Get your free

credit score

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Do more with your

credit score™

Free daily score refreshes

Always know your most up-to-date TransUnion credit score

with daily refreshes.

Free credit report summary

Track your open accounts, debts, and

other important factors that are

impacting your credit score.

Free credit monitoring

Get notified about changes to your

credit file, so you can spot potential

errors and protect your score.

Understanding your credit score

Poor credit (300-549)

A poor credit score is in the range 300 to 549, and is typically the result of negative marks on your credit file. If you have a poor score, you may find it more difficult to qualify for most credit products. Even if you are approved, you likely won’t receive the best terms or lowest interest rate. Luckily, there are secured credit cards and other tools designed to help you improve your credit score.

Fair (550-639)

A fair credit score is in the range 550 to 639. It typically means you have some credit history with a few negative marks. If you have a fair score, you likely have access to some credit card and loan options, but you may not qualify for the best terms or lowest rates. By continuing to use credit responsibly, you can grow your score and unlock more offers.

Good (640-719)

A good credit score is in the range 640 to 719, and is typically the result of mostly postive credit history. If you have a good credit score, you’re more likely to get approved for credit products. A good credit score can also help you get better interest rates and terms for credit cards, loans, mortgages, and more.

Excellent (720-850)

An excellent credit score is in the range 720 to 850, and is typically the result of positive credit history. If you have an excellent credit score, you likely qualify for most credit products and usually have more options to choose from. An excellent credit score can help you get competitive interest rates and flexible terms for credit cards, loans, mortgages, and more.

Poor credit (300-549)

A poor credit score is in the range 300 to 549, and is typically the result of negative marks on your credit file. If you have a poor score, you may find it more difficult to qualify for most credit products. Even if you are approved, you likely won’t receive the best terms or lowest interest rate. Luckily, there are secured credit cards and other tools designed to help you improve your credit score.

Fair (550-639)

A fair credit score is in the range 550 to 639. It typically means you have some credit history with a few negative marks. If you have a fair score, you likely have access to some credit card and loan options, but you may not qualify for the best terms or lowest rates. By continuing to use credit responsibly, you can grow your score and unlock more offers.

Good (640-719)

A good credit score is in the range 640 to 719, and is typically the result of mostly postive credit history. If you have a good credit score, you’re more likely to get approved for credit products. A good credit score can also help you get better interest rates and terms for credit cards, loans, mortgages, and more.

Excellent (720-850)

An excellent credit score is in the range 720 to 850, and is typically the result of positive credit history. If you have an excellent credit score, you likely qualify for most credit products and usually have more options to choose from. An excellent credit score can help you get competitive interest rates and flexible terms for credit cards, loans, mortgages, and more.

What makes up your credit score?

Credit payment history determines about 35% of your score. The first thing any lender wants to know is whether you’ve paid past credit accounts on time. This is one of the most important factors for determining your credit score.

Your credit age plays a role in your final credit score. It consists of factors such as age of oldest credit account, newest credit account, average of all accounts, types of accounts (mortgage, auto loans, etc), and last time each account was used.

Your credit utilization is the ratio of the amount of your credit card balances compared to the credit limits you have available. For example, if you have $500 credit balance while your limit is $1000, then your credit utilization is 50%.

Accounts mix (or credit mix) involves different types of accounts that you have, such as revolving accounts, installment accounts, or open accounts. Having a mix of accounts does have an impact on your overall credit score.

When applying for credit, lenders will check your credit score (inquiry), which will impact your credit score depending on your account. A soft inquiry will not affect your score but a hard inquiry on the other hand will.

Sign up for free to see where you stand on each of these factors.

What your credit score

can do for you

Better credit cards

Your credit score affects what card options you have, including the interest rate and credit limit you’re offered.

Better mortgage rates

A good credit score can help you get your first home, dream home, or to refinance your current mortgage with the best rate available.

Better auto loans

A higher credit score usually means a lower interest rate on auto loans, and smaller monthly payments.

What affects your credit score?

Several things are taken into consideration when determining your credit score.

Know which ones can help bring your score up or down.

What negatively affects your credit score

Having ANY late payment appear on your credit report will have an impact on your credit score. Other consequences include being charged a late fee and increased interest rates on your account.

When you apply for credit, the first thing a creditor or lender does is pull your credit file. This is considered a hard inquiry. Hard inquiries can stay on your report for up to two years, and can lower your credit score. If you’re applying for credit, knowing your chances of approval upfront can help limit the number of hard inquiries required. Applying for too many credit accounts in a short time can cause lenders to view you as higher-risk.

Closing a card that’s paid in full may prevent you from racking up more debt, but it can also negatively affect your credit score for a couple of reasons. First off, removing any line of credit can raise your overall credit utilization, AKA your debt-to-credit ratio. If your credit utilization exceeds 30%, it can hurt your credit score. Another factor that determines your credit score is your ability to manage different credit accounts responsibly over a long period of time. Closing a credit card you’ve had for a while can lower your overall credit age, which can lower your score.

If you’re the victim of identity theft, a fraudster can seriously damage your credit score. They can apply for new credit cards and loans in your name, max out the limit, and rack up missed payments. Every credit product they apply for comes with a hard inquiry, which can lower your score. That’s before the negative marks for high utilization and late payments start appearing on your credit file.

Obviously, paying your loans off on time is essential for avoiding credit trouble. Still, don’t be surprised if your credit score dips a little after you make a final loan payment. Closing out the account could give you less of a mix between credit card and installment debt, which is bad for your credit score. It is also likely to reduce the average age of your credit accounts, which is another negative.

Being an authorized user is often a temporary arrangement. For example, college students may be allowed to use a parent’s account while still in school, and then be taken off the account after graduation. Be aware that when you stop being an authorized user it’s as if you closed an account. Your available credit and the age of your credit accounts are likely to fall. Those are both bad for credit scores.

Minimum payment amounts are generally so low that if you have new purchases each month, making only the minimum payments will probably cause the balance you owe to grow over time. As your credit utilization rate creeps up, it will start to drag your credit score down. This will also cause you to pay more interest over time, making your debt harder to afford.

Do not assume that avoiding credit use makes you look less risky. While a bad payment history is the worst thing for your credit score, a lack of any history makes it hard to build a good score. Not using credit can create a lack of information that reduces your credit score. The older your payment history becomes, the less relevant it is to your credit score.

What positively affects your credit score

Your payment history is the most important factor for your credit score, so you should always try to make full payments on time. If you can’t pay off the full balance, it’s important to make at least the minimum payment. This helps improve your credit rating and will eventually open up more doors to lower interest rates and better offers.

Using Credit Sesame to refresh your score daily is considered a soft inquiry, which has no impact on your credit score. Updating your score regularly can help you see where you stand and understand the specific factors affecting your credit. Daily credit monitoring alerts notify you about any important changes, such as new inquiries, open accounts, or negative marks. Knowing about these changes as they happen can help you spot errors, inaccuracies and potential fraud you need to report.

You should always try to use less than 30% of your total available credit. For example, if you have a credit card with a $10,000 limit, you should keep your balance below $3,000. If you have to make a larger purchase, increasing your credit limit can be a quick and easy way to keep your utilization rate low. For example, by increasing your credit limit to $15,000 you would be able to spend up to $4,500 and still maintain 30% utilization.

A 2021 Consumer Reports study found that about 1 in 3 study participants found at least one error on their report. Unfortunately, most people don’t know what to do when they find them. If you spot an error on your credit report, it’s important to file the dispute with the correct bureau online and keep following up until it’s resolved.

Obviously, paying your loans off on time is essential for avoiding credit trouble. Still, don’t be surprised if your credit score dips a little after you make a final loan payment. Closing out the account could give you less of a mix between credit card and installment debt, which is bad for your credit score. It is also likely to reduce the average age of your credit accounts, which is another negative.

Being named as an authorized user on someone else’s account can be a good way to build credit. Becoming an authorized user includes the account on your record, which may be the best way for someone without a strong credit history to establish a credit record. The key is that you and the person you share the account with have to use it responsibly, so the record you build is a good one.

Minimum payments are designed to be low enough to stretch repayment out over a long time. Making more than the minimum payment helps keep the balance you owe down. That reduces your credit utilization rate, which is good for your credit score. It also means paying less interest, which makes your debt more affordable.

Credit scores are updated regularly with fresh information as it becomes available. A steady pattern of using credit and making your payments gives you a healthy payment history. If you pay off your balance in full every month within the bill’s grace period, you can maintain your payment history without incurring interest charges.

What negatively affects your credit score

Having ANY late payment appear on your credit report will have an impact on your credit score. Other consequences include being charged a late fee and increased interest rates on your account.

When you apply for credit, the first thing a creditor or lender does is pull your credit file. This is considered a hard inquiry. Hard inquiries can stay on your report for up to two years, and can lower your credit score. If you’re applying for credit, knowing your chances of approval upfront can help limit the number of hard inquiries required. Applying for too many credit accounts in a short time can cause lenders to view you as higher-risk.

Closing a card that’s paid in full may prevent you from racking up more debt, but it can also negatively affect your credit score for a couple of reasons. First off, removing any line of credit can raise your overall credit utilization, AKA your debt-to-credit ratio. If your credit utilization exceeds 30%, it can hurt your credit score. Another factor that determines your credit score is your ability to manage different credit accounts responsibly over a long period of time. Closing a credit card you’ve had for a while can lower your overall credit age, which can lower your score.

If you’re the victim of identity theft, a fraudster can seriously damage your credit score. They can apply for new credit cards and loans in your name, max out the limit, and rack up missed payments. Every credit product they apply for comes with a hard inquiry, which can lower your score. That’s before the negative marks for high utilization and late payments start appearing on your credit file.

Obviously, paying your loans off on time is essential for avoiding credit trouble. Still, don’t be surprised if your credit score dips a little after you make a final loan payment. Closing out the account could give you less of a mix between credit card and installment debt, which is bad for your credit score. It is also likely to reduce the average age of your credit accounts, which is another negative.

Being an authorized user is often a temporary arrangement. For example, college students may be allowed to use a parent’s account while still in school, and then be taken off the account after graduation. Be aware that when you stop being an authorized user it’s as if you closed an account. Your available credit and the age of your credit accounts are likely to fall. Those are both bad for credit scores.

Minimum payment amounts are generally so low that if you have new purchases each month, making only the minimum payments will probably cause the balance you owe to grow over time. As your credit utilization rate creeps up, it will start to drag your credit score down. This will also cause you to pay more interest over time, making your debt harder to afford.

Do not assume that avoiding credit use makes you look less risky. While a bad payment history is the worst thing for your credit score, a lack of any history makes it hard to build a good score. Not using credit can create a lack of information that reduces your credit score. The older your payment history becomes, the less relevant it is to your credit score.

What positively affects your credit score

Your payment history is the most important factor for your credit score, so you should always try to make full payments on time. If you can’t pay off the full balance, it’s important to make at least the minimum payment. This helps improve your credit rating and will eventually open up more doors to lower interest rates and better offers.

Using Credit Sesame to refresh your score daily is considered a soft inquiry, which has no impact on your credit score. Updating your score regularly can help you see where you stand and understand the specific factors affecting your credit. Daily credit monitoring alerts notify you about any important changes, such as new inquiries, open accounts, or negative marks. Knowing about these changes as they happen can help you spot errors, inaccuracies and potential fraud you need to report.

You should always try to use less than 30% of your total available credit. For example, if you have a credit card with a $10,000 limit, you should keep your balance below $3,000. If you have to make a larger purchase, increasing your credit limit can be a quick and easy way to keep your utilization rate low. For example, by increasing your credit limit to $15,000 you would be able to spend up to $4,500 and still maintain 30% utilization.

A 2021 Consumer Reports study found that about 1 in 3 study participants found at least one error on their report. Unfortunately, most people don’t know what to do when they find them. If you spot an error on your credit report, it’s important to file the dispute with the correct bureau online and keep following up until it’s resolved.

Obviously, paying your loans off on time is essential for avoiding credit trouble. Still, don’t be surprised if your credit score dips a little after you make a final loan payment. Closing out the account could give you less of a mix between credit card and installment debt, which is bad for your credit score. It is also likely to reduce the average age of your credit accounts, which is another negative.

Being named as an authorized user on someone else’s account can be a good way to build credit. Becoming an authorized user includes the account on your record, which may be the best way for someone without a strong credit history to establish a credit record. The key is that you and the person you share the account with have to use it responsibly, so the record you build is a good one.

Minimum payments are designed to be low enough to stretch repayment out over a long time. Making more than the minimum payment helps keep the balance you owe down. That reduces your credit utilization rate, which is good for your credit score. It also means paying less interest, which makes your debt more affordable.

Credit scores are updated regularly with fresh information as it becomes available. A steady pattern of using credit and making your payments gives you a healthy payment history. If you pay off your balance in full every month within the bill’s grace period, you can maintain your payment history without incurring interest charges.

By clicking on the button above, you agree to the

Credit Sesame Terms of Use and Privacy Policy.

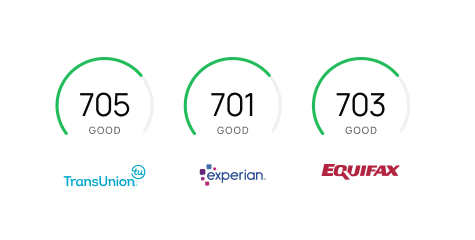

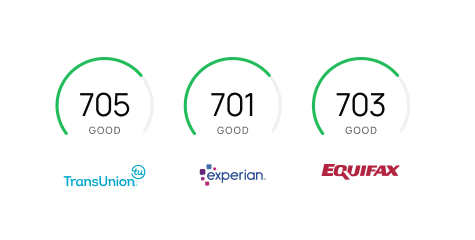

How does Credit Sesame

get your score?

There are three main credit Bureaus: Equifax, Experian, and TransUnion. Credit Sesame refreshes your TransUnion credit score daily for free. Get your credit score and credit report from all three Bureaus when you upgrade to Premium.

Get your credit score for free

No credit card. No trials. No commitments.

Secure

Shiva

Free

Charles

Helpful

Brian

The word on Credit Sesame

Rewarding

Torrey

Necessary

T-wanna

Savings

Latoya

Free

Charles

Fast

Randi

Free

Charles

Fast

Randi

Easy

Shiva

Helpful

Brian

Secure

Amanda

Secure

Amanda

Fast

Randi

Easy

Shiva

Secure

Shiva

As featured in

Security you can trust

We always treat your data as

if it were our own

We protect your

data with 256-bit encryption

We do not sell your personal

info to third parties

Got questions? We have answers.

What is a credit score?

Credit is the ability and agreement to borrow money with a commitment to repay later. You might need credit to purchase a service or product, like a car or a house, that you can’t pay for immediately.

Your credit score is a measure of how reliably you manage and repay money you have borrowed. It’s based on multiple factors like payment history, type of credit accounts and length of credit history, and reflects your credit risk to lenders. You have several credit scores you can check from the top three credit bureaus—Equifax, Experian and TransUnion—and these credit bureaus compile your credit report. A higher credit score means you have shown responsible credit history and gives you more borrowing power at lower interest rates.

How do I check my credit score for free?

With a Credit Sesame account, you can update your credit score daily for free. We work with one of the top credit bureaus, TransUnion, to provide you an instant credit check using VantageScore 3.0, which is used widely by lenders.

Does checking my credit score hurt my credit?

There is no impact on your credit score when you check your score with Credit Sesame because credit score checks are considered soft inquiries. You can check your score with Credit Sesame as often as you like and it won’t affect your credit standing.

What do I need to sign up for a Credit Sesame account?

Signing up for your free Credit Sesame account is quick and easy. All you need is your email address, legal name, date of birth, home address, phone number, and the last four numbers of your social security number. It only takes around 90 seconds to set up your account and get your credit score.

Is my free credit score on Credit Sesame accurate?

The credit score you see using Credit Sesame is your real credit score. We work with TransUnion, one of the top credit bureaus, and use VantageScore 3.0 to calculate your credit score, which is one of the most widely used scoring models. VantageScore was designed in collaboration by all three of the top credit bureaus using a scoring range of 300 to 850.

How do I establish a credit score?

You need a history of credit use to establish a credit score. Unfortunately, most lenders check your score before opening a line of credit. This means it can be a challenge to get started. Fortunately, there are ways around this that allow you to establish a credit score for the first time.

• Get a credit card—For your first credit card, try applying for a secured cards student card or retail credit card.

• Become an authorized user—Ask a trusted friend or family member with a great credit history to add you as an authorized user on one of their credit cards. Remember, this puts your credit health in their hands.

• Use Credit Sesame—We offer simple credit building solutions like Sesame Cash and Credit Builder, which use your debit purchases to establish and build your credit score.

As soon as you start using credit, payments are recorded by the three major credit bureaus, TransUnion, Equifax and Experian. This establishes your credit history and your credit score.

What credit score do I start with?

Your initial credit score depends on your history with credit. If you have no credit history, you have no credit score. If you have ever used a credit card or had a loan, you may not know your credit score, but you have a credit history. As soon as you establish a credit history and payments are reported to the credit bureaus, you have a credit score. The lowest possible score is 300. If you start with good credit habits your score is likely to be higher than this. If you continue with good credit management, you can expect your score to grow.

What is the highest credit score I can have?

850 is rated as excellent and is the highest credit score you can achieve with VantageScore and FICO, the scoring models used by most lenders. Luckily, having the perfect credit score is not necessary for most borrowing scenarios. Good financial health and access to credit is possible with lower scores considered to be very good or good. A credit score in the 700’s means you are likely to qualify for great rates from lenders.

What is a poor, fair, good, and an excellent credit score?

Your credit score may be described as poor, fair, good or excellent depending on how the credit score bands are defined. Your credit standing helps lenders assess how much of a credit risk you are. The Credit Sesame app defines these ranges as:

Poor—300 to 549

Fair—550 to 639

Good—640 to 719

Excellent—720-850

Credit Sesame updates your credit score daily, so you can see changes as they happen. It is easy, free and does not affect your credit score.

What affects my credit score?

The five main factors contributing to your credit score are payment history, credit utilization, credit history length, credit mix and new credit accounts. It is important to know how they impact your credit score.

- Payment history—The most important factor, payment history considers if you make regular payments, on time. Even one missed payment may impact your credit score negatively.

- Credit utilization—This is the ratio of how much of your available credit is being used. If you have $1,000 available and you use $200, your credit utilization is 20%. Ideally keep under 30% to avoid negatively impacting your credit score.

- Credit history length—As the name implies, this is a measure of how long your credit accounts have been active. It is the average of all your credit accounts including the oldest and the newest.

- Credit mix—This takes into account the number of revolving (for example, a credit card) and instalment (for example, a mortgage) accounts you have. A diverse mix of credit accounts is generally linked to a higher credit score, providing that all repayments are made in full and on time.

- New credit accounts—Each new credit account application results in a hard inquiry on your credit report. Having too many inquiries or opening too many accounts in a short period may indicate you need more credit than you can repay reliably. This can hurt your score.

How do I improve my credit score?

- Open one or two new accounts that report to the bureaus

- Maintain low balances and credit utilization

- Pay all bills on time, every time

- Pay down existing account balances

How do I build positive credit history?

Your credit report shows lenders how you manage the credit available to you. Over time, with the right actions, the negative information drops off and you can build positive credit history.

Your payment history is the most important factor that impacts your credit. Even one missed payment can hurt your score, so you should pay all your bills on time, every time. One way to ensure you do this is to create a budget and note the amount and dates of all repayments. Aim to pay a day early so that you never pay late.

Keep your credit utilization (the amount of credit you have available versus the amount you’re using) at 30% or lower and make sure you have a diverse credit portfolio with revolving credit and instalment loans.