How to check your credit score

Do you know how to check your credit score? If not, now is the time to learn. It’s useful to check and understand your credit score for several reasons.

- If you know your credit score, you won’t waste time chasing loans you can’t get (yet). For instance, some personal loans are only available to borrowers with scores of 740 or higher. If you know your score is 660, you won’t waste time applying for those.

- Checking your credit score before applying for a mortgage, installment loan, or credit card can help determine your likely interest rate and payment.

- If you’re working to improve your credit, checking your score regularly helps you track your progress.

- Getting quotes from several lenders before taking a loan saves you money. However, lenders can only provide a meaningful quote with an estimated credit score.

There are many ways to get a credit score, some of which are free. But, not every source provides the same type of credit score. When you access your credit score, you need to know which score you’re getting and what, if anything, it will cost.

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Main credit score types

There are two major credit scoring models, each with several variations and versions. These are the FICO and VantageScore. They calculate your score by applying slightly different formulas to your credit report data.

There are currently 16 versions of the FICO score and you don’t get to choose which one a creditor uses when you apply for a loan.

In 2006, all three bureaus got together and created the VantageScore. VantageScore incorporates credit data from all three bureaus, while FICO may have a different score for each credit bureau. There have been several versions of the VantageScore.

How many credit scores are there?

Chances are good that you have more than one credit score. In fact, you could have 20 credit scores! That’s understandable when you see how credit scores are calculated.

To calculate a credit score, a requester, such as a bank, obtains a credit report from a Credit Reporting Agency (CRA) and applies a scoring model like FICO or VantageScore. Custom models are also available. This process results in multiple scores, as FICO offers various versions tailored to specific loan types (auto, mortgage), and creditors can choose from three credit bureaus. While it is technically possible to have many FICO scores based on the credit products and creditors’ preferences, the actual number is unlikely to exceed 20.

Credit scores provided to consumers are often educational and different from those used by creditors. And even scores used by creditors are likely to vary depending on who pulls it and when it was pulled.

Why do credit scores vary by provider?

If you apply for a mortgage with Banks A and B, each bank might come up with a different credit score for you. And if you apply for a credit card with Bank A, the credit card department might get a different score than the mortgage department.

Most scoring models are some version of the VantageScore or the FICO score. Variations exist for different industries and educational scores for consumers that creditors don’t use. Each model may consider the information in your credit report slightly differently. It’s like one of those popular cooking shows in which all contestants get the same ingredients to use but may combine them in different amounts and get different results.

However, your credit scores are likely similar; even an educational score is helpful. If your educational score is trending up or down, your others are probably moving in the same direction.

Credit scores may also vary because of how creditors report to the three major credit bureaus. Your credit card company might report to Experian on the 5th of the month, TransUnion on the 15th, and Equifax on the 25th. Your balance will likely differ on each of those days, and that’s all it takes to alter your score. Or a creditor might only report to two of the three bureaus – so your payment history – good or bad – with that company won’t make it into every score.

How to check your credit score (5 methods)

Credit card issuers

Many credit card companies offer free credit scores to their cardholders. You can get a score from your statement or by logging into your account online.

- American Express: VantageScore 3.0 by TransUnion

- Bank of America: FICO by TransUnion

- Capital One: VantageScore 3.0 by TransUnion

- Chase: VantageScore 3.0 by Experian

- Citi: FICO by Equifax

- Discover: FICO by TransUnion

- U.S. Bank: VantageScore 3.0 by TransUnion

- Wells Fargo: FICO by Experian

Some companies don’t even require you to be a customer to access your credit score.

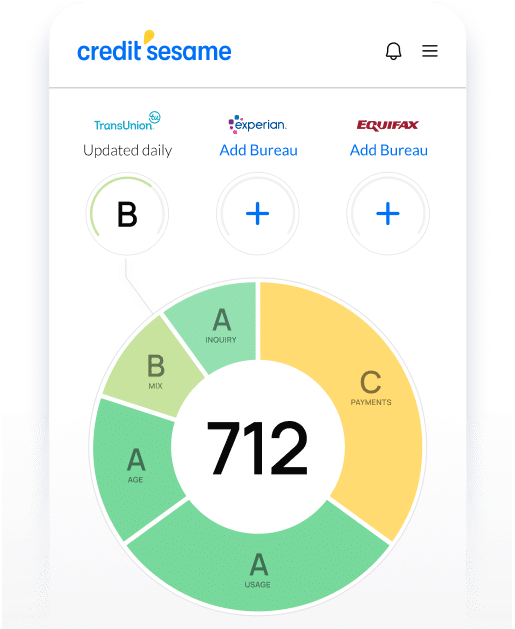

Credit monitoring sites

Most credit monitoring companies (like Credit Sesame) offer free VantageScores to their customers. Credit Sesame includes free credit monitoring and other tools to help you raise and protect your credit score. You don’t need to supply credit card information or sign up for a trial, and you can check your credit score for free every day if you want.

FICO also offers credit scores and credit monitoring. Plan prices range from free to $29.95 per month.

Your bank

If you need to know your credit score, check with your bank or credit union. Many of them allow you to log into your account online or through their mobile app and see your credit score. You may also be able to call their customer service department.

Major credit bureaus

The three main credit bureaus, Equifax, Experian, and TransUnion, offer credit scores and monthly updates. Some are free, and others cost extra.

You are entitled by law to a free credit report from each of the big three bureaus every year. You can order them on the federal government’s site, www.annualcreditreport.com. However, these free reports don’t include your credit scores.

Credit counselors

Does checking your own credit lower your score?

You may have heard that “hard” credit inquiries, for example, when you apply for credit and a company pulls your credit report – cause your FICO score or VantageScore to drop. That’s mostly true. Each inquiry causes a three to five-point drop.

Why do inquiries hurt your credit score?

Credit scoring models penalize consumers who generate many hard credit inquiries because, statistically, people with many applications for new credit are more likely to default on their debts. Every credit card and personal loan application inquiry hurts you a little. Be careful when shopping for these loans, and only allow a hard pull when you know you want that loan or card and you’re confident you’ll be approved.

However, credit scoring models treat inquiries for mortgages and vehicle loans differently because most people only shop for one loan. If you have inquiries from six mortgage lenders in a month, you’re probably not getting six mortgages – you’re just checking interest rates with several lenders. So, multiple inquiries from mortgage or auto lenders within a short timeframe are treated as one inquiry by scoring models.

Next are the “soft” inquiries, in which companies check your credit score to see if they want to offer you credit. The difference with a soft inquiry is that you do not initiate it, so you won’t be penalized.

If you need to know your credit score, check with your bank or credit union. Many of them allow you to log into your account online or through their mobile app and see your credit score. You may also be able to call their customer service department.

Checking your own credit score

What about checking your own credit score? That’s a soft inquiry, too. It does no damage at all. You can check your credit score through any of the above-listed sources as often as you want. Personal finance experts recommend closely monitoring your credit report and score.

- Track your score over time to see the impact of changes to your credit management tactics.

- Keep an eye on your score to head off identity theft.

- Check your score and credit reports for accurate or complete information.

It’s easy and, in many cases, free to check your credit score—there’s no reason not to. However, credit monitoring is an excellent option for staying on top of your credit with less effort.

Is it okay to check your credit score with different sources?

Of course, it is. You know you can have many different credit scores, so why not look at more than one? Banks, credit monitoring sites, credit card issuers, and credit bureaus may offer your different credit scores at little or no cost. So, tapping several sources for whatever information they can provide is fine.

In addition, some sites combine other valuable services like credit monitoring and credit building with free credit scores. These can help improve your financial health, raise your credit score, and save money on everything you finance.

In a nutshell

Understanding credit scores empowers you. Regularly monitoring your credit score allows you to identify and address errors quickly, protecting your financial health. Knowing when your score is good can help you qualify for better loans, negotiate interest rates, and track your financial progress.

Your credit score is a key factor in your financial well-being. Take control by checking your score regularly, understanding how it's calculated, and taking steps to improve it. Remember, multiple scores exist, but the overall message is clear: a good credit score unlocks financial opportunities.

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

What is a credit score

What's a good credit score?

How to improve credit score

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.