What is the highest credit score

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- Why do credit scores matter?

- What types of credit scores are available, and how are they calculated?

- What are the lowest and highest credit scores?

- What is the highest credit score?

- What does the highest credit score mean?

- What are some of the benefits of having the highest credit score?

- Who can achieve the highest credit score?

- How can you work toward the highest credit score as a low-income earner?

- How can you work toward the highest credit score as a high-income earner?

- In a nutshell

Share this

Why do credit scores matter?

Your credit score, whatever it is, is important for several reasons.

First, it reflects your financial history over time. Doing the right things such as paying down debt, keeping debt at manageable levels and balancing the kinds of debt you hold can work to your advantage and nudge your score higher.

- Illustrate your ability to manage and pay off debt

- Record your financial history for future lenders, landlords and others

- Summarize your financial habits over time with a single number

- Benchmark your money management habits today and give you a baseline against which to raise your score

Second, your credit score gives others a sense of how you manage your finances. This is important when a landlord is deciding whether to offer you a rental contract on an apartment, for example, or when a bank is considering whether to extend a credit card.

A credit score is a shortcut that answers the question, “Will this person reliably pay their bills? Someone with the highest credit score is considered reliable.

What types of credit scores are available, and how are they calculated?

In fact, you have more than one credit score. Two of the most common scores are FICO and VantageScore.

- Timely payments. Does this person have a history of paying their bills on time? (35%)

- Debt balance. How much debt does this person owe? (30%)

- Credit history length. How far back does this person’s credit history extend? (15%)

- Credit mix. Does this person have several types of credit, such as credit cards, a mortgage or a car loan? (10%)

- Recent credit activity. Has this person recently applied for credit? (10%)

A closer look at each score factor illustrates why these questions are important.

Timely payments

If you tend to pay your bills on time over a period of years, you are likely a better candidate for a loan than someone who has been inconsistent or missed payments. The better your history of payment, the stronger your score is likely to be.

Debt balance

To have a high credit score, some level of debt must be reflected in your records. This is known as your credit utilization ratio. It is important that your debt levels not be too high. For example, some experts suggest holding a credit card balance no greater than 25% of the total credit available to you. This type of active and balanced usage shows lenders you know how to manage debt without maxing out your accounts, which could suggest you are financially riskier in your behaviors.

Credit history length

Lenders are more likely to extend credit to someone who has a history of using debt. In many cases, this is measured in years or more. Some types of credit might require less history. A little research can help you understand the requirements for the type of credit you seek.

Credit mix

A higher credit score is contingent on having multiple types of debt. This could include a combination of credit cards, car loans, student loans, a mortgage or a line of credit for your business. A combination of debt types allows you to demonstrate your proficiency in managing each.

Recent credit activity

A smaller factor in determining your score, recent credit activity simply refers to requests you’ve made related to your credit. This could be requesting your annual free credit reports or applying for a loan or a credit card. This can temporarily reduce your credit score slightly or, in some cases, raise it. In short, the impact is likely to be minimal as long as you are taking steps to manage the factors described earlier.

What are the lowest and highest credit scores?

- Very Poor to Poor: 300 to 549

- Fair: 550-629

- Good: 640-719

- Excellent: 720 to 850

What is the highest credit score?

Across both FICO and VantageScore, the highest achievable credit score is 850. In the past, some people achieved a score of up to 990 under VantageScore. That system has since been updated in line with FICO numbers.

What does the highest credit score mean?

If you have the highest credit score, it means you have successfully balanced the five factors discussed previously. You make timely payments again and again. You use debt without maxing out your accounts, and you pay attention to the ratio of how much credit you’re using versus how much credit is available to you. Your credit history dates back two to three years or more, and your financial practices have been consistently positive as evaluated by the scoring agencies. You hold multiple types of credit. And whether you’ve requested new credit recently or simply checked in on your score, those activities are in line with outstanding debt management practices.

To be fair, there is likely a little bit of luck involved with achieving the highest credit score: It’s estimated that fewer than 2% of Americans have achieved 850, and only one in five have a score exceeding 800.

In most cases, the highest credit score is a product of repeated good debt management habits, ongoing review of your credit score and collaboration with trusted financial advisers to keep your score on track.

What are some of the benefits of having the highest credit score?

- Get exclusive access to attractive credit card offers, bigger lines of credit or other types of financing.

- Secure lower rates on certain types of insurance, such as home or auto, as well as better interest rates on loans.

- Land a new home or apartment more quickly.

- Avoid a security deposit (in some cases) for utilities or other services to your home.

- Earn rewards such as money back on common expenses.

Beyond those benefits, having a high credit score can also boost your morale and give you greater confidence in your ability to manage debt.

Who can achieve the highest credit score?

Although achieving a high credit score is easier for those with good to excellent credit already, it’s within reach for many people willing to put in the time and work required. Follow the factors identified earlier. Work on lowering your credit use ratio, paying bills on time and developing a strong credit history.

How can you work toward the highest credit score as a low-income earner?

If you have a low credit score, a good first step might be to pull your free annual credit report from the three credit bureaus: Equifax, Experian and TransUnion. This gives you a starting point from which you can identify ways to improve your score.

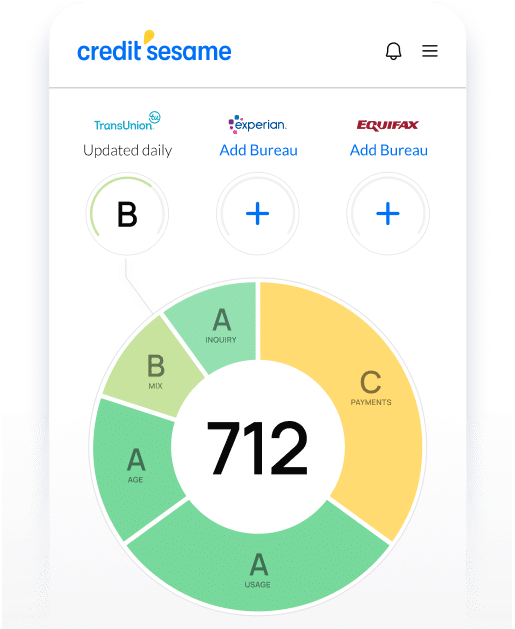

Get your free credit score and credit report summary with Credit Sesame

Consider working with a trusted financial adviser, a partner or, in some cases, a co-signer. Although your credit score is connected to your individual financial habits, working with others you can depend upon can help you learn and improve your number. Co-signing for a loan can also help improve your score when your co-signer has a strong credit score themselves.

Some of the credit bureaus even offer special programs designed with low-income earners in mind. For example, you probably have a cellphone with a payment plan. You likely also have monthly utility bills. In some cases, your credit bureau might be able to add those kinds of monthly payments to your credit report. Assuming you successfully pay these bills monthly, you could end up boosting your credit score over time because of those reliable payments.

Another option is to consider opening a secured credit card account. This means you place a certain amount of cash with your bank. In turn, the bank lends you money up to a certain level. This could expand access to credit you otherwise might be unable to secure.

Credit Sesame’s Credit Builder service helps you establish and increase your credit score

How can you work toward the highest credit score as a high-income earner?

A high income does not guarantee the highest credit score. One strategy effective for some high-income earners is to review your available credit. Ask your financial provider to update your records to reflect your income, particularly if you have taken a new, higher-paying job or received a raise. These new numbers could make you eligible for a higher credit amount. In turn, this could boost your credit utilization ratio and help nudge your score higher.

Also, check your annual credit report for errors. Mistakes on credit reports happen more often than you might realize. In unfortunate cases, you might see that someone has tried to commit fraud by taking out credit in your name. Correcting mistakes of any kind can ultimately help you get your credit score to a higher level.

In a nutshell

Although the highest credit score might provide some perks and be a point of pride, most people don't achieve it and don’t need it. Aim to stay in the good to excellent credit score range and you are assured of access to many of the credit products available to those with the highest score. If you keep up the good practices you need to build and maintain a good to excellent credit score, you may just end up with the highest credit score possible.

Take a look at your credit score and ask yourself: What's one thing I could do this month to help raise this score? It might be as simple as paying off your monthly bills. The sooner you take the first step, the more time you have to increase your score. Focus not on getting the highest possible credit score but on improving your score in a way that enables you to achieve your personal financial goals

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

How to build credit

How to improve credit score

What's a good credit score?

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.