If you’ve just checked your credit prior to a big purchase and found your score was less than desirable, don’t worry. There are ways to improve your score quickly —in as little as 30 days. From strategies to improve your score quickly to the benefits of repairing your credit, we’ll tackle all of that and more in this article.

Introduction

Perhaps your credit score has always been an “out of sight, out of mind” thing. That’s maybe okay until you go to buy a car or apply for a job that requires a credit check and realize that your score is not as great as you’d hoped.

Whether you’re just trying to fix your score because you know you should or because you want a better rate on that upcoming purchase, let’s look at some of the ways you can improve your score in as little as 30 days.

Why you should know how to improve your credit in 30 days

Your credit score, love it or hate it, gives lenders a snapshot of your credit history and financial wellbeing. It’s used to quickly gauge your trustworthiness as a borrower and the likelihood that you’ll repay your debts as promised.

Those three digits that make up your credit score can have huge implications on your life. For instance, interest rates are almost always directly determined by your credit score, insurance carriers often take your credit score into consideration for premium rates, and you may even be out of the running for certain jobs if your credit is poor. So, if your credit is bad, it could not only be the source of major headaches — it could also be costing you thousands of dollars.

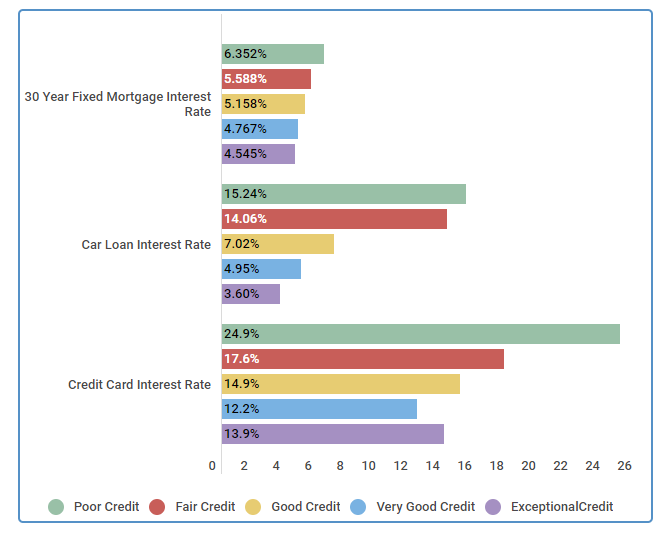

Below is a chart that shows the different interest rates for different credit score ranges.

Interest Rate Ranges for Different Credit Score Ranks

| Type of Loan | Poor Credit | Fair Credit | Good Credit | Very Good Credit | Exceptional Credit |

|---|---|---|---|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% | 5.588% | 5.158% | 4.767% | 4.545% |

| Car Loan Interest Rate | 15.24% | 14.06% | 7.02% | 4.95% | 3.60% |

| Credit Card Interest Rate | 24.9% | 17.6% | 14.9% | 12.2% | 13.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018.

Let’s look closer at the interest rates for car loans. Say you’re applying for a 5-year, $30,000 loan to purchase a new car. If you have exceptional credit, your interest rate could be 3.6 percent — meaning, a $547 monthly car payment. However, if you have poor credit, your interest rate could be 15.24% — which translates to a monthly payment of $717, for the very same car.

Ways to improve your credit in 30 days

Sometimes, even the smallest change to your credit can have a big impact on your borrowing power. If you know you’re about to buy a car or are working to get a home, you can take some of these steps to quickly improve your score. You might just end up moving from one credit range to another, which (as we saw in the data above) could have a big impact.

Remember, moving from just poor credit on a car loan to fair credit means moving from 15.24% interest to 14.06%. And, that’s just moving up one range, think of the differences of going from poor to excellent.

Although improving your credit can take time, there are some strategies you can take to see results quickly.

Check your credit report

The first step to take when trying to improve your credit score is to check your credit report. After all, until you know what your credit score is and what information is contained in your credit report, how do you know where to begin? Your credit score can fluctuate month to month, and your credit behavior is also updated on a regular basis, so we recommend checking your score on a monthly basis. If something looks off, request a copy of your full credit report from all three major credit bureaus.

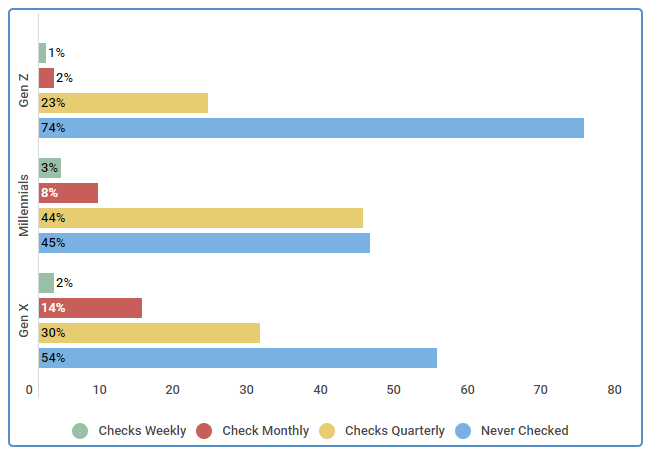

Even though consumers can easily find their credit scores on Creditsesame.com, many do not. Regardless of why, Americans in general are not checking their credit often enough. To find out if that is really what is happening, Credit Sesame surveyed 650 consumers to see how often credit scores are checked.

How Many Americans Know Their Credit Scores?

| Generation | Checks Weekly | Check Monthly | Checks Quarterly | Never Checked |

|---|---|---|---|---|

| Gen Z | 1% | 2% | 23% | 74% |

| Millennials | 3% | 8% | 44% | 45% |

| Gen X | 2% | 14% | 30% | 54% |

Source: We surveyed 650 US consumers on 9/5/18 during a time period of 2 weeks.

As the data above indicates, the majority of US consumers never check their credit score — meaning that they could be missing errors in their credit report that may be negatively affecting their scores.

Dispute any errors

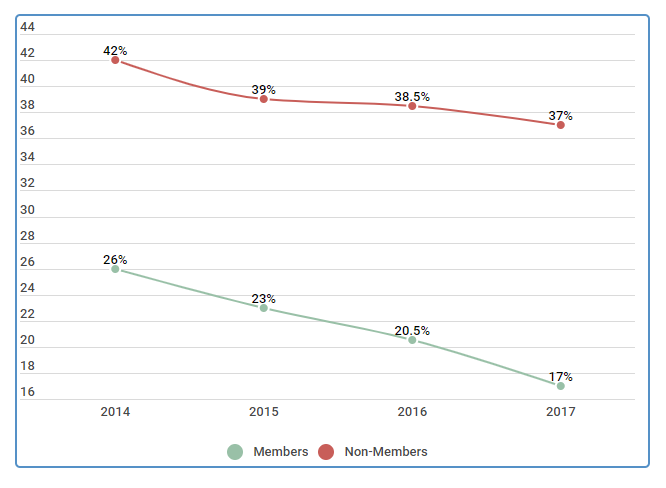

Research has shown that as many as 37% of consumers found errors on their credit report in 2017. Sometimes, the impact is negligible — other times, it can be catastrophic. Either way, if you find an error on your credit report, be sure to dispute it with the credit bureau.

Percent of credit reports that contain errors for members and non-members between 2014-2017

| Found Inaccuracies on Credit Report | Members | Non-Members |

|---|---|---|

| 2014 | 26% | 42% |

| 2015 | 23% | 39% |

| 2016 | 20.5% | 38.5% |

| 2017 | 17% | 37% |

Source: Survey of 500 members and non-members who check their credit reports yearly. Survey was done in October annually.

If you find an error in your credit report, keep in mind that you’ll want to check your credit report with the other bureaus to see if the false or outdated information has been reported to them, as well.

Clear up any collections accounts

If you have any collections accounts with small balances, or balances that you don’t mind paying in full, contact the collections agency and tell them you want to arrange a “pay for delete.” This is exactly what it sounds like — you want to pay off the account to have it deleted from your credit report. You should also tell them you’d like a confirmation letter, before paying off the balance.

If the collections agency won’t agree to remove the account from your credit report, you always have the option of not paying the balance — after all, the damage has been done to your credit. Without an agreement to remove the account from your report, your credit won’t improve even by paying off the account.

Average improvement to credit score by removing a collections account

| Credit Ranking | 30 Days |

|---|---|

| Excellent (800+) | 3% |

| Very Good (750+) | 3.5% |

| Good (700+) | 7% |

| Fair (650+) | 9.9% |

| Poor (600+) | 11% |

| Bad (550<) | 14% |

Source: Survey of 2000 members and non-members 5/5/2018.

* If you have a collections on your credit report, it is nearly impossible to have an excellent or very good credit score.

As you can see above, if you have a collections account on your credit report, it is nearly impossible to have excellent, or even very good credit. However, if you fall into one of the other categories (good, fair, poor, or bad), removing a collections account from your credit report can have a significant impact on your score — as much as 30%.

| Related to "Improve Credit Score in 30 Days" |

|---|

| Free Credit Score |

| Credit Freeze |

| What is a Good Credit Score |

| Discover Scorecard |

| Credit Repair |

| How to Improve Your Credit Score |

Reduce the amount of debt you owe

Another tactic to quickly improve your credit score is to reduce the amount of debt you owe, thereby decreasing your credit utilization. Your credit utilization is one of the largest factors in your credit score, so this strategy can make a big impact — and quickly.

Average improvement to credit score by improving debt ratio

| Credit Ranking | 30 Days |

|---|---|

| Excellent (800+) | 1% |

| Very Good (750+) | 1.8% |

| Good (700+) | 3% |

| Fair (650+) | 4.5% |

| Poor (600+) | 6% |

| Bad (550<) | 9% |

Source: Survey of 2000 members and non-members 5/5/2018.

This is a great strategy for everyone to employ, since it will benefit you regardless of your current credit score. Even those with excellent credit will see a slight bump in their score by increasing their credit limits.

Become an authorized user

Another strategy that will help you improve your score is to be added as an authorized user on someone else’s account. By becoming an authorized user on the account of someone with a good credit history can lend you instant credibility when it comes to your own credit. But use this strategy wisely — since the owner of the account is responsible for paying the bill for the account, you’ll want to use it responsibly.

Average credit score improvement at 30 days as an authorized user divided by credit rankings

| Credit Ranking | 30 Days |

|---|---|

| Excellent (800+) | 1% |

| Very Good (750+) | 1.5% |

| Good (700+) | 3.5% |

| Fair (650+) | 9.6% |

| Poor (600+) | 9.6% |

| Bad (550<) | 10% |

Source: Survey of 2000 members and non-members 5/5/2018.

This is an especially strong strategy for those with fair, poor or bad credit. As you can see from the data above, these groups can expect to see anywhere from a 9.6 percent to a 10% increase in their scores.

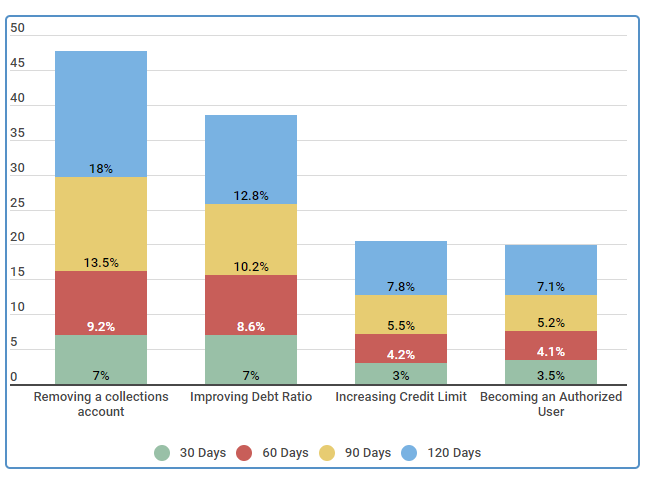

Building credit takes time

One of the most important things to remember, however, is that building credit takes time — so don’t be discouraged if you don’t see drastic improvements at the 30 day mark. Let’s take a quick look at the impact the strategies above have further down the road.

Average improvement over time for various credit improving methods

| Credit improving method | 30 Days | 60 Days | 90 Days | 120 Days |

|---|---|---|---|---|

| Removing a collections account | 7% | 9.2% | 13.5% | 18% |

| Improving Debt Ratio | 7% | 8.6% | 10.2% | 12.8% |

| Increasing Credit Limit | 3% | 4.2% | 5.5% | 7.8% |

| Becoming an Authorized User | 3.5% | 4.1% | 5.2% | 7.1% |

Source: Survey of 2000 members and non-members 5/5/2018.

Each of the strategies above work to steadily improve your credit over time, so don’t give up. For instance, increasing your credit limit may lead to a 3 percent increase in your score at the 30 day mark, but increases to nearly 8 percent by 4 months.

Benefits of improving your credit quickly

Your credit score, as part of your overall credit and financial health, will touch nearly every aspect of your life. From the interest rate you’ll pay on your credit card for those small purchases to whether or not you’ll be able to get a loan to buy your dream car, your credit plays a bigger role than you may initially realize. Taking control of your credit now and working to improve your credit score will not only make it easier for you to have the things you need and want, it will also save you thousands in the process.

We talked with Credit Sesame member, Ivan, to find out why he needed to raise his credit score in just 30 days — and how he managed to do it. Here are the steps he took to raise his credit score nearly 30 points in just 30 days.

Ivan had to raise his credit in 30 days

Description: Ivan a 29 year old just received a job offer across the country. The state that he is moving to allows employers to check credit before hiring, and his job offer is contingent on him raising his credit by at least 30 points. They will only hold the job for 31 days, and this is Ivan’s dream job. With hard work and the help of Credit Sesame he was able to do it. Here is how.

| Factor | Update Date | Change | Score |

|---|---|---|---|

| Received offer contingent on credit | June 2018 | 0+ | 725 |

| Paid credit card before due date | June 2018 | +6 | 731 |

| Paid down debt, increased ratio | June 2018 | +9 | 740 |

| Decreased Utilization | July 2018 | +6 | 746 |

| Paid credit card halfway through month | July 2018 | +7 | 753 |

| End of credit cycle | July 2018 | +0 | 753 |

Source: We ran the survey and collected different cases from our members between September 2015 and September 2016.

Ivan’s story is important because it stresses the importance of credit and the role that it can play in your everyday life — even serving as the deciding factor in whether or not you’ll be offered your dream job.

Conclusion & summary

Your credit can have a tremendous impact on your life. Not only can good credit make it easier for you to purchase expensive items, it can also save you a significant amount of money in the process. Sometimes you need to improve your credit score quickly. Fortunately, it’s possible to improve your credit score quickly — often in as little as 30 days.

Once your credit score has improved, remember to use your credit wisely moving forward. Try to avoid debt whenever possible, pay your bills on time, and try to pay off your credit cards each month to avoid interest charges. The ultimate goal is to improve your financial health, and improving your credit score nearly always improves your overall financial health in the process.