For many of us, a college degree comes with a high price tag. The average cost of in-state tuition, fees, room and board at a four-year public university totaled $20,090 for the 2016-17 school year. Private universities clock in at $45,370, according to CollegeBoard.

Not surprisingly, most students (70 to 90 percent, depending on the source) turn to student loans to cover the gap. Collectively, Americans owe more than $1.4 trillion in student loan debt and counting.

Federal student loans

While borrowing to pay for college isn’t ideal, it may be a necessity and in that case, federal student loans should be your first choice. Federal loans offer relatively low interest rates and generous options when it’s time to start repaying your student loans.

One potential stumbling block with federal student loans is that they limit the amount you can borrow each year.

- For subsidized or unsubsidized Stafford loans, for example, the total amount you can currently borrow as an undergrad is $57,500, assuming you’re financially independent from your parents

- Graduate and professional students can borrow up to $138,500, but that still may fall short of the total cost

If your federal student aid package comes up short, one possible solution is private student loans. Private student loans differ from federal loans in several key ways and before you borrow, you need to understand those differences.

What are private student loans?

Private student loans are funded by private lenders. Some of the most recognizable private student loan lenders include Sallie Mae, LendKey and College Ave, but loans are also offered by many other banks, including PNC Bank, Citizens Bank and SunTrust.

The advantages of private student loans

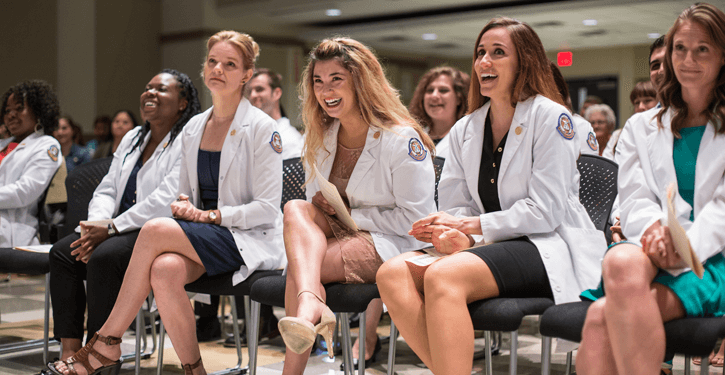

The primary benefit that private student loans offer is the ability to borrow more than you could with a federal student loan. Typically, private student loan lenders set their annual lending limit to match the total cost of attendance, minus any other financial aid you qualify for. As a result, the total aggregate loan limits for undergraduates and graduate or professional students may be much higher than that associated with federal student loans alone. If you attend a pricey private university or you’ve got your sights set on med school, private student loans can pick up where your federal loans leave off.

Private student loans can also come to the rescue if, for some reason, you neglected to fill out the Free Application for Federal Student Aid (FAFSA) by the required deadline. This is the application that’s required to apply for federal student loans. The processing time for private student loans is usually shorter than the wait time for federal student loans so even if you wait until the last minute, you could still be able to get the funding you need for school.

Applying for private student loans: Your credit counts

One of the main differences between private student loans and federal student loans is the criteria used to determine whether you can get a loan.

For loans funded through the Department of Education, the primary determining factor is your financial need, which is based, in part, on how much money your parents are expected to contribute to your education. This contribution amount is calculated using your cost of attendance, your parents’ income, any scholarships you’ve received and any assets you or your parents have, including funds in a 529 savings account.

For private student loans, financial need carries less weight than your ability to repay the loan and your credit standing. Just as a lender checks your credit when you apply for a car loan or a mortgage, private student loan lenders look at your credit when you apply for a student loan. Specifically, they check your credit report and credit score to gauge the level of risk you represent, based on how you’ve managed your credit and debt in the past. Your credit score also influences the interest rate the lender charges on what you borrow.

If you don’t have a lengthy credit history yet or you’ve got a low credit score because of a past credit mistake, you could hit a snag during the application process. That doesn’t mean you’re down for the count, however. You could still qualify for a private student loan by enlisting the help of a cosigner.

How cosigning works for private student loans

Cosigning on a private student loan works the same way as cosigning on any other loan. The lender looks at your cosigner’s financials, including his or her income, assets, debt and credit score. Your cosigner doesn’t necessarily have to be a parent either. Many private student loan lenders will let any U.S. citizen over the age of 18 act as a cosigner on a private student loan.

If your cosigner’s got a strong credit profile, your lower credit score or nonexistent credit history may not work against you so much during the loan application process. There is, however, a catch. When the cosigner puts his or her name on your loan, he/she assumes equal responsibility for the debt. That means if you default on the payments down the line, the default will show up on your cosigner’s credit report as well as yours. The lender can enforce collection actions against both of you, including suing you both for the balance owed.

While you may not have any intention of defaulting on your private student loans, you can’t predict what curveballs life may throw your way. For that reason, it’s important that you have a good relationship with your cosigner and you both understand the implications of cosigning.

How to get out of a cosigned loan

If your cosigner is hesitant to make this financial commitment, you have two possible solutions.

- Get the loan with a cosigner and then refinance the loans after you’ve paid on them for a while. Refinancing means taking out a new loan to pay off the old one. Your credit will need to be able to stand on its own to get approved for the new loan.

- Choose a private student loan lender that allows the cosigner to be released from his or her obligation to the debt after you’ve made a certain number of payments against the loan. For example, you may be able to get your cosigner released after making 24 or 36 consecutive, on-time payments. This option generally requires some paperwork and proof that you’ve got enough income to sustain the loan payments.

How private student loans affect your credit

Once you’re approved for a private student loan, either with or without a cosigner, the loan or loans will show up on your credit report. These loans are a type of installment debt, meaning the balance does not increase, and the payments are fixed for a set period of time.

A private student loan affects your credit score like any other installment loan. If you make your payments on time, your credit score will benefit. If you pay late or let the loan slip into default, your credit score will suffer.

Having a private student loan listed on your credit report can be helpful if credit cards were your only accounts previously. Along with your payment history, part of your credit score calculation is based on the different types of credit you’re using. Credit cards are revolving debt, meaning that as you pay the balance down you can make new purchases against your available credit.

A private student loan does not show up in your credit utilization ratio. This ratio indicates how much of your available revolving credit limit you’re using at any given time, and it accounts for nearly one third of your credit score. Lower utilization is better, meaning you should have available credit but not use it much. The payoff date and payment amount is fixed on an installment loan and you can’t borrow more against the loan as you pay it down.

Downsides to private student loans

Compared to federal student loans, private student loans are associated with several important potential drawbacks.

Interest rate

Rates for federal student loans are set by Congress. As of 2017, the highest rate on a federal student loan was 6.84 percent.

Private student loan rates are set by lenders. Since those rates depend in part on your credit, it’s possible to pay an interest rate well in the double-digit range if your credit score is on the lower side of the spectrum. The higher your rate, the higher your monthly payment and the more the loan will cost over time.

Private loans may have a fixed or variable rate. A variable rate is tied to an underlying index, such as the federal Prime rate. When the index rate changes, so too does the rate on your student loan.

What that means for borrowers who choose private student loans with a variable rate is that their monthly payments will increase or decrease over time. In today’s market, rates are expected to rise over time.

Grace period

The repayment period on a federal loan typically begins six months after you graduate or leave school. Private student lenders may not offer a grace period at all. Some expect you to begin making payments while you’re still in school.

Repayment options

Repayment options on a private loan are very limited. Federal loans allow deferment and forbearance under certain circumstances, both of which allow you to temporarily skip payments on your loans. For a private loan, the lender decides whether to extend these same protections and many do not.

Federal loans offer a wide variety of repayment plans, including many that are tied to your income. During years when you earn less, your required payment is lowered accordingly. Most federal loans are considered satisfied in full after you make a required number of payments, even if there is still a balance due. Private loans do not offer forgiveness of any unpaid balance, no matter how many decades you pay.

Comparing private student loans

If you’re considering private student loans, the best thing you can do is carefully compare different lenders to see which one is a good fit, based on how much you can borrow, the interest rates and the minimum credit score needed to qualify.

Check your credit report and score before you apply for a loan to get an idea of how likely you are to be approved on your own. The same applies if you’ve already got private student loans and you’re interested in refinancing. Sign up for a free Credit Sesame account for access to your free credit score, updated monthly, and your credit dashboard, where you can see how you’re doing on all the factors that influence your score. You will also find recommendations for private student loan refinance lenders, based on your credit profile.

Sources:

https://trends.collegeboard.org/college-pricing/figures-tables/average-published-undergraduate-charges-sector-2016-17

https://www.federalreserve.gov/releases/g19/current/default.htm

https://studentaid.ed.gov/sa/types/loans/interest-rates

https://studentaid.ed.gov/sa/repay-loans/understand/plans