Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Tax season is in full swing for most of us.

With a relatively straightforward filing, taxes aren’t that much of a headache, but it’s a different story if you itemize.

When your filing is more complicated, keeping track of things like charitable donations, medical expenses and unreimbursed volunteer or work expenses can easily become a nightmare.

If piles of paperwork have you throwing your hands up in frustration every tax season, a solution could be closer than you realize.

Key Points

Using a credit card to pay for deductible expenses can help cut down on the stress by simplifying your accounting.

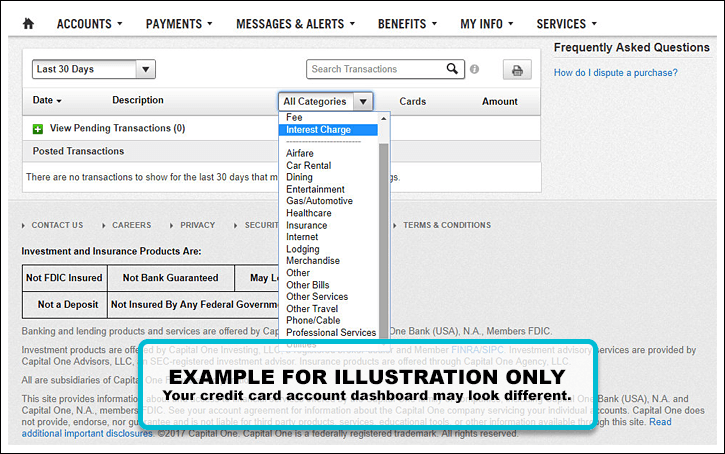

1. Many Credit Cards Allow Transaction Categorization

Choose a card that offers categories that reflect the kind of expenses you want to track, or one allows you to create your own categories. For example, my credit card includes categories for things like healthcare, airfare, car rentals and entertainment, which could be useful if I needed to track deductible medical expenses or travel related to business.

2. Use Your Credit Card to Track Deductible Expenses

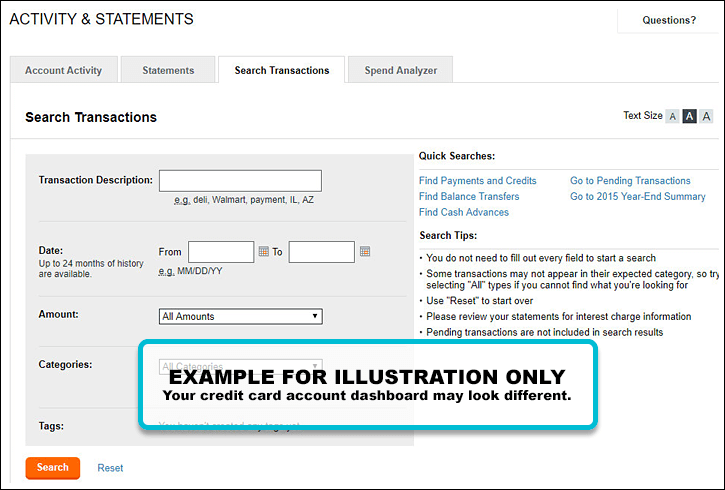

Tracking deductible expenses with a credit card isn’t rocket science. As you make purchases, you assign them to specific categories and tag them accordingly.

You can then search your transaction history and create reports, based on the categories that you selected. Depending on the card, you may also be able to download a year-end summary or statement showing your transactions for the previous 12 months. You can then use that history to help you prepare your return.

Dos and Don’ts

Do: Categorize and Make Notes

Take time to categorize your expenses and include appropriate notes for each transaction. Do this daily, weekly or monthly.

This legwork will make it easier to search for deductible expenses once you’re ready to tackle your tax paperwork.

Do: Use a Dedicated Credit Card for Business Expenses

Use a dedicated card for deductible expenses (and any other expenses you want to track). If you’re using one card to track charitable donations and another for medical and dental expenses and a third card for unreimbursed travel expenses for your job, you’re creating more work for yourself at tax time.

Don’t: Mix Business and Personal

Don’t use the same card for business and personal expenses. Separation is simplification. Also, you may open yourself up to personal legal liability if you co-mingle business and personal funds.

You can deduct certain expenses associated with the card itself, but this gets complicated if you mix business and personal. On a business account, you may be able to deduct the annual fee, late fees, cash advance fees and interest charges. If you co-mingle funds, you can only deduct a percentage of those fees equal to the percentage of business use on the card. See how mixing can really start to muddle things?

Don’t: Carry a Balance

Don’t carry a balance on a business or personal card. If you must carry a balance, do so with a really good understanding of your annual percentage rate (APR). The higher the APR, the more you’ll pay in interest charges for your deductible expenses or anything else you charge.

Pay in full each month to avoid interest charges no matter what your APR is.

Don’t: Miss a Payment

Don’t miss a payment on your card. Of the many factors that influence your credit score, your payment history is the most important.

Do: Take the Time to Choose the Right Card

Think carefully about what card features will best meet your needs. Weigh fees and benefits along with the card’s intended use. You can use a consumer credit card as your designated “business” card, but you should not apply for a business credit card unless you intend to use it for your business.

The Case for Business Cards

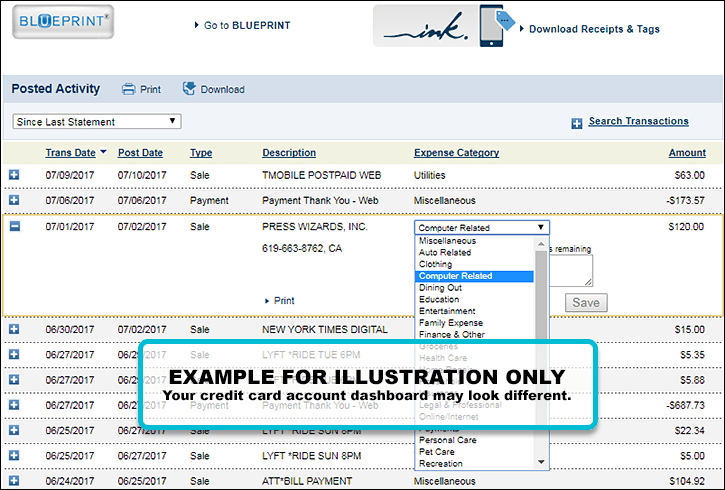

Some business cards offer an easy dashboard where you can assign transactions to specific categories and add memos with additional details. You can customize the transaction history and it’s downloadable.

Business credit cards are not covered by the CARD Act. For example, your due date may change every month.

The Case for Personal Cards

If you just need a way to manage things like charitable donations or medical expenses, a personal credit card may fit the bill just fine.

Personal, or consumer, credit cards come with the full protection of the CARD Act. For example, your due date will be fixed.

If earning rewards on purchases is important to you, decide what type of rewards (travel miles, points or cash back) you want to earn before you apply for a card.

Summary and Conclusion

- Separate business from personal, and use different credit cards for the two.

- Take advantage of your credit card’s expense categorization features.

- Track and categorize your expenses frequently.

- Use a business credit card for business expenses if you want more robust accounting features.

- Don’t carry a balance and don’t pay late.

- Before you apply, check your credit for free on Credit Sesame. In addition to your free credit score, you’ll get recommendations for credit cards that could be a great match for your unique credit profile.

Disclosure: Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. The editorial content on this page is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer. The credit card offers that appear on this site are from credit card companies from which we may receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. All images and trademarks are the property of their respective owners.

See the online provider’s application for details about terms and conditions. Offers are subject to change and the terms displayed may not be available to all consumers. Please visit the provider’s site for current information and verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.