Cash or points? It’s a tough decision when going in for a rewards credit card, but there’s no denying that cash back credit cards are hard to pass up, since they give back a percentage of your eligible purchases in real dollars.

Think about what you could do with the amount of cash back you receive, like invest it into a high-interest savings account, pay down debt, build an emergency fund, or use it towards another purchase.

Your options to redeem rewards are many, and so are the types of cash back credit cards on the market. You’ll typically find cash back rates of anywhere from 1% to 5%, based on the particular card. Depending on the card you choose the available cash back credit cards may also offer a bonus for qualifying new Cardmembers, or an introductory Annual Percentage Rate (APR) offer along with the various terms and conditions to consider for each card. Then, too, it would be helpful to know which cards are suggested for certain credit scores, and what your score is before applying. Keep in mind that credit scores are just one factor that credit card issuers use to assess your eligibility for a credit card. Just because your credit score is in a particular range does not guarantee you will be approved for a credit card. Credit card issuers use a variety of different types of credit scores and other criteria to make credit decisions.

Which card is right for you? For a start, look for one that closely matches your spending habits to find one that is a fit for you.

What credit score is needed for a cash back credit card?

Having a healthy credit profile is definitely a step in the right direction. There are many variables in the decision making process to extend credit, your credit score included. However, having a credit score in a particular range is not a guarantee that you will be approved for a credit card or if you are approved what the terms extended to you will be.

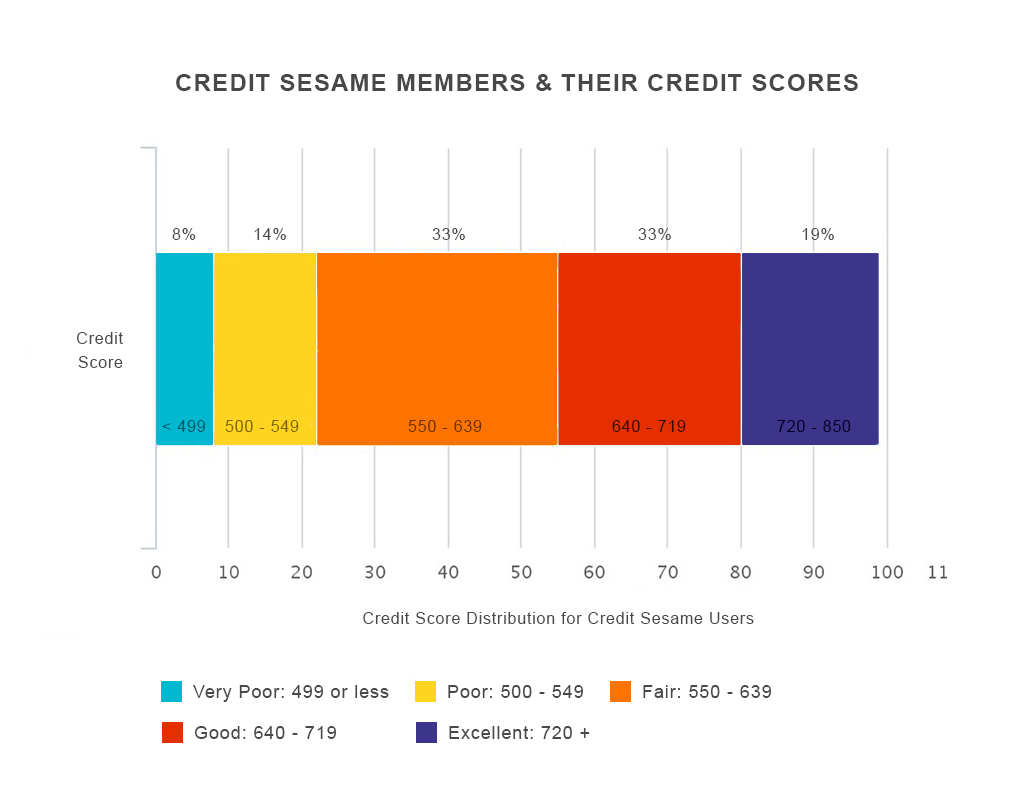

To give you an idea of credit scores and ranges (credit scores and ranges vary based on the credit bureau, below chart is based on the TransUnion scoring model), this is a chart that shows the average credit scores, taken from a subset of Credit Sesame’s 7 million members collected October 2015.

If you’re unsure of where you stand, check out your credit score before you apply for a card. You can get a free copy of your credit report every 12 months from each credit reporting company.

Best cash back cards

If you sign up for one or more cards, consider them for the rewards they offer that can translate to cash in your pocket. Examine your typical spending first, and choose the card that offers the greatest reward for the purchases you are already likely to make. Here are a few other tips you may find helpful when considering a card. If the card has an annual fee consider if it makes sense to own the card, meaning do the features and perks of the card even out or outweigh the cost of the annual fee. If you tend to carry a balance pay attention to the Annual Percentage Rates (APR’s).

Once you decide on a card be sure to manage your account responsibly such as make all your payments so they are received on-time. Stay within your means, don’t use the card as a reason to spend more just to earn rewards. Use your cash back refund wisely, invest it into a high-interest deposit account, pay off debt or use it towards future purchases that, with card in hand, earn you more cash back with smart use.

If you’re interested in cash back credit cards you can learn more and view credit card offers from our partners – click here.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available.

Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click on the “Apply Now” button, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.