Whenever people talk about mortgages it is almost always a discussion between a 30 year and a 15 year mortgage, but what about the middle road? In 2013 a whopping 89% of mortgage borrowers went with a 30 year mortgage, while 8% went with a 15 year mortgage, 3% went with an adjustable rate mortgage, and under 1% selected “other”, a category that would include the 20 year mortgage. Why on Earth is the 20 year mortgage so neglected? I strongly believe that a 20 year mortgage combines the best from a 30 year mortgage and the best from a 15 year mortgage. Using the median home price of $189,000 and subtracting out a 20% down payment, the median loan amount would be around $150,000. Using this figure let’s take a look at how these mortgage options compare.

1. The interest rate is much better than a 30 year loan: Currently a 30 year mortgage has a 4.125% rate, a 20 year mortgage has a 3.75% rate, and a 15 year mortgage has a 3.375% rate. This is a .375% advantage that a 20 year loan has over a 30 year loan. If the amortization timelines were the same, this .375% advantage would save around $50 a month on a $150,000 loan.

2. The monthly payments are more affordable than a 15-year mortgage: With a $150,000 balance a 30 year mortgage payment would be $727 per month, a 20 year mortgage payment would be $889 per month, and a 15 year payment would be $1,063 per month. This makes the 20 year mortgage $174 cheaper than a 15 year mortgage and only $162 more expensive than a 30 year mortgage. The payment is on a 20 year mortgage is actually closer to a 30 year mortgage, even though the total payback time is closer to a 15 year.

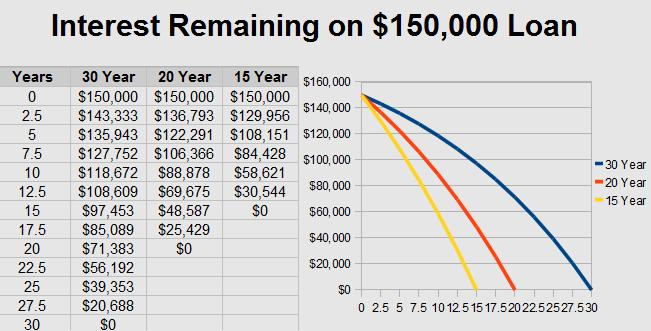

3. The amortization follows more closely to a 15 year than a 30 year: A good representation of how different these loans are is looking at the remaining loan balance 5 years into the loan. After owning a home for 5 years it may be time to move up to a nicer place or move to a different area to take advantage of an exciting job opportunity. 5 years into a 30 year $150,000 mortgage the home owner would still owe $135,943. If the homeowner went with a 20 year mortgage he would only owe $122,291. This $13,000 makes a big difference when going to sell a home.

4. You get 2/3 of the benefits of a 15 year for 1/2 the cost: Compared to a 30 year loan, a 20 year loan is paid off 10 years early, and a 15 year loan is paid off 15 years early. This gives 2/3 of the benefit of a 15 year mortgage. The monthly payment on a 20 year mortgage is 22.3% more than a 30 year payment, while a 15 year monthly payment is 46.2% more than a 30 year. This makes the added monthly cost of a 20 year loan only 48.3% the added cost of a 15 year loan. The total interest paid on a 30 year loan would be a staggering $111,711. The interest paid on a 20 year loan would be $63,440, and the interest paid on a 15 year loan would be $41,365. A 20 year loan saves $48,271 in interest, while the 15 year loan saves $70,346. This shows that a 20 year loan saves 68.6% of the interest amount that a 15 year mortgage does!

5. 20 year mortgages are great for refinancing: It’s only human nature to seek out the best deal. Because of this we refinance our homes when interest rates fall. The problem is that the majority of homeowners who refinance their homes get a new 30 year mortgage. This starts the amortization over again, adding time onto the loan and starting the amortization over again. Sure, the homeowner may be saving some money on the monthly payment, but in the long run can actually end up paying more in total interest. When refinancing, homeowners should strive to get a mortgage that doesn’t add any more time onto their current loan, making a 20 year mortgage a great option.

A 20 year mortgage is much easier to afford on a monthly basis than a 15 year mortgage and takes away the major negatives of a 30 year mortgage; extremely long amortization period and a large total dollar amount of interest paid. With all of the advantages of a 20 year mortgage, would you consider breaking away from the crowd and going with a 20 year mortgage for a purchase or refinance?

Author Bio

John C is a nuclear power plant contractor and personal financial blogger at Action Economics with a goal of retiring by age 45. He lives with his wife and 4 rambunctious boys in beautiful southwest Michigan. He earned a bachelors of Business Administration in 2011 and holds a CAPM certificate.