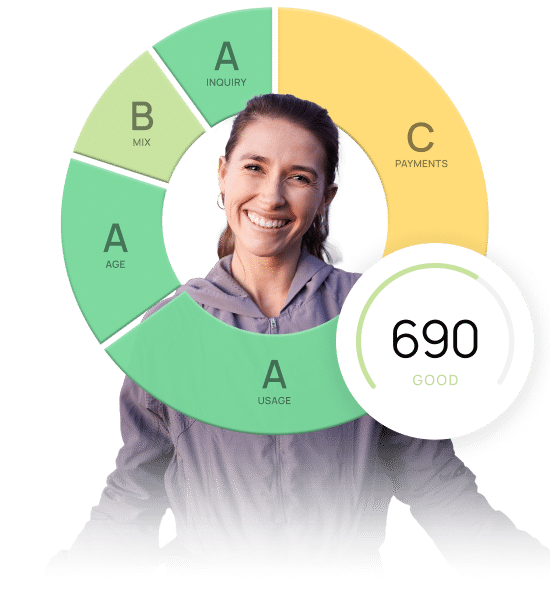

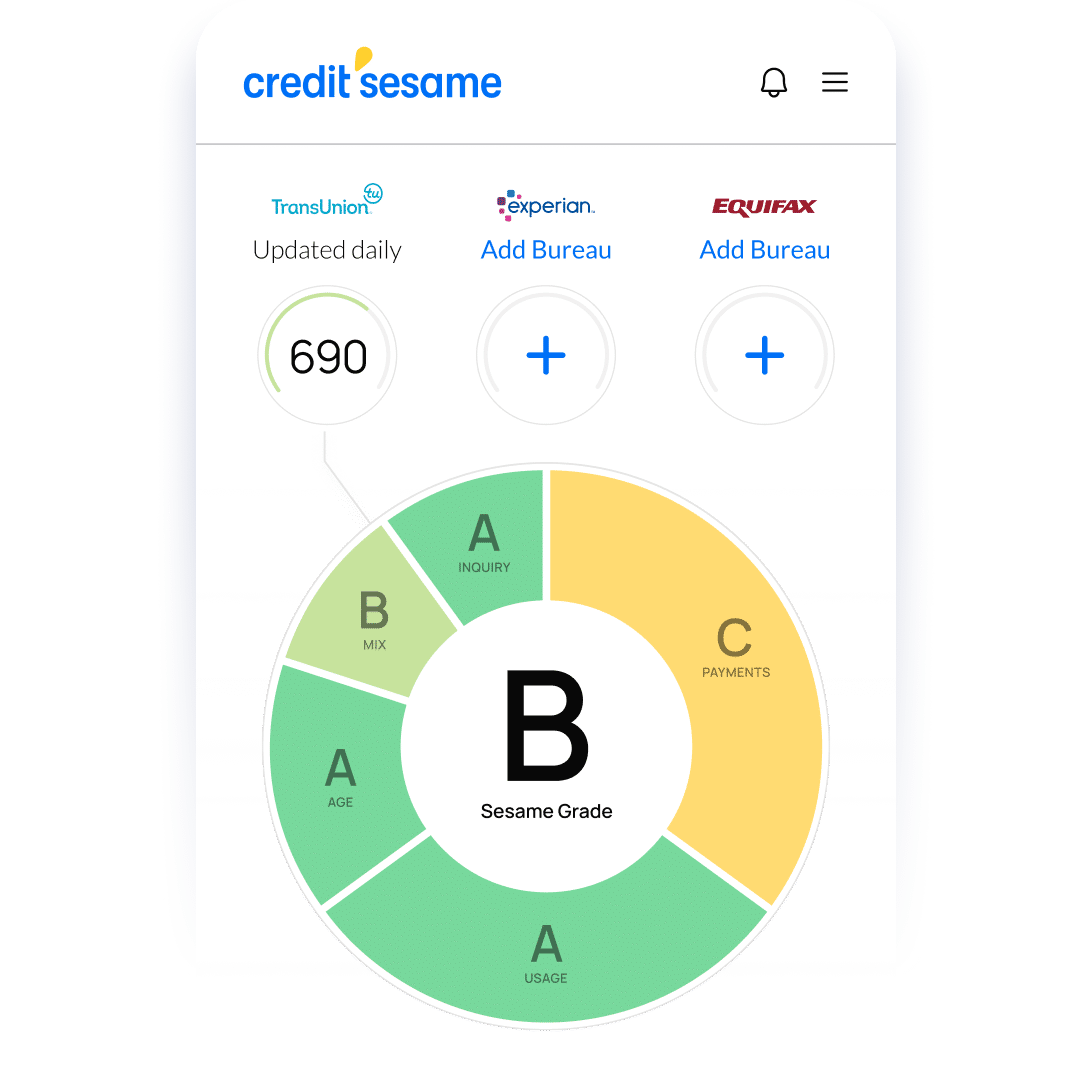

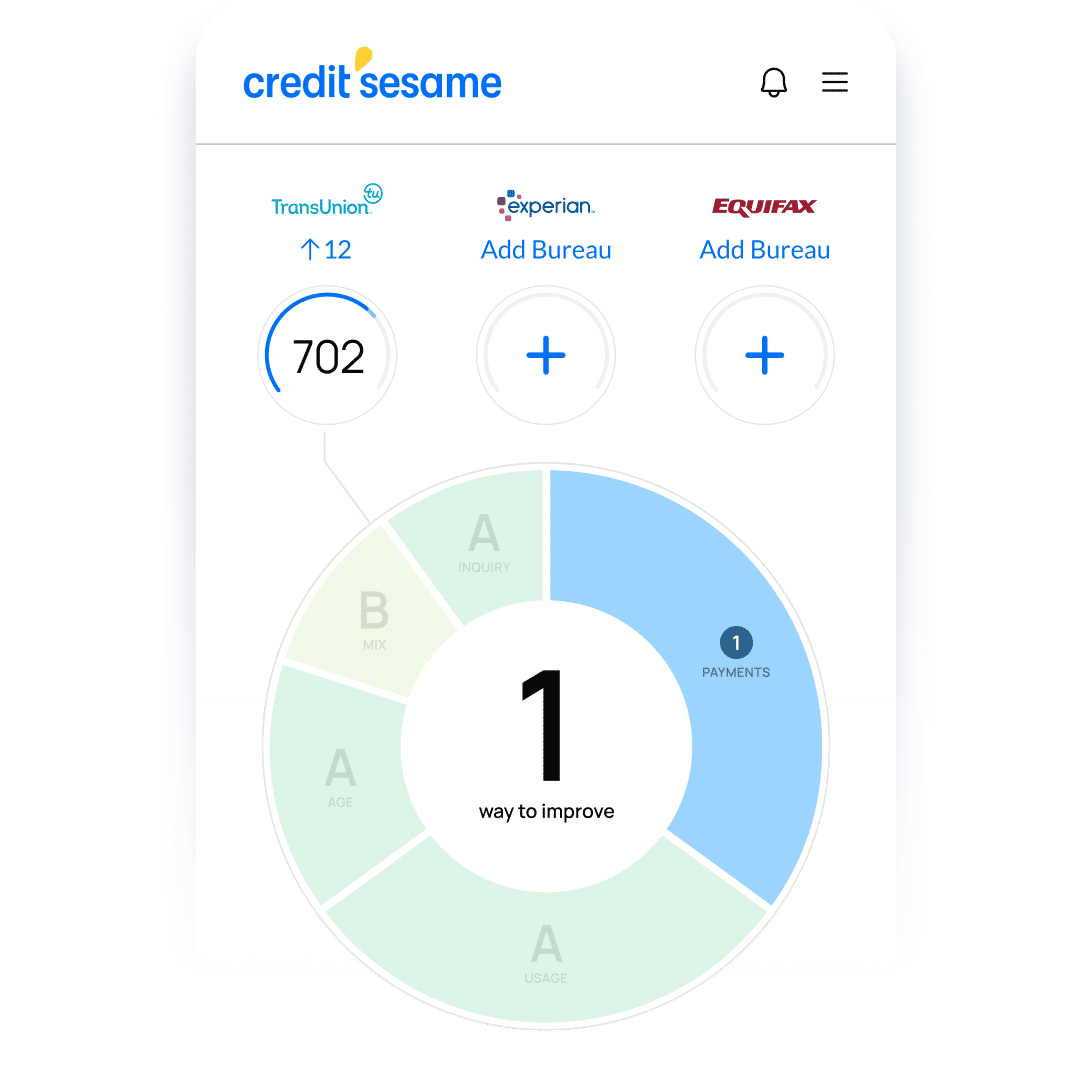

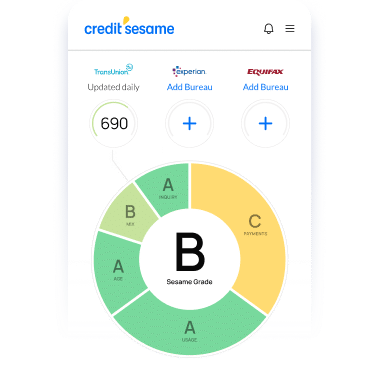

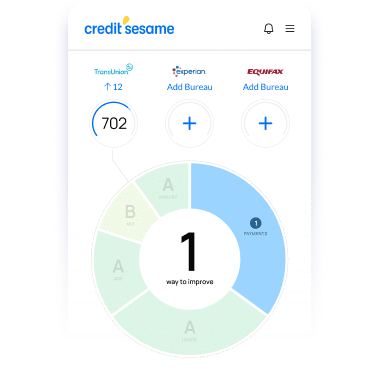

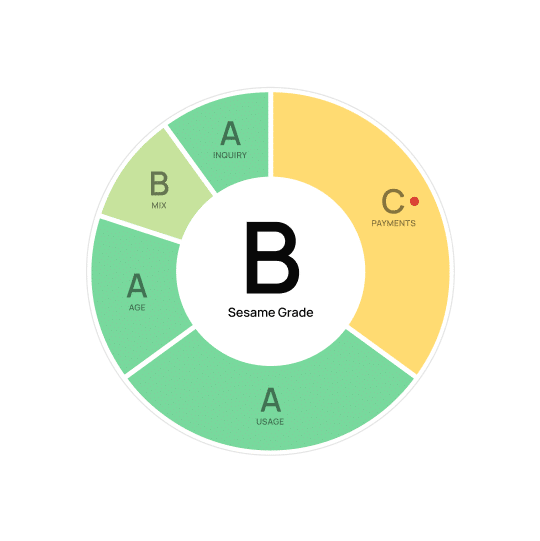

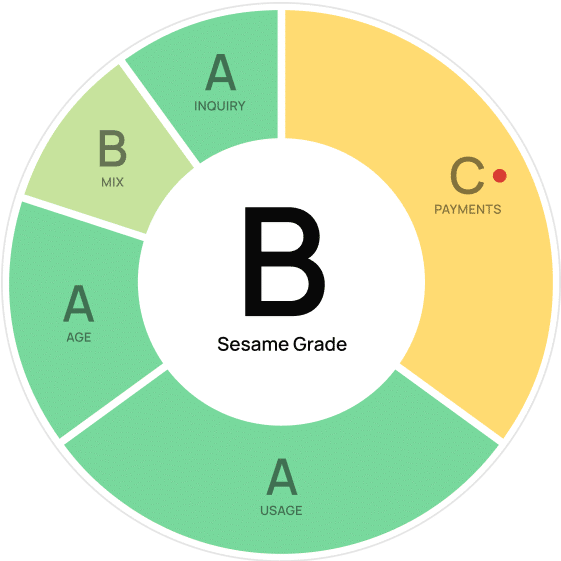

Sesame Ring

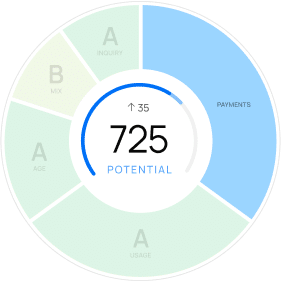

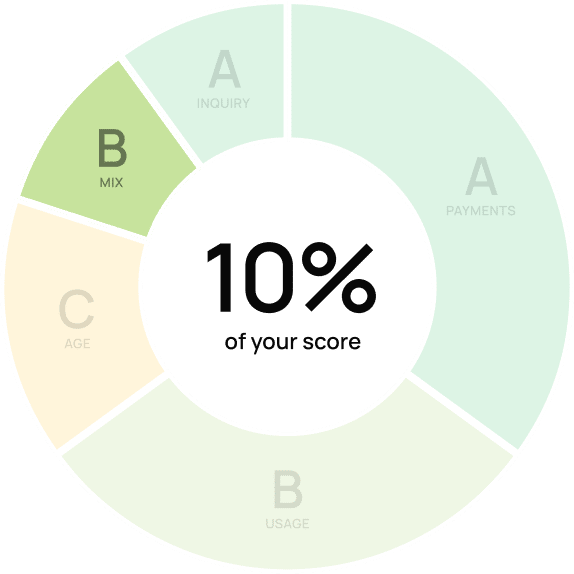

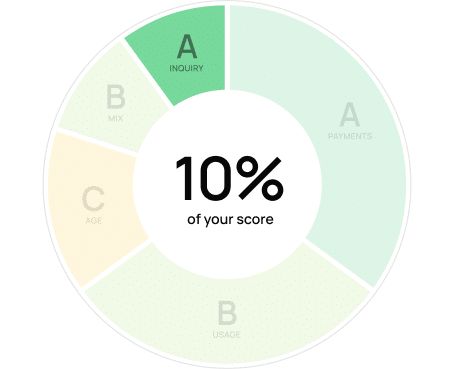

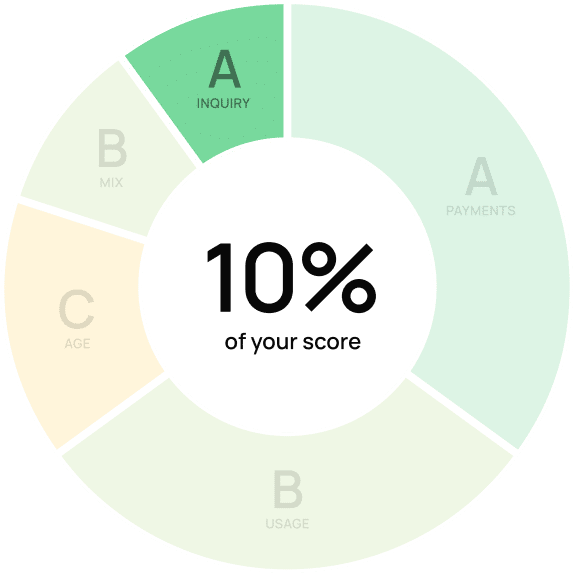

Your credit score

made

simple

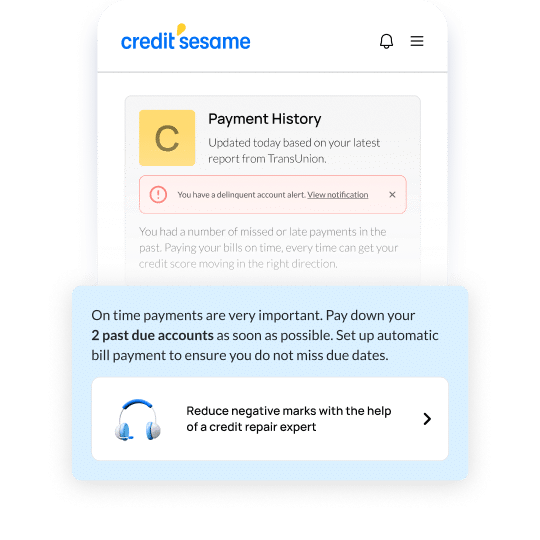

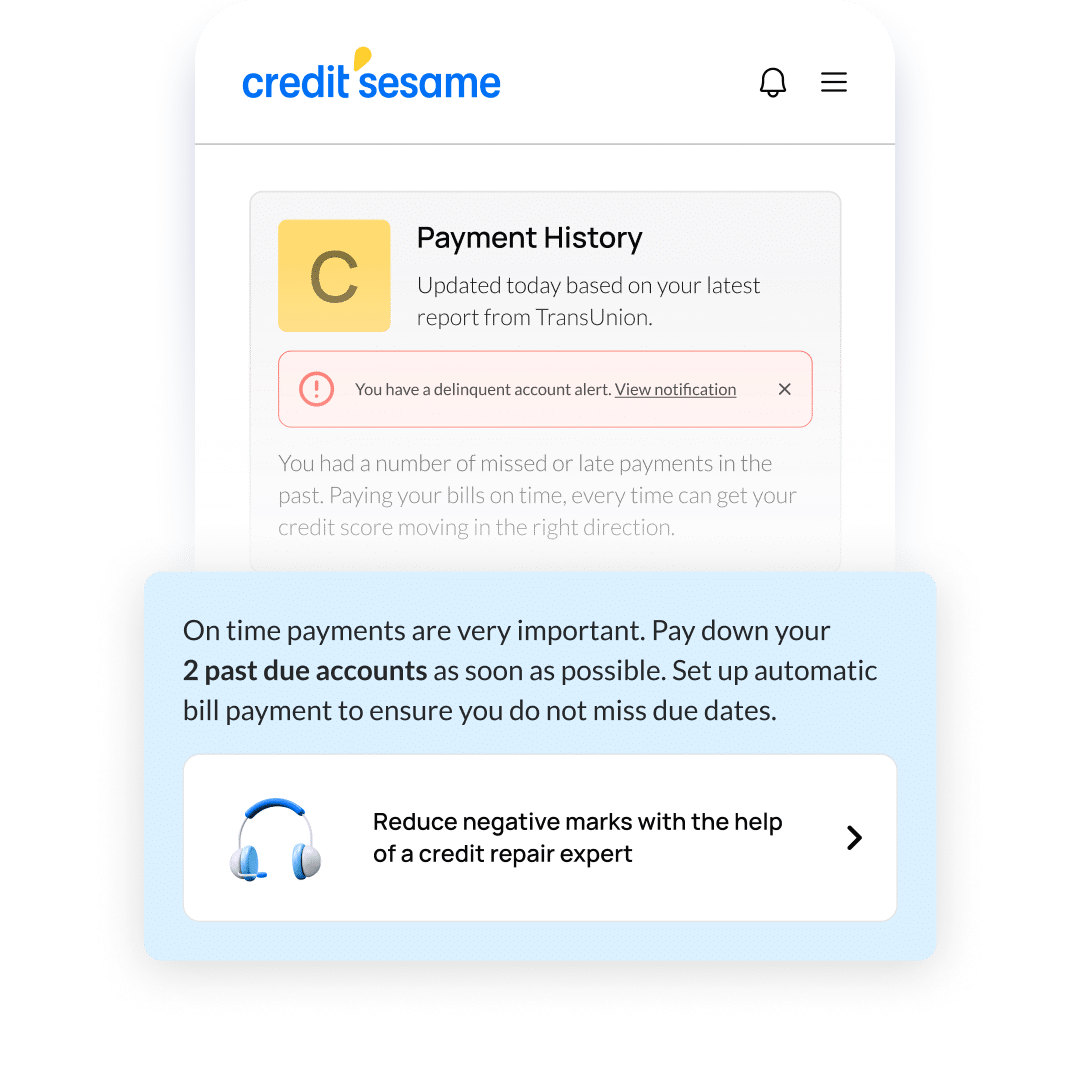

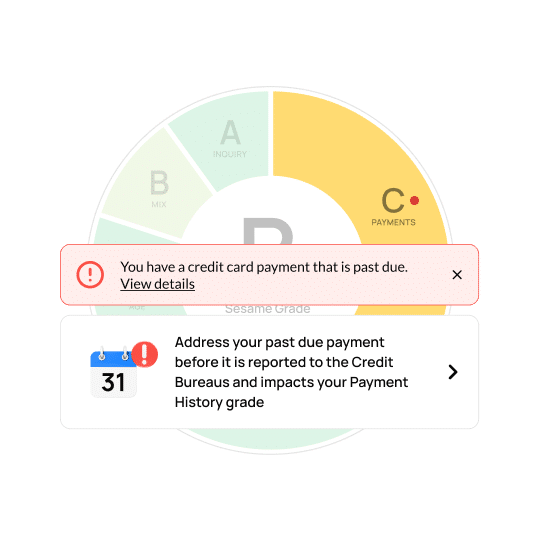

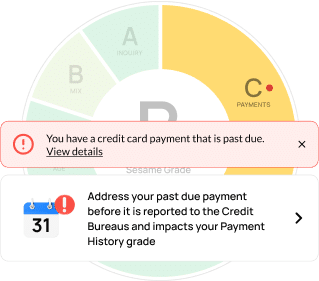

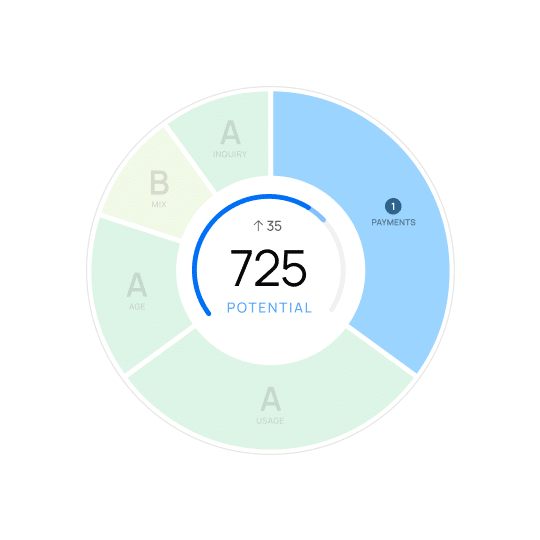

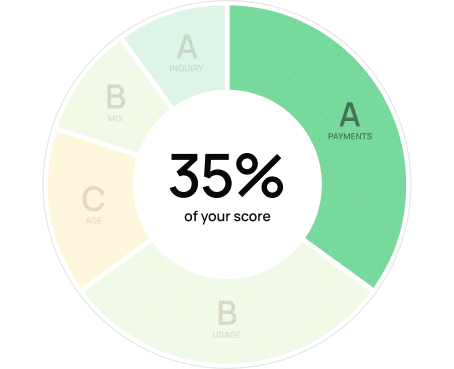

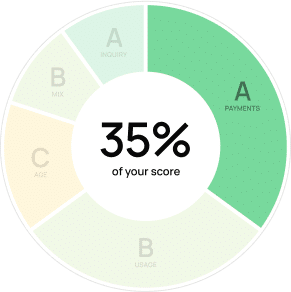

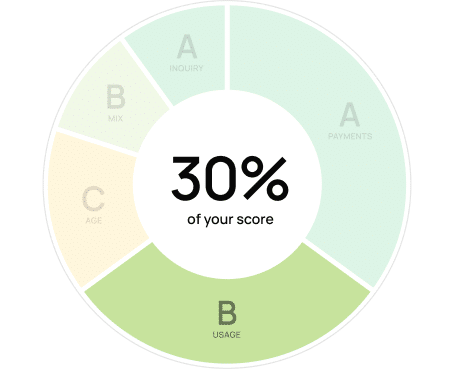

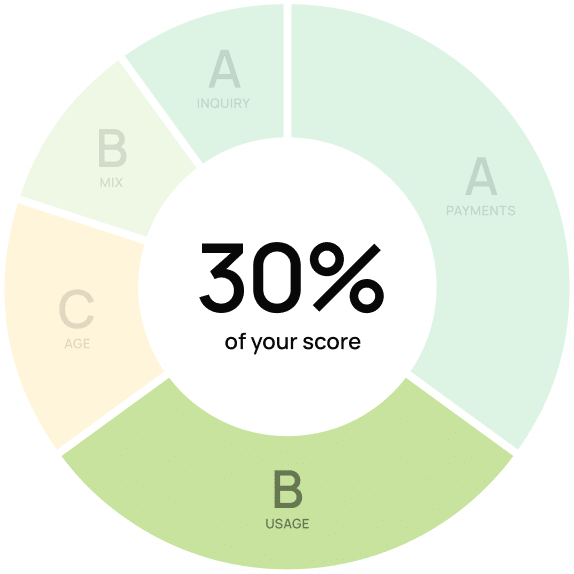

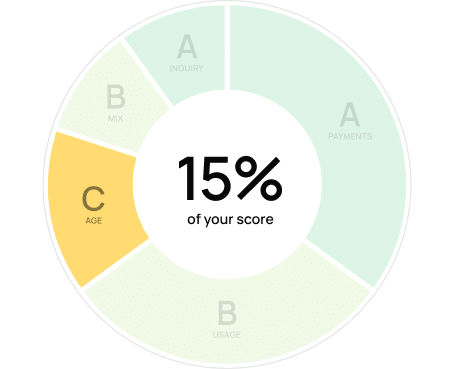

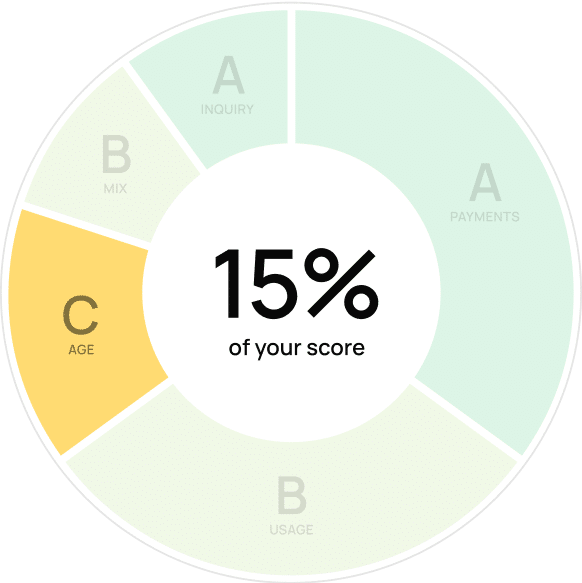

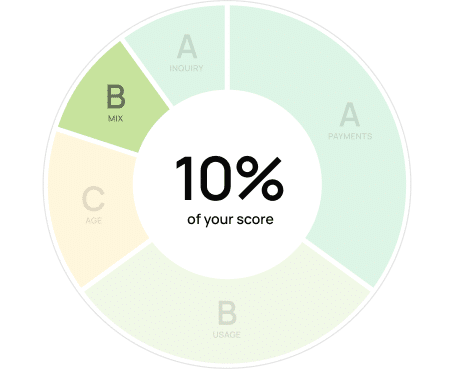

Get a more comprehensive look at your credit score,

see the factors behind the numbers, and follow clear actions to reach your goals.

By clicking on the button above, you agree to the

Credit Sesame Terms of Use and Privacy Policy.