When it comes to important digits, you might be surprised by which one ranks at the top. No, it’s not your Social Security number. Or your phone number. And it’s not even your birthdate or your zip code. Stumped?

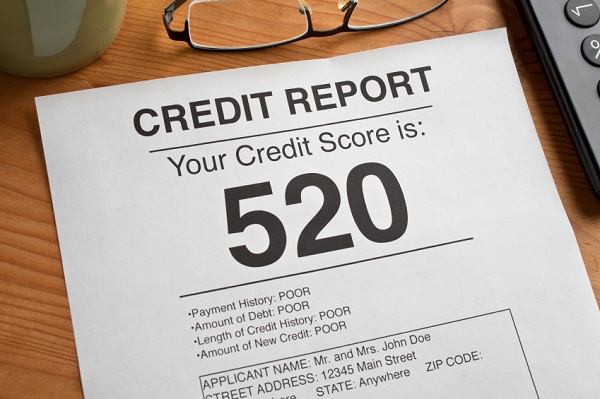

It’s your credit score. This powerful three digit number can be your best friend or your worst enemy. You may already know that a poor credit score can keep you from borrowing money to purchase a house or getting a credit card. But there are numerous other ways that having bad credit can negatively affect your life.

It is a fact of life that things get hard now and then, financially speaking, for most of us. During these times, running up a credit card balance might seem more desirable an option than buying your children fewer Christmas gifts. Or, faced with a layoff or unexpected large expense, you might consider skipping a credit card or loan payment. Worse still, you might simply stop paying a debt and let it go completely into default.

Unfortunately, the momentary relief of the financial obligation will be repaid a hundred or thousand-fold in negative financial consequences. Having poor financial health takes its toll. How much does bad credit cost you? Read on for surprising answers.

Don’t think bad credit can hurt you? Here are 17 ways that show otherwise.

[cta button=”text for button” image=”http://override-default-image-url” link=”http://override-default-link/”]Get your free credit score—no credit card required![/cta]

1. Employment Troubles

What does your credit history have to do with your job performance? You may think that the answer is nothing — but that’s not how a lot of employers see it. Federal law allows workplaces to pull both employees’ and applicants’ credit reports. If you earn more than $75,000 per year, your employer will see even more information than any lender who checks your credit. For high earners, the report will contain liens, collections, judgments and bankruptcies outside the normal reporting window of seven to ten years.

Not only that, but the information contained in the files can be used to make hiring choices or as a reason to take disciplinary action or even terminate someone. Currently, only 10 states restrict an employer’s ability to access your credit report or use it when making employment decisions. According to a 2013 study by Demos, 10 percent of people have been denied a position due to information contained in their credit report.

In all states, the employer must have your written permission before accessing your credit report. And in most cases, they won’t tell you if something on your credit report caused them to decline to offer the job.

2. Lack of Means to Pay for Emergencies

Did your furnace bite the dust? Or maybe you had a car accident and your insurance coverage left you on the hook for a large portion of the expense? If you have bad credit, it’s unlikely that you’ve built a proper emergency fund. And without that, you’re going to have difficulty paying when something unexpected crops up. Even worse, having poor credit will likely keep you from qualifying for an emergency loan.

3. More Stress

Poor credit can wreak havoc on all areas of your life — including your mental state. If you’re financially strapped and worrying about maxed out credit cards, struggling to manage overwhelming debt, and dreading phone calls from debt collectors for unpaid bills —the financial stress and sleepless nights can really take a toll on your mental and physical wellbeing.

4. Unhealthy Lifestyle

If you don’t have good credit, it’s likely that your bank account is always running on empty. Which means that you’re probably going without things you might need in life, such as doctor’s visits, medication or even food.

5. Expensive Car Insurance

Bad news: Many states allow insurers to charge drivers with low credit higher rates to insure their personal vehicles. (They also allow denial of coverage.) That’s because some insurers think that if you’re irresponsible with your finances (like you don’t pay your bills on time), that you’re also more likely to be irresponsible behind the wheel.

6. Effect on Professional Standing

Because of the Fair Credit Reporting Act, workers who receive professional licenses (think: medical professionals, teachers, contractors) can have their credit checked by the government agency issuing the certificate. If yours is poor, it’s possible that your license could be withheld.

7. Relationship Drama

Awful credit can have a detrimental effect on your personal relationships. CNN reports that up to 30 percent of women and 20 percent of men say they will not marry a person with bad credit. And 75 percent of women say they consider a potential date’s credit score in dating decisions. Even worse, marriages can take a beating if bad credit is involved. Research conducted by Jeffrey Dow at the National Marriage Project confirms the commonly held belief that financial troubles can cause major marital problems. His work found that couples that accumulated debt become more unhappy than those that those that pay off debt together. (The rate of discontent increases with the amount of debt accrued.) But credit troubles don’t just stop with arguments and nights going to bed mad at your partner. In fact, money messes more frequently lead to divorce than any other marital troubles — including infidelity.

So word of advice: If you love your spouse, show your credit some love, too.

8. Higher Interest Rates

If your FICO score is between 680 and 720, you’ll be approved for financing to some extent. But you’ll always pay higher rates.

In the case of a mortgage, even a one percent difference will cost you tens of thousands of dollars in extra interest charges over the life of the loan. If you borrow $187,000 at 5 percent, your monthly payment will be around $1,000. The same amount at 6.25 percent costs $1,151 per month. With today’s current market a borrower with stellar credit could pay as little as 4.24 percent, for a monthly payment of $918.*

Average credit, therefore, costs the borrower about $30,600 in additional interest charges over the life of the loan. Poor credit costs the borrower an extra $83,721.

Auto loan interest rates vary even more wildly, from 2 or 3 percent to 17 or 18 percent. A borrower with poor credit could easily pay ten times more in interest charges than someone with excellent credit.

9. Inability to Better Yourself

Want a better job? You might need to go back to school to obtain a higher degree. But if your credit is less-than-desirable, that’s going to be quite difficult (if not impossible), since it’s unlikely that you’ll qualify for a student loan.

10. No Power

If you’re getting ready to turn on your residence’s utilities (water, electricity, gas) — or you want to switch from one service provider to another — you need solid credit. That’s because utility providers often check it before providing service. If you’ve missed payments or made them late in the past, they could require you to put down a deposit, get a letter of guarantee from someone (putting them on the hook for your bill if you skip out on it), or deny you service completely.

11. Bigger Down Payments

If you have bad credit scores you’re probably going to be required to make a larger down payment — regardless of whether you’re buying a house, a car, or a boat. Why? Your three-digit number is an indication of your credit worthiness, which is the judgment of whether or not you’re likely to default on your debt obligations. If your score is bad, lenders will view you as a risky borrower and in turn, will require more cash up front before issuing you a loan.

12. Limited to Alternative Lenders

What are you going to do if you find yourself in a major financial pickle and need to borrow cash? If your credit is bad, and you can’t receive assistance from a traditional lender, you’re going to have to resort to other means, like borrowing money from lenders of last resort, family and friends or trying to crowd source financial assistance.

13. Unfulfilled Aspirations

If you have the entrepreneurial spirit, opening a small business or launching a digital startup might be your ultimate goal. Bad credit can preclude you from achieving your dream since you may not be able to secure a small business loan or a home equity line of credit (even if you put your own home up as collateral).

14. Fewer Travel Options

A break from the stress of every day life is good for the mind and the soul. But if your credit is in the dumps, you may not be able to get away from it all. That’s right, you might not be able to take a vacation. You can’t purchase airline tickets with cash. And most hotels and car rental agencies require a credit card when making a reservation; not having one will be a red flag that you’re a credit risk. Some rental companies do accept a debit card, but it’s probable that they’ll perform a credit check, during which they’ll discover your poor history.

And the hits just keep on coming. Since your credit history is keeping you from getting a credit card, it’s also preventing you from using a rewards card and racking up those valuable points that can be redeemed for free travel, cash-back, and more.

15. Inability to Rent

Landlords want reliable tenants, which is why most conduct a credit check before handing over the keys. If late payments dragged yours down, you could have trouble getting a different property owner to give you a second chance.

16. No Refinancing Options

Mortgage rates have been at or near historic lows for years now. If your interest is higher than you’d like it to be, you might not be able to land a better one if you’ve neglected your credit since buying your home. Because of the Great Recession (and the flood of foreclosures that resulted from it), banks scrutinize borrowers’ credit more now than ever before. If they find it lacking, you’ll be left with your current loan terms.

17. Costlier Property Tax

A study reported in InsuranceJournal revealed that homeowners with bad credit pay a whopping 91 percent (!) more for their property coverage than residents with a great credit history. Forty-seven states allow insurers to hit those with poor credit with higher rates; only California, Massachusetts, and Maryland ban it.

Fortunately, it’s never too late to improve bad credit. To learn more, sign up for a free account with CreditSesame.com, where you’ll get access to your free credit score, a free summary of your credit report summary and a personalized action plan based on your individual credit profile. The service is 100% free and updated every month so you can track and monitor your progress along the way.