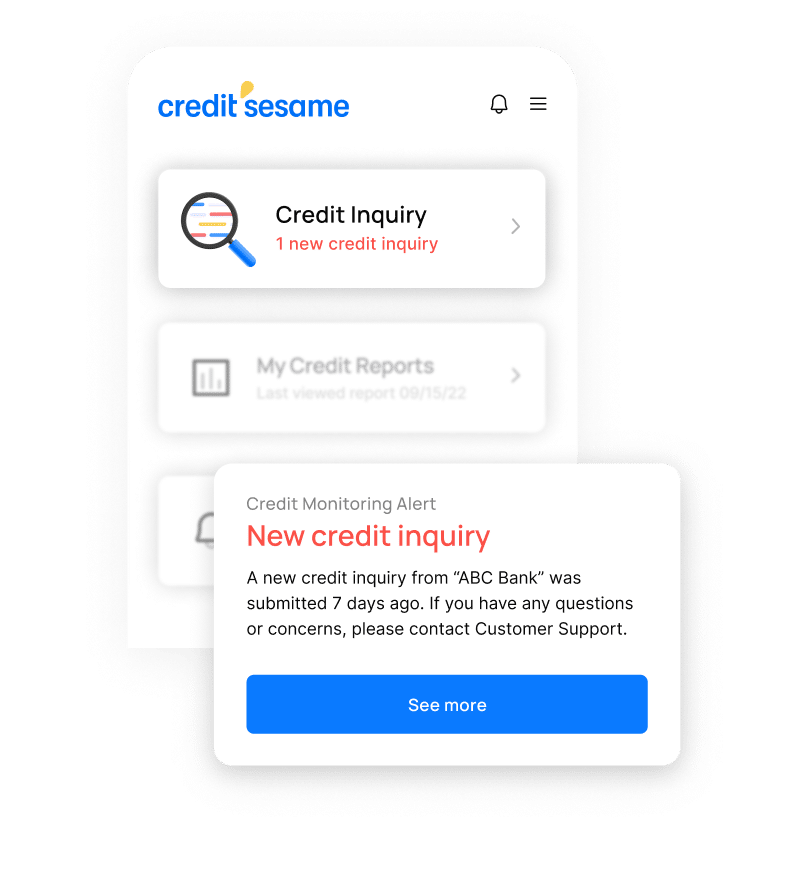

Potential errors early

Legitimate credit history is not the only thing that shows up on your free credit report summary. Administrative errors and fraudulent accounts do too. By spotting errors early, you can take action and correct them quickly.

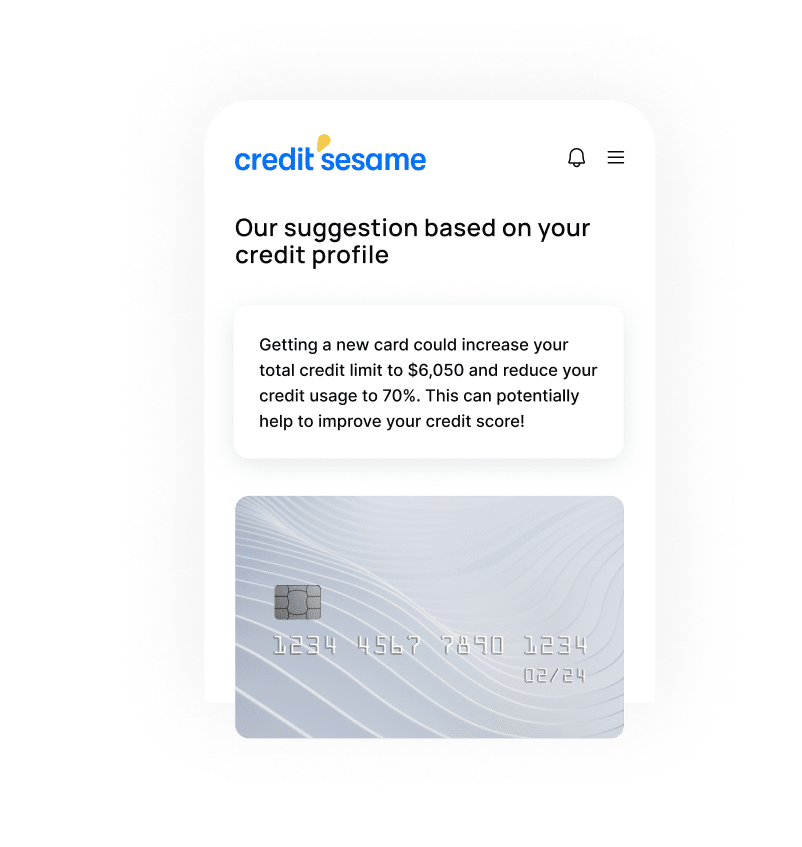

Better financial products

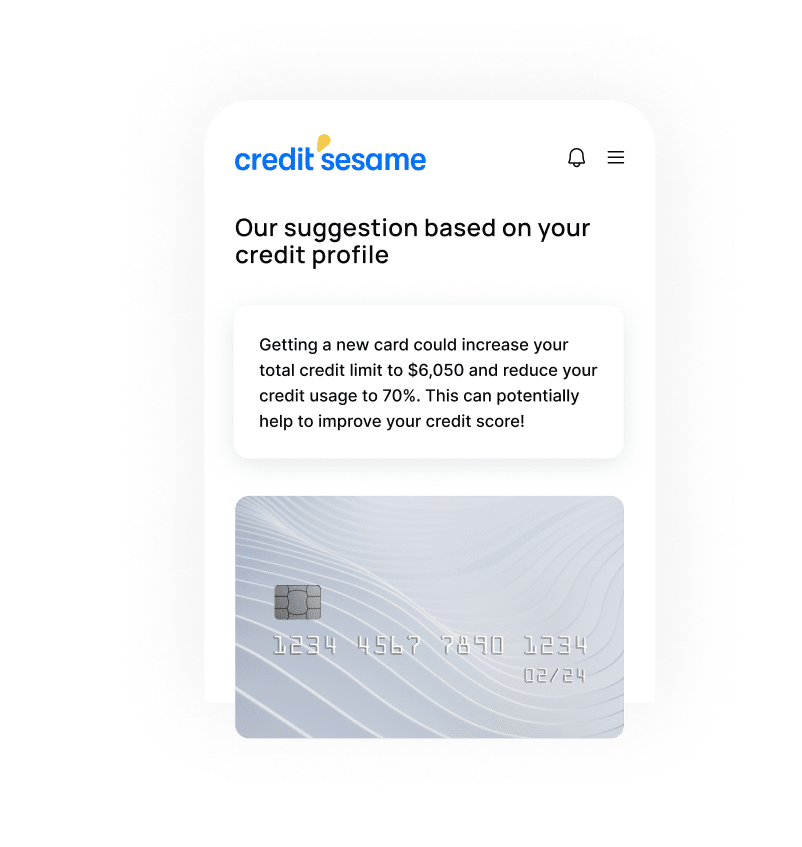

We review your free credit report summary daily to find financial products that are right for you. We show you new options that can help you build positive credit history, lower your debt, and save more money.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

See more with your FREE credit report summary

Your credit report breakdown

Refreshing your credit score daily for free with Credit Sesame shows you when that three-digit number has changed. Your free credit report summary is a record of your TransUnion credit history and personal information.

Factors impacting your credit

Your free credit report summary gives you a letter grade for five factors that can impact your credit score. This includes your payment history, credit usage, new inquires, open accounts, and the age of your accounts.

A breakdown of each factor

We monitor your TransUnion credit file and alert you about important changes like new accounts or negative marks.

Steps to build credit history

Your letter grade helps you quickly identify any factors you should focus on. We analyze each factor and provide personalized recommendations that can help you establish, build, or maintain positive credit history.

Potential errors early

Legitimate credit history is not the only thing that shows up on your free credit report summary. Administrative errors and fraudulent accounts do too. By spotting errors early, you can take action and correct them quickly.

Better financial products

We review your free credit report summary daily to find financial products that are right for you. We show you new options that can help you build positive credit history, lower your debt, and save more money.

By clicking on the button above, you agree to the

Credit Sesame Terms of Use and Privacy Policy.

The factors on

your free credit report summary

The factors on your free credit report summary

Your credit report summary covers five important factors that can impact your credit score. You see a letter grade for each and a breakdown of the credit behavior being reported to TransUnion.

Your payment history is a record of your payments on credit accounts. This includes utility bills, credit cards, student loans, auto loans, mortgages, and more. Payments past 30 days late can show up on your credit report and lower your score.

What your credit report card shows:

- Accounts with late payments.

- Bankruptcies, chargeoffs, collections, and foreclosures

Your credit age is the length of time credit accounts in your name have been active. It considers the age of your oldest and newest account, as well as the average age of all open accounts. A longer credit history helps creditors determine what kind of borrower you are.

What your credit report card shows:

- The age of all open credit accounts in your name

- The average age of your credit history

Your credit utilization is the amount of the debt you carry compared to the of credit available to you. If you have $1,000 balance available and you use $200, your credit utilization is 20%. You should try to keep your credit utilization under 30% to avoid negatively impacting your credit score.

What your credit report card shows:

- A list of open accounts, including your current balance, credit limit, and utilization rate

Account mix is a record of the different types credit accounts you have. Revolving credit, such as a credit card, does not have a set end date and can continue to accumulate interest. Installment loans, like a car payment, do have a set have a set end date and repayment terms. A diverse mix of accounts in good standing is good for your credit score.

What your credit report card shows:

- A list of your open accounts

- A breakdown of the types of accounts you have

Credit inquires are a record of the lenders that have requested your credit report as the result of a credit application. This shows up on your credit report as a “hard inquiry” and can temporarily lower your score. Checking your own credit score is considered a “soft inquiry” and does not affect your credit.

What your credit report card shows:

- A list of hard inquires, including the date it was requested and the name of the lender

Comparing your FREE credit report summary

Credit Report | Free Credit Report Summary | Free Credit Score | |

|---|---|---|---|

What is it? | A record of your credit activity and current credit situation generated by each of the three major bureaus: TransUnion, Experian, and Equifax | A summary of your TransUnion credit report compiled into a format that is easy to understand | Your TransUnion credit score |

Where can you get it? | You can get a free credit report from each major bureau once per year. Upgrade to Credit Sesame Premium to get your credit reports monthly | You can refresh your credit report summary every week for free with your Credit Sesame account | You can refresh your TransUnion credit score every day for free with your Credit Sesame account |

What information does it include? |

| A letter grade for five major factors that impact your credit score:

| Your VantageScore 3.0 credit score from TransUnion |

Who uses it? | Lenders may check your credit report in order to determine if you qualify for new credit products you apply for | You can use your credit report summary to check what is impacting your score and the next steps to take. | A landlord or utility company may check your credit score to assess your ability to make on time payments |

Credit Report | Free Credit Report Summary | Free Credit Score |

|---|---|---|

What is it?

A record of your credit activity and current credit situation generated by each of the three major bureaus: TransUnion, Experian, and Equifax | What is it?

A summary of your TransUnion credit report compiled into a format that is easy to understand | What is it?

Your TransUnion credit score |

Where can you get it?

You can get a free credit report from each major bureau once per year. Upgrade to Credit Sesame Premium to get your credit reports monthly | Where can you get it?

You can refresh your credit report summary every week for free with your Credit Sesame account | Where can you get it?

You can refresh your TransUnion credit score every day for free with your Credit Sesame account |

What information does it include?

| What information does it include?

A letter grade for five major factors that impact your credit score:

| What information does it include?

Your VantageScore 3.0 credit score from TransUnion |

Who uses it?

Lenders may check your credit report in order to determine if you qualify for new credit products you apply for | Who uses it?

You can use your credit report summary to check what is impacting your score and the next steps to take. | Who uses it?

A landlord or utility company may check your credit score to assess your ability to make on time payments |

You have the right to see your credit reports for free

No credit card. No trials. No commitments.

Secure

Shiva

Free

Charles

Helpful

Brian

The word on Credit Sesame

Rewarding

Torrey

Necessary

T-wanna

Savings

Latoya

Free

Charles

Fast

Randi

Free

Charles

Fast

Randi

Easy

Shiva

Helpful

Brian

Secure

Amanda

Secure

Amanda

Fast

Randi

Easy

Shiva

Secure

Shiva

As featured in

Security you can trust

Security you

can trust

We always treat your data as

if it were our own

We protect your

data with 256-bit encryption

We do not sell your personal

info to third parties

Get your credit report summary for free

Got questions?

We have answers.

Your credit report is an industry term used to describe a file containing your personal and credit information compiled by credit bureaus, usually TransUnion, Experian or Equifax.

The free credit report summary provided by Credit Sesame is a breakdown and analysis of all data and information in your TransUnion credit report.

Checking your free Credit Sesame credit report summary has no impact on your credit score.

You are the only person who can access your Credit Sesame credit report summary. Lenders may access your full credit report when assessing an application for a credit card or loan, but this is not the same as your credit report summary.

Credit Sesame works with TransUnion to provide your free VantageScore 3.0 credit score, updated daily, and credit report summary, updated weekly. For monthly access to your full credit reports from the three major bureaus, TransUnion, Experian and Equifax, sign up for Credit Sesame Premium.

Your credit report summary contains highlights from your full credit report. Lenders see this information when they access your credit report, but do not have access to your credit report summary.

To see all information on your full credit report sign up for Credit Sesame Premium.

You are legally entitled to receive your three credit reports for free once a year from each of the three major credit bureaus, Equifax, Experian and TransUnion. You can request a copy of each annually from AnnualCreditReport.com.