EDITOR’S NOTE: The OpenSky® Secured Visa® Credit Card, and First Progress Platinum Prestige Mastercard® Secured Credit Card offers mentioned in this article have expired and are not available on our site

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved, or otherwise endorsed by any of these entities. First published September 14, 2016

OpenSky® Secured Visa® Credit Card snapshot

When you’re trying to establish credit for the first time or rebuild your score after a bankruptcy, foreclosure, or other rough financial spot, a secured credit card, when used responsibly by you can be a lifesaver. The OpenSky® Secured Visa® Credit Card is one you may want to consider, whether you’re starting out or you’re starting over. You can apply for the card without a credit check and it takes just a few minutes to apply for an account. If you need a secured card to get your credit on track, take a close look at our review of the OpenSky® Secured Visa® Credit Card and compare this card with others you are considering and you may find one that fits your needs.

OpenSky® Secured Visa® Credit Card highlights

| OpenSky® Secured Visa® Credit Card At a Glance | |

|---|---|

| Annual Fee: | $35 |

| Application Fee: | None |

| Security Deposit: | as low as $200 and up to $3,000 |

| Rewards Program: | None |

| We Think it’s Great For: | Someone who’s building credit for the first time Someone who’s interested in repairing bad credit |

| We Think These Folks Should Do More Research: | Someone who wants to earn rewards on their spending Someone who wants to be able to transfer a balance Someone who carries a balance from month to month |

| Additional Notes: | Terms and conditions apply. View the cardholder agreement. |

How does a secured card work?

If you’ve never had a secured credit card before you might not understand how they work. Here’s a quick rundown. To open a secured credit card account, you have to make a cash deposit to the card issuer. The amount of your deposit is usually, but not always, the amount of your credit limit. However, your monthly payments don’t come out of your deposit – your deposit is held as collateral in case you fail to pay your payment due. With a secured card you still have to pay off your charges each month, in short, you need to pay at least your minimum payment due on time each month. Anytime you make a transaction such as a purchase or cash advance, your available credit is reduced by that amount. After your payment is credited to your account, your available credit goes back up.

Later on when you upgrade to a traditional credit card or close the account for any other reason, your deposit will be returned to you in full, assuming you’ve paid your balance in full and met all your financial obligations on the secured card. Be sure to read the terms/cardholder agreement for each credit card for more information.

OpenSky® Secured Visa® Credit Card basics

The OpenSky® Secured Visa® Credit Card allows you to make your security deposit as low as $200 and up to $3,000, so you have some flexibility when it comes to determine how much credit you will have with the Card. Your refundable* deposit, as low as $200, becomes your OpenSky Visa credit limit. (*View the cardholder agreement)

The OpenSky® Secured Visa® Credit Card reports to all three major credit bureaus monthly, so your account history will factor into your credit score. Not all secured cards report to all three bureaus. This is an important detail to ask about, since documenting how you are handling your account and building a credit history depends on the card issuer reporting your account details to all three major credit bureaus.

The Annual Percentage Rate (APR) is currently 25.64% variable. This APR will vary with the market based on the prime rate. This card does not charge a fee to apply but it does come with a $35 annual fee.

OpenSky® offers an unsecured credit card account, so you’ll have to keep an eye on your credit and consider applying for a traditional card after six to twelve months after you have demonstrated consistent responsible management of all your credit obligations.

View the OpenSky® Secured Visa® Credit Card cardholder agreement and their application page for more details.

Terms apply.

OpenSky® Secured Visa® Credit Card vs. other secured options

It’s always a good idea to shop around. We’ve chosen another option we think may be worth a look for anyone who’s considering a secured card to improve their credit.

First Progress Platinum Prestige Mastercard® Secured Credit Card

Card highlights we want to feature:

-

- No minimum credit history or credit score required

-

- Your credit line is secured by your fully-refundable deposit of $200 – $2,000 submitted with your application

-

- $49 annual fee

-

- Reports to all three major credit bureaus

The First Progress Platinum Prestige Mastercard® Secured Credit Card is issued by Synovus Bank. Your credit line is secured by your fully-refundable deposit of $200 – $2,000 submitted with your application. Your security deposit is always 100% refundable providing you have met all your financial obligations that are due on the card.

The annual fee is a few bucks higher then the OpenSky® Secured Visa® Credit Card but the purchase APR is quite a bit lower. That could make this card more valuable than the OpenSky® Secured Visa® Credit Card if you aren’t able to pay off in full what you charge each month. Your balances and payment activity will be reported to the credit bureaus and will show up on your credit reports.

When looking to convert to a traditional credit card, after six to twelve months after you have demonstrated consistent responsible management of all your credit obligations, you may be eligible for a traditional credit card. Check with the card issuer if they have a program in place to convert you to a traditional card.

Another perk to consider, with the First Progress Platinum Prestige Mastercard® Secured Credit Card you earn 1% cash back rewards on payments made to your First Progress Secured credit card account.

Terms apply.

A word about utilization ratio

A higher credit line can work in your favor where your credit score is concerned because it affects your credit utilization ratio. Your utilization ratio is how much debt you have compared to your total credit limit. If you have a high credit line but you use only a small percentage of it, that helps your credit score. Your credit score is inversely proportional to your utilization. In other words, the more of your available credit that you use, the lower your score will be (all else equal).

Here’s an example. Let’s say you charged $250. If your secured card has a $500 limit, your utilization is 50%. People with top credit scores tend to use no more than about 7% of their credit limit. Let’s say instead that you have a $5,000 limit on your secured card. Now you’re only using 5% of your credit. The higher credit limit on the very same card can put you elbow-to-elbow with people who have credit scores of 800 or higher.

Credit Sesame data shows members are using too much of their available credit

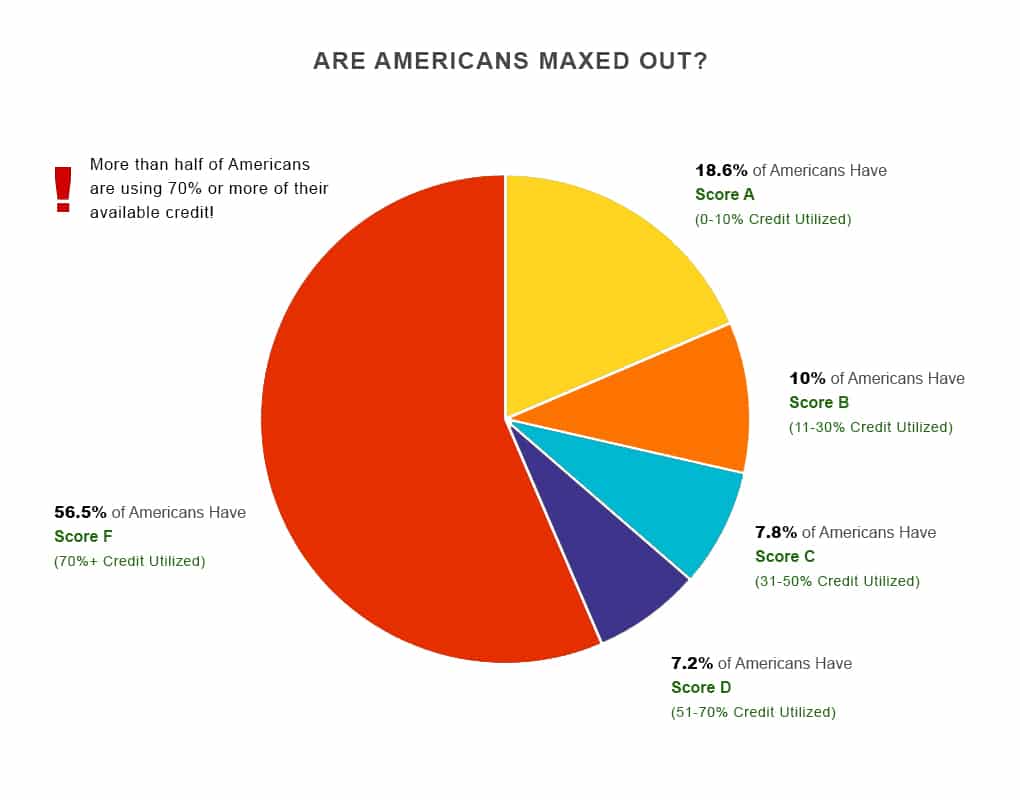

If you’re dealing with a high utilization, don’t worry, you’re not alone. According to data gathered from a subset of Credit Sesame’s 8 million members, we discovered that more than half are using 70% or more of their available credit. (Your utilization is directly tied to a credit letter grade, which is why the lower the utilization rate, the higher your letter grade, as it shows in the pie chart below.)

*Data from the pie chart gathered from a subset of Credit Sesame’s 8 million members August 2015.

When looking for a credit card, a couple of points to compare would be the purchase APR and the annual fee. Again, the purchase APR is a moot point if you pay your purchase balance in full every month. Most credit card issuers will not charge you any interest on your purchases if you pay your entire balance by the due date each month (payment must be credited to your account by the due date). Be sure to read the terms and conditions for any card you are considering applying for to see how interest is charged.

Does OpenSky® Secured Visa® Credit Card offer rewards?

The OpenSky® Secured Visa® Credit Card doesn’t have a rewards program. That means you won’t earn any cash back, points or miles when you make purchases with the card.

OpenSky® Secured Visa® Credit Card pros

So what do we think are the OpenSky® Secured Visa® Credit Card’s strong points?

The application process is fairly straightforward, you can sign up online and there is no credit check necessary to apply.

You can open the account with as low as $200, however if you provide a security deposit of $3,000 you can get the maximum credit limit, which is pretty high.

This card can be used anywhere Visa® is accepted.

OpenSky® Secured Visa® Credit Card cons

No credit card is 100% perfect and the OpenSky® Secured Visa® Credit Card falls short on a couple of different counts.

The 25.64% variable purchase APR means this card doesn’t come cheap if you carry a balance. If you just pay the minimum payment due each month, you’ll still build a credit history but at a premium, meaning you will be

paying finance charges on any of your balances that you carry.

The lack of a rewards program is also something some card members may find discouraging. After all, who doesn’t want to put a little money back in their pockets while they spend?

Should you get the OpenSky® Secured Visa® Credit Card?

If your number one goal is growing your credit and you’re not as concerned with lots of bells and whistles, the OpenSky® Secured Visa® Credit Card may be worth a closer look from you. As long as you pay your bills on time (at least the minimum balance due) and keep your balance low in relation to your credit limit, this card can be used as a tool to help put you on the path to building, or improving your credit. Remember it’s ultimately up to you to handle your credit responsibly.

To get a feel for your starting point, take a look at your free credit report from Credit Sesame.

Independent Review Disclosure: All the information about the OpenSky® Secured Visa® Credit Card, and First Progress Platinum Prestige Mastercard® Secured Credit Card have been collected independently by CreditSesame.com and have not been reviewed or provided by the issuer of these cards. The OpenSky® Secured Visa® Credit Card, and First Progress Platinum Prestige Mastercard® Secured Credit Card are not available through CreditSesame.com.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available.

Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click to apply, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.