Credit Sesame discusses the relationship between income and credit score.

High income earners tend to have high credit scores and low income earners tend to have low credit scores. However, the relationship between income and credit score is the result of many factors and a high income does not guarantee a high score and more than a low income guarantees a low score. Personal income is not used to calculate credit scores. But it can seem that way and raise questions about the correlation between income and credit scores.

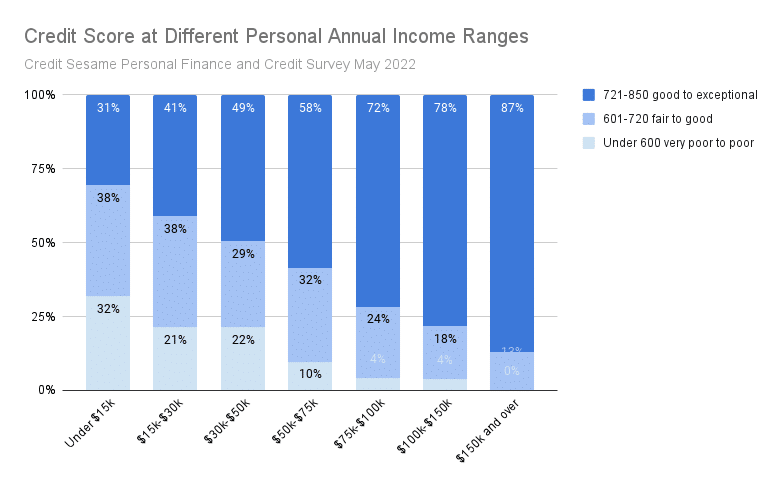

A recent survey by Credit Sesame indicates that 31% of Americans with an income of under $15,000 per year have a high credit score that is good to exceptional. At the other end of the scale 8% of Americans with an income exceeding $75,000 per year have a low credit score that is very poor to poor.

There is a clear correlation between income and credit score with lower income earners tending to have lower credit scores and higher income earners tending to have higher credit scores.

Exactly how does personal income affect credit score?

Does correlation mean causation?

While the Credit Sesame survey results show a correlation between low income and low credit score, and high income and high credit score, that doesn’t mean one doesn’t causes the other. A correlation is when there is an association between variables and one tends to track the other. Causation is when a change in one variable inevitably results in a change to the second. The difference between correlation and causation is important. It means that in spite of the apparent relationship between in come and credit score, a high income doesn’t automatically result in a high credit score, and a low income does not guarantee a low credit score.

How a credit score is calculated

Income isn’t tracked in credit reports, so it cannot affect credit scores. A credit score is a measure of a person’s ability to repay loans.

The three main national credit bureaus, Experian, TransUnion and Equifax, collect data in credit reports such as your history of borrowing money in loans and credit card accounts, and your history of repaying those debts.

Here are some things not included in a credit report to help eliminate potential bias:

- Income

- Marital status

- Employment status

- Race or ethnicity

- Religious affiliation

A FICO credit score is the most common credit score. The most important factors affecting a FICO credit score are:

- Bill payment history. Paying your bills on time is the best way to raise a credit score.

- Credit card balances. Using less than 30% of your total credit limit is best.

- Length of credit history. The longer you keep credit accounts open, the better.

- Credit mix. A diversity of credit accounts is best, including installment loans such as auto, student and home loans, and revolving credit accounts such as credit cards.

- New credit and recent applications. Too many new accounts or inquiries can hurt a score.

Why do low income earners tend to have lower scores?

About one in three people with an annual income under $15,000 have very poor to poor credit scores, the survey found.

The reasons can be varied, but may start with not having enough money to pay their bills. This can mean late or no payments made on credit cards and other bills, and a poor payment history is the biggest factor that can lower a credit score.

People who lose their job, are ill and can’t work, or face other factors that lower their ability to work and earn an income may add more charges to their credit cards and thus increase the amount of available credit they use.

Why do high income earners tend to have higher scores?

Once people start earning $75,000 or more per year, they’re less likely to have poor credit scores, the survey found. Those earning $150,000 or more had the highest scores, with 87% having good to excellent credit.

Their high scores may be tied to having more money to pay their bills, which if done on time can raise their scores. They may also rely less on credit cards to pay their bills, and use less of their credit limit.

Again, income isn’t used to calculate a credit score, but during a credit application process many lenders require proof of income through a pay stub or tax return as a way to show you can afford a credit card bill.

The percentage of your monthly income that you spend on debt payments, known as the debt-to-income ratio, or DTI, is factored into mortgage applications. A ratio of 36% or less is preferred. High income earners may be more likely to not use as much of their income on debt.

How do some low income earners have high credit scores?

Low income doesn’t cause low credit scores, so low income earners can have high credit scores just like anyone else can. The survey found that almost one in three Americans with annual income of $15,000 or less have good to excellent credit scores.

Low income earners can live within their means, pay their bills on time, limit use of their available credit, and take other steps toward good credit, just like people of any income level. Having a low income doesn’t mean you have poor credit habits.

How do some high income earners have low credit scores?

The same logic is true for people with high incomes. They can make mistakes and have low scores.

A credit score doesn’t show how much you earn. It also doesn’t show how big your retirement account balance is, if you’re a saver, or how stable your job is. Regardless of income, a credit score is a way to see how you’ve dealt with any credit you’ve taken on.

The wealthy can miss payments, rely too much on credit, have high debt, and open too many accounts. All of those factors affect a credit score.

Income and credit score takeaway

Low income may make it more challenging to get a high credit score, but does not make it impossible. Having a high income makes it easier to get a high score but it does not guarantee it.

You may also be interested in:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.

Survey methodology

The Credit Sesame Personal Finance and Credit Survey 2022 was designed and executed by Credit Sesame using the Momentive Inc. survey tool. General population data was collected online May 20-21, 2022. The survey sample comprised 1,222 U.S. residents aged 18 to 99 years balanced for age and gender using U.S. Census data. The sample data is accurate to within + 2.88 percentage points using a 95% confidence level.