If you’ve recently checked your credit and discovered that your credit score is 616, congrats. You’ve taken the first step into taking better care of your credit health by looking into your credit report and knowing your score. But do you really know what a 680 credit score means?

What is a 616 credit score in terms of financial power?

For the purpose of this article, we’re going to look at the FICO Score model for credit scores, since it is the most wicredit monitoring programsdely used and known model. FICO Scores are three-digit scores that fall somewhere between 300 and 850 — and the higher your score is, the better your credit is. On the FICO scale, 616 is considered to be Poor credit, but there are plenty of lenders who will extend credit to people with scores in this range. Consumers with this credit score can, however, be considered poor borrowers, and may be subject to higher interest rates or less than ideal terms for loans and/or credit cards.

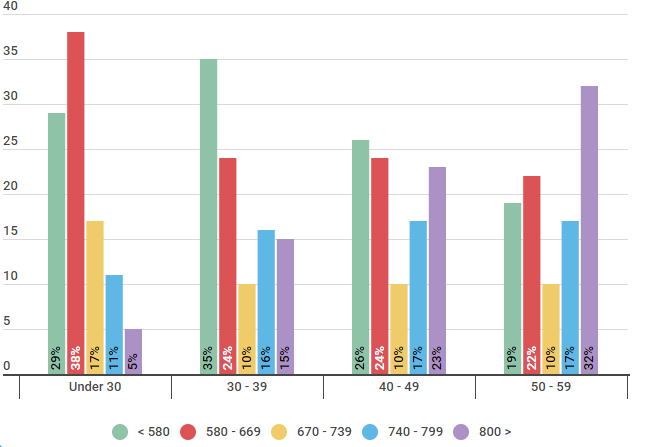

Here’s a breakdown of where US consumers stand when it comes to their credit scores:

U.S. Population Divided by FICO Score Ranges

| Age | < 580 | 580 - 669 | 670 - 739 | 740 - 799 | 800 > |

|---|---|---|---|---|---|

| Under 30 | 29% | 38% | 17% | 11% | 5% |

| 30 - 39 | 35% | 24% | 10% | 16% | 15% |

| 40 - 49 | 26% | 24% | 10% | 17% | 23% |

| 50 - 59 | 19% | 22% | 10% | 17% | 32% |

Source: We ran a survey of 550 US consumers in different age groups on 9/26/2018 to understand which credit score ranges they fell into.

If your credit score isn’t where you want it to be, don’t fret — there are steps that you can take to help build and improve your credit. But before you can know how to improve your score, you need to first understand the individual factors that contribute to your score.

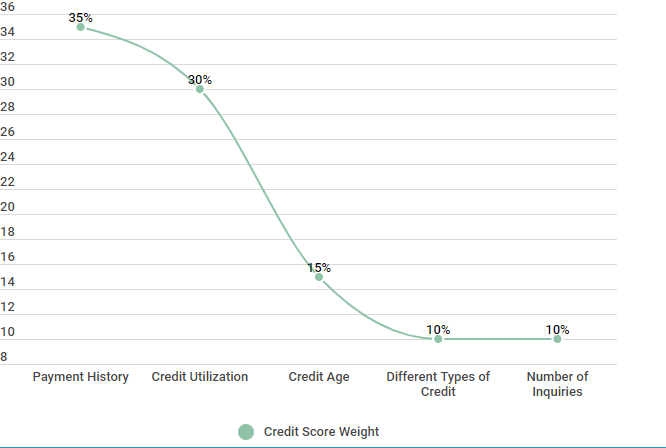

Factors in your credit score

In order to fully understand your credit score, let’s take a closer look at what goes into building your score.

- Payment History. Your payment history accounts for 35 percent of your total score, making it the single most important factor. The best thing you can do for your credit score is to make at least your minimum payment due on time each month — every month.

- Credit Utilization. Your credit utilization isn’t far behind your payment history when it comes to weight. Accounting for 30 percent of your credit score, your credit utilization can most simply be thought of as the total debt you owe compared to your total credit limit. You should aim to keep this number below 30 percent. The best credit scores have a credit utilization between 1 and 10 percent.

- Credit Age. Another factor in your credit score is the length or age of your credit history. This accounts for 15 percent of your score. Some lenders want to see the age of your oldest account; others want to see an average age of all of your open accounts. Either way, be sure to keep your oldest accounts open and in good standing.

- Different Types of Credit. Lenders want to see different types of credit on your credit report to demonstrate responsible behavior with different types of credit. While this may sound intimidating, there’s a good chance you already have different types of credit on your credit report — for instance, consumer credit cards, auto loans, or a student loan are different types of accounts. Different types of credit account for 10 percent of your Credit Score.

- Number of Inquiries. Rounding out the last 10 percent of your score, the number of hard inquiries on your credit report can cause your score to drop slightly. While

checking your credit yourself (a soft inquiry) won’t hurt your score, hard inquiries (such as when you apply for a new credit card) will — so limit the number of new accounts that you apply for.

FICO Scoring Model Calculation (Weight) Factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: https://www.myfico.com/credit-education/whats-in-your-credit-score

All of these factors are considered when calculating your credit score. Some factors, ranked by their weight in the total score, count more than others. There are many different ways to improve your credit score, some of which can deliver rapid increases from 616 and some deliver results over longer periods of time.

What can you expect with a 616 credit score?

With a 616 credit score, while you are still considered to have Fair credit, there are plenty of lenders who will be willing to work with you, whether you are looking for a car, a house, or get a credit card. However, the chances are good that you will end up paying a bit more for the same items than someone with a better credit score.

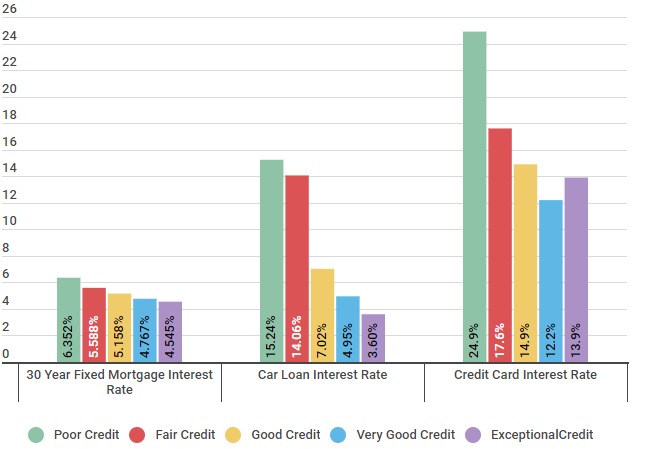

Here’s a quick breakdown of average interest rates for different credit score ranges on some of the most common purchases impacted by credit scores:

Interest Rate Ranges for Different Credit Score Ranks

| Type of Loan | Poor Credit | Fair Credit | Good Credit | Very Good Credit | Exceptional Credit |

|---|---|---|---|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% | 5.588% | 5.158% | 4.767% | 4.545% |

| Car Loan Interest Rate | 15.24% | 14.06% | 7.02% | 4.95% | 3.60% |

| Credit Card Interest Rate | 24.9% | 17.6% | 14.9% | 12.2% | 13.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning on January 18, 2018.

As you can see, you’ll end up paying a significant amount more in interest to purchase the same thing. For instance, the average credit card interest rate for someone with Fair credit is nearly 18 percent — this number is slashed quite a bit for someone with Good credit.

Similarly, the interest rate on a car loan for someone with Fair credit can be upward of 14 percent — that number is closer to three percent with exceptional credit. In other words, it pays (literally) to try to improve your score.

Of course, there’s always room for improvement! If you’re not happy with your 616 credit score, one of the first (and best) things you can do is clear up any negative information on your report. Let’s look at how to do that.

Dealing with negative information on your credit report

It’s no secret that negative information can have a huge impact on your credit score and your credit report — not to mention moving forward, your ability to get new credit with favorable terms. Negative marks do not last forever. There are several things that can have a negative impact on your credit score:

- Chapter 7 bankruptcy stays on your credit report for 10 years

- Late payments or past due accounts stay on your credit report for 7 years

- Accounts that are sent to collections stay on your credit report for 7 years

- Chapter 13 bankruptcy stays on your credit report for 7 years

- Hard inquiries stay on your credit report for 2 years

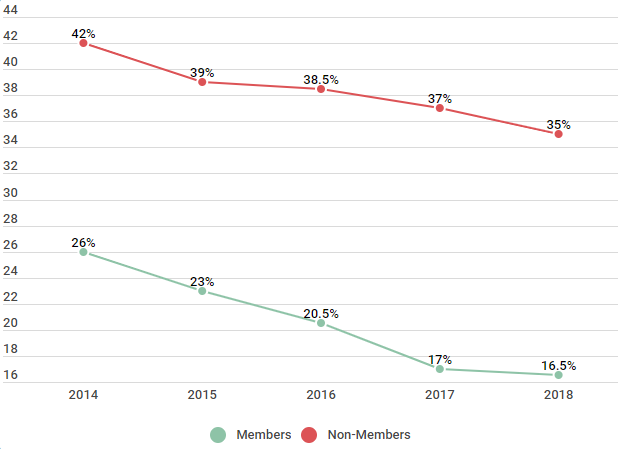

Research has shown that many US consumers find their credit reports contain errors. Over time that number has shown a decrease, but with just under 17 percent of Credit Sesame members still finding errors, it is wise to be vigilant.

Percentage of consumers who found inaccuracies on their credit report from 2014-2018

| Found Inaccuracies on Credit Report | Members | Non-Members |

|---|---|---|

| 2014 | 26% | 42% |

| 2015 | 23% | 39% |

| 2016 | 20.5% | 38.5% |

| 2017 | 17% | 37% |

| 2018 | 16.5% | 35% |

Source: Survey of 500 members and non-members who check their credit reports yearly. A Survey was done in annually in October.

The first step to improving your credit is to make sure all the information on your current credit report is accurate. Next:

- File disputes for any inaccuracies; accurate information, however damning, is not removable.

- Improve your previous negative habits and replace them with good habits. Bring any overdue accounts current, pay any liens (if necessary), work with collection agencies and creditors to clear up any collections, don’t apply for any new lines of credit, make sure to pay all of your bills on time, and pay down current debt ASAP.

Credit Report Inaccuracies, percentage resolved, and length until resolution

| Inaccuracies and resolution timeline | Members | Non-Members |

|---|---|---|

| Found Inaccuracies | 17% | 37% |

| Resolved Inaccuracies | 74% | 62% |

| Average Time for Credit to be Adjusted | <45 Days | 45-60 Days |

Source: Survey of 500 members and non-members who found inaccuracies on their credit report. Survey completed over the course of 9 months from December 1, 2017 – August 1, 2018.

The great thing about credit scores is that they’re not permanent — there’s always room for improvement. In fact, one of our Credit Sesame members was able to improve his score by 134 points in just two years. Here is her story:

| Free credit score |

|---|

| What's a credit score |

| Building credit |

| How to improve your credit score |

| What is a great credit score |

| What is considered excellent credit |

How Sira improved her 616 credit score to 750 in 2 years

Member Since: 7/08/2015

| The great thing about credit scores is that they’re not permanent — there’s always room for improvement. In fact, one of our Credit Sesame members was able to improve his score by 134 points in just two years. Here is her story: | |||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| How | were | you | able | to | raise | your | 616 | credit | score? | ||||||||||||||||||||||||||||||||||

| I was irresponsible with credit when I was younger. I used credit cards to buy fast food, take trips across the country I couldn’t afford, and buy things I didn’t need. A few years ago, I got a serious promotion with an even more serious wage increase. My boss (who’s also my mentor) suggested I pull my credit score and pay down my debt. I didn’t realize that Equifax, Experian, and Transunion all reported to the VantageScore. I was able to pay down the debts of my youth and raise my credit score. by nearly 20 points right off the bat. | |||||||||||||||||||||||||||||||||||||||||||

| What | was | your | score | previously? | |||||||||||||||||||||||||||||||||||||||

| My score was really low when I started paying attention to it, 616, which isn’t very bad, but it isn’t good either. | |||||||||||||||||||||||||||||||||||||||||||

| How | long | did | it | take | for | you | to | see | a | difference? | |||||||||||||||||||||||||||||||||

| Improving | my | credit | score | was | easy | because | I | had | a | chunk | of | money | from | my | promotion | to | pay | off | my | debts | and | decrease | my | credit | card | utilization | to | less | than | 25 | percent. | I | saw | my | credit | score | rise | 20 | points | within | a | few | weeks. |

Many people are similar to Sira in that they used credit irresponsibly, but it doesn’t always have to be that way. Checking your credit, enrolling in credit monitoring programs, and paying on time, every time can go a long ways towards a positive credit future.

TLDR; what can you do with a 616 credit score?

To recap, while a 616 credit score certainly isn’t the best score you can have, you still have plenty of options when it comes to your credit (even though you may have to pay a bit more for them). The best thing you can do is to take the proper steps to work to improve your score.

The good news? Time, along with the proper steps and action, can improve even the lowest credit score. The impact of the negative factors on your score lessens, and the negative marks will eventually fall off completely — leaving you with a higher score. While you’re waiting, good credit habits will help you build positive credit. These behaviors today mean that when the negative reports cycle off of your credit report in the future, you’re left with a better score.