SAN FRANCISCO, Calif., September 1, 2020 — CB Insights today named Credit Sesame to the third annual Fintech 250, a prestigious list of emerging private companies working on groundbreaking financial technology.

Since its inception, Credit Sesame has focused on credit and helping consumers improve their financial health. Credit Sesame’s deep credit expertise and understanding of the relationship between credit and cash provides a unique solution for millions of Americans by helping them effectively use their credit and cash to work toward financial stability and create better opportunities for themselves and their families.

Credit Sesame has emerged as a leading credit management company producing impactful results for consumers. About 60 percent of Credit Sesame members have seen their credit score improve within the first six months of using the platform — 50 percent have seen their credit score improve by more than ten points in their first six months, and 20 percent have seen their credit score improve more than 50 points in their first six months.

Earlier this year, Credit Sesame launched Sesame Cash, the first digital bank account that helps consumers grow their cash and credit together, while providing customers with more rewards and benefits than any other digital bank account on the market. The company is one of the fastest growing challenger banks, signing up more than 200,000 customers its first month and rewarding thousands of customers with cash rewards for improving their credit scores.

“We initially approached personal finance from the perspective of personal credit management, which has enormous demand as it’s an integral part of a person’s financial picture. With the launch of our digital banking service, Sesame Cash, we are expanding our AI and optimization capabilities from credit to cash-and-credit management,” said Adrian Nazari, Credit Sesame CEO and founder. “We already serve a large and growing member base, and now we have a more holistic personal finance platform with the potential for massive scale. We’re honored to be recognized by CB Insights for our progress here.”

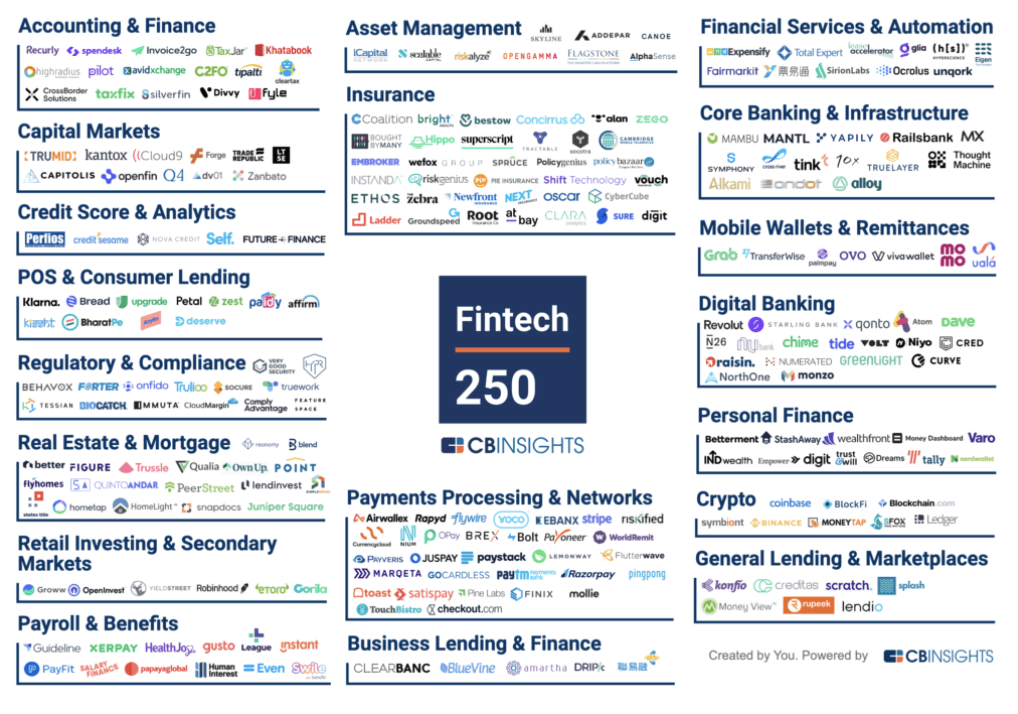

Through an evidence-based approach, the CB Insights Intelligence Unit selected the Fintech 250 from a pool of 16,000 companies, including applicants and nominees, based on several factors. These factors include patent activity, investor quality, news sentiment analysis, proprietary Mosaic scores, market potential, partnerships, competitive landscape, team strength, and tech novelty. The Mosaic Score, based on CB Insights’ algorithm, measures the overall health and growth potential of private companies to help predict a company’s momentum.

“We’re proud to, once again, recognize the 250 best private fintech companies globally. This year’s Fintech 250 represents 25 countries and spans 19 categories — reimagining everything from retail banking and crypto, to insurance and asset management,” said CB Insights CEO Anand Sanwal. “The previous Fintech 250 class raised more than $22 billion in investor financing and saw more than 20 exits after being recognized, and we expect this year’s class will have similar success as they continue to transform how people and businesses spend, save, borrow, and invest their money.”

About CB Insights

At CB Insights, we believe the most complex strategic business questions are best answered with facts. We are a machine intelligence company that synthesizes, analyzes and visualizes millions of documents to give our clients fast, fact-based insights. Serving the majority of the Fortune 100, we give companies the power to make better decisions, take control of their own future, and capitalize on change.

About Credit Sesame

Credit Sesame’s mission is to help consumers work toward financial stability and ultimately create better opportunities for themselves and their families. Strong credit health is inextricably linked to financial health and stability, and with the launch of Sesame Cash, Credit Sesame will help consumers manage both. Credit Sesame has helped millions of consumers improve their credit scores, increase their approval odds, lower the cost of credit and save money. Credit Sesame is funded by leading venture capital firms and strategic investors, including Menlo Ventures, Inventus Capital, Globespan Capital, IA Capital Groups, NortonLifeLock, Capital One Ventures, Stanford University, and ATW Partners, among others. Credit Sesame currently operates in the U.S. and Canada. For more information on Credit Sesame, visit www.creditsesame.com and follow on Facebook, Twitter and LinkedIn.