Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Overview: Is it Better to Use a Debit Card or a Credit Card?

Do you find yourself using a credit card more often than a debit card lately?

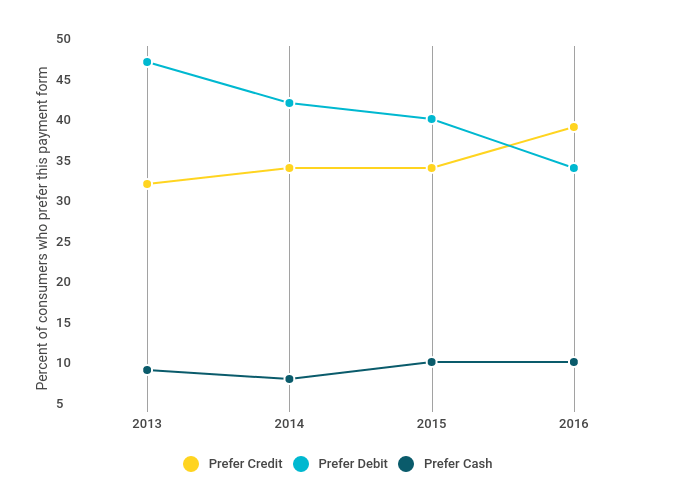

Nationwide, that’s the trend. Nearly half of us preferred debit in 2013, but that number was down to about one third in 2016.

The number of people who prefer credit, however, is rising.

Source: TSYS – 2016 U.S. Consumer Payment Study

What’s the Difference Between Credit and Debit Cards?

Debit cards and credit cards may look and feel like the same thing, but they are not.

It’s actually quite easy to understand the difference.

What is a Debit Card?

With debit cards, you spend your own money, plain and simple.

What is a Credit Card?

With credit cards, you borrow from a lender who wants to charge you interest.

On the face of it, it may seem like a no-brainer that you should use a debit card instead of a credit card — but if choosing between debit and credit were as simple as a two-sentence summary, we would already be done here.

As you can see, we’re not. Why? Because the devil is in the details.

The Key Points: Determining When to Use Your Debit Card and Credit Card for Maximum Advantage

Enough definitions – let’s take a look at how people around the US use their cards and whether they are using them correctly and to their greatest potential.

First we’ll answer a basic question that you came here to understand.

Basic Rules of Debit and Credit: When Should You Use Credit and When Should You Use Debit?

Match the card to the goal.

If you want to avoid debt or you don’t like paying monthly bills, use your debit card.

If you want to earn rewards for your everyday spending, use a credit card that allows you to do that.

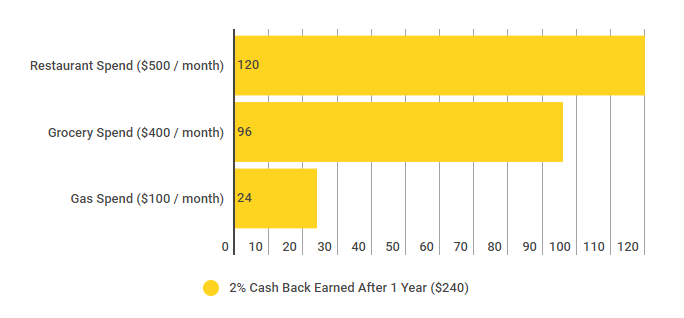

Some consumers underestimate the value of credit cards and therefore don’t take advantage of opportunities to lower costs by earning points, miles or cash back.

The Data: Using Your Credit Card for Points, Cash Back, and Other Perks

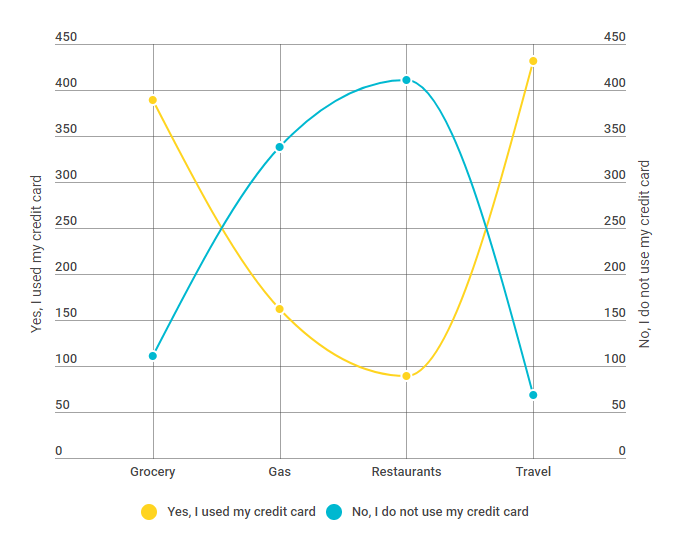

Most of us buy groceries, gas and restaurant meals. Many of us also spend money on travel. These are the spending categories where many credit cards pay the greatest rewards.

We asked 1,000 Americans whether they use their credit card on any of these 4 common spending categories. Respondents could select multiple options.

This doesn’t mean that credit cards are always the best choice, but let’s take a look at the conditions we think are ideal for using a credit card.

Reasons to Use a Credit Card

Why Are Credit Cards More Convenient Than Debit Cards?

Here are 5 basic rules of thumb to follow when deciding which card to use for your purchases.

#1: You want to build your credit

Many consumers perceive debit and credit cards as essentially the same thing. They are not.

A debit card is merely a convenient way to spend the money you already have in your checking account.

In other words, it is just like spending cash.

You don’t build a healthy credit profile spending cash, so don’t imagine that you are building your credit by using your debit card. You need to have and use credit to build a great credit score.

If you’re just starting out in the credit card space, a credit-building card may be a great option for you.

#2: You want to minimize your fraud liability

Credit cards can help you mitigate the damage caused by two main categories of financial fraud: identity theft and plain-old dishonesty.

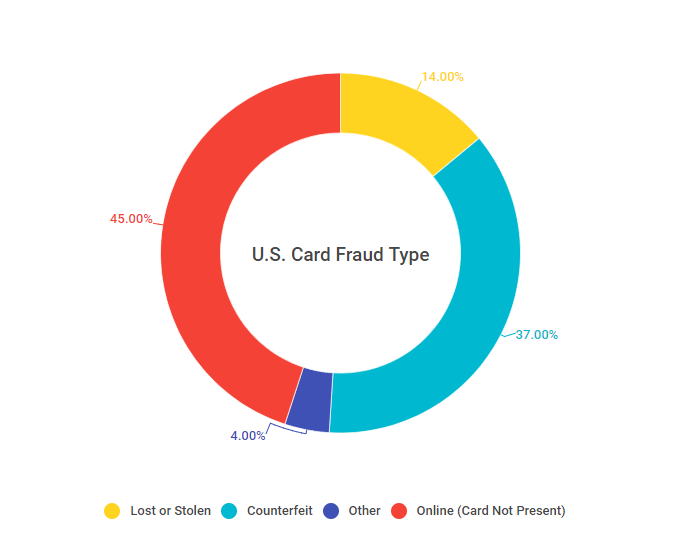

Take a look at the the types of credit card theft in 2014, representing 12.7 million Americans.

Source: Nasdaq – Credit Card Fraud and ID Theft Statistics

Identity theft is increasingly prevalent, and your personal financial liability for charges resulting from identity theft depends on what kind of card you use and how you quickly you alert the card issuer in case of a problem.

Federal Law on Credit Card Fraud

By federal law, your liability for credit card fraud can never be more than $50.00.

In the case of debit card fraud, however, you might be liable for the entire amount charged, depending on how quickly you alert the card issuer of the problem.

Note that some banks offer more debit card protection than required by law. Read the fine print or ask your bank!

Protect Your Money by Using Your Credit Cards

Dishonest vendors like it when you pay them straight out of your checking account via cash, check, or debit card.

That’s because it can be much harder for you to get your money back once somebody else already has it.

That incompetent plumber who left your bathroom in shambles would be pleased as punch to receive your debit payment without delay — but if you were wise enough to pay him with a credit card, you can dispute the charges.

Federal law says you don’t have to pay your credit card issuer for those charges while the dispute is pending. If your credit issuer decides in your favor, you’ll never have to pay a dime.

Debit Cards Aren’t So Lucky!

On a debit card, your first problem is that the money is already out of your account.

The bank does have a duty to investigate, but the dispute process varies from one back to the next and tends to involve more work on the part of the consumer (credit card disputes often start with just a single click).

Bonus Tip: If you run your debit card as “credit” and sign for the transaction, the bank has to follow Visa/Mastercard rules and treat the transaction as a credit purchase.

#3: You’re going on vacation

Hotels and rental car agencies will roll out the red carpet for your credit card, but not so much for your debit card.

This is because they don’t know how much money you have in your checking account, but they do know that your credit issuer can always afford to pick up the tab.

As long as they have their money, the rest is between you and your bank.

If you choose to use a debit card instead of credit card in some travel scenarios, expect merchants and vendors to require a deposit in the form of a temporary hold on your account.

#4: You want perks

If you like things like frequent flier miles, cash back, and extra insurance, you probably need to use a credit card.

Some, but not all, credit cards offer perks that you might not even be even aware of — such as extended warranties on large purchases, insurance coverage on rental cars, or price guarantees on the items you buy with the card.

Check out the fine print on your credit card agreement. You might be pleasantly surprised.

Although there may still be one or two debit cards out there somewhere that pay rewards, most banks reward only credit cards.

Here’s how this can work in your favor:

So why is your bank eager to reward you for using a credit card, but not for using a debit card?

Because when you use a credit card, your bank (card issuer) charges a fee to the merchant. There’s also a fee to use debit cards, but it’s lower. The bank can also charge interest on the balance you carry from month to month.If you are a wise credit card user, you will make sure they never have that chance, because you will pay off your entire balance every single billing period.

If you’re not sure whether or not you have the means or self-discipline to pay off your entire balance every single billing period, then keep reading. The next section is especially for you.

The Only Reason to Use a Debit Card

#1. You Want to Manage Your Spending

That’s it.

The list of reasons to use a debit card instead of a credit card includes only one item — but don’t let this brevity fool you, because the one lonely item on this list is definitely a biggie.

In fact, managing spending should be priority number one for us all, far over and above any of the advantages to using a credit card.

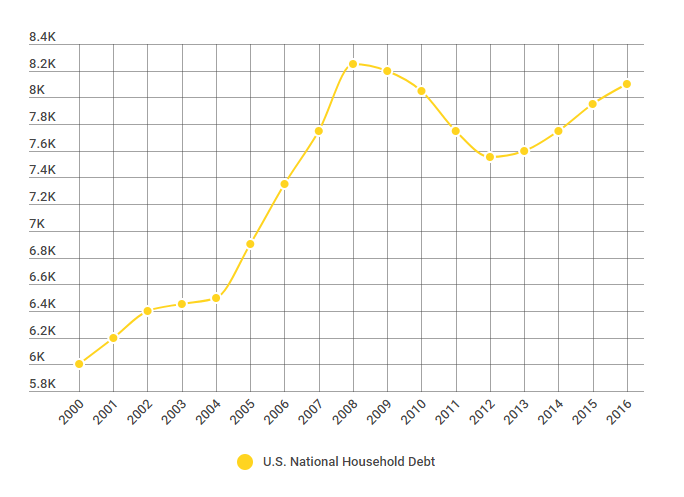

Just take a look at average credit card debt in the United States, and you’ll get the picture:

Source: CNBC – Here’s How Much the Average US Family Has in Credit Card Debt

See? Many people who use credit cards soon find that their reach exceeds their grasp.

Your credit card issuer is more than happy to let you carry forward an increasing credit card balance every month, because when you do that, they get to charge interest.

Your crippling debt is their business success.

The rule of thumb for using a credit card is to never purchase with credit what you cannot afford with cash.

If you do not think you can follow this rule, it is best to avoid credit cards altogether.

Bonus Tip: Opting-In to Debit Card Overdrafts is a Bad Idea

Many banks will allow you to opt-in to overdraft protection on your debit card.

If you do opt-in, your bank will allow you to make a purchase that exceeds your balance.

You’ll pay a hefty fee for the privilege, and the budgeting benefits of debit cards go straight out the window.

Don’t opt-in to overdrafts. When your account is empty, let your card be declined.

Recapping the Key Points

You’ve heard what we had to say, but now it’s time to hear a bit from our members.

Sesame Stories: Which Cards Do You Use?

Sesame Stories are the perspectives of our members on the topic we are discussing.

Brandyn B.

Member since 2015

Q: Do you use credit, debit or both?

A: Both but mostly my debit card.

Q: What purchases do you prefer to make with credit cards and why?

A: I have a credit card that I use for travel (airfare, car rentals) because the last time I rented a car with a debit card they put a big hold on my funds

Q: What purchases do you prefer to make with debit cards and why?

A: I do all my normal spending on my debit card, gas, groceries, whenever I eat out, because I do not want to get a bill in the mail.

Q: Can you explain how debit cards affect your credit?

A: My debit card is not on my credit report, which I know because I got all three credit reports last year.

Q: Did you ever choose debit over credit (or vice versa) and later regret it? Why?

A: Yes, absolutely. I used a credit card for about six months and before I knew it I owed almost $2,000. It took me more than a year and a half to get that bill paid off and I don’t want to be in that situation again. I use my debit card because then I know exactly how much money I have to spend every month.

Brandyn got a new credit card and used it for only six months.

Before she knew it, she had racked up a $2,000 debt that would take her the next year and a half to pay off.

She says she learned her lesson: “I don’t ever want to be in that situation again. I use my debit card now, because with my debit card I know exactly how much money I have to spend every month.”

Contrast Brandyn’s story with that of Janice, who “found out the hard way” that using debit cards did nothing for her credit score.

Janice L.

Member since 2014

Q: Do you use credit, debit or both?

A: I use both.

Q: What purchases do you prefer to make with credit cards and why?

A: I use my credit card for most purchases because I want to earn the cash back.

Q: What purchases do you prefer to make with debit cards and why?

A: I only use my debit card to get cash.

Q: Can you explain how debit cards affect your credit?

A: Debit cards do absolutely nothing for your credit, which I found out the hard way. The whole time I was in college I was using a debit card only and I thought I was building an excellent credit history because I had no debt. Then when I went to buy a car they said I had a “thin” file. Basically they had my student loan on my credit report but nothing else, and the student loan was not in repayment yet so there was no payment history to show. I had to take a really expensive car loan even though I had always paid every bill on time.

Q: Did you ever choose debit over credit (or vice versa) and later regret it? Why?

A: Yes, I used debit for so many years thinking I was doing something good. I spend the same amount of money but now I know that I’m doing myself a favor if I use my credit card because my credit score keeps going up.

Like most of us, Janice was familiar with credit horror stories like Brandyn’s, so she assumed (as many people do) that staying out of debt was unambiguously good.

That’s why, as a college student, she exclusively used her debit card.

She wanted to avoid accumulating debt of any kind.

But this cautious policy backfired on Janice after college, when she wanted to buy a car.

She found out that her credit score was not good enough to quality for the loan she wanted, because her decision to avoid using credit meant that she had almost no credit history.

“No credit” may be better than bad credit, but it didn’t help Janice get what she wanted.

You can avoid the problems that Brandyn and Janice experienced by carefully defining your financial goals and choosing the card that best helps you reach those goals.

Conclusion & Summary

Use your credit card to build credit.

Use your debit card if you think you might spend more than you can afford to pay back when the bill arrives.

A great credit score is not worth crippling debt.

If you do use a debit card, choose one that has the Visa or Mastercard logo on it. That may give you extra protection or benefits.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available.

Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click on the “Apply Now” button, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.