Credit Sesame discusses what might be in store for 2023 interest rates.

In 2022, interest rates rose by about 4.25%, the sharpest increase in a year since the early 1980s. After that unusual jump in rates, the stock market ended the year on a sour note reacting to clear signals from the Fed to expect more rate increases in 2023. Higher interest rates are bad news in a few different ways:

- It is more expensive for consumers to borrow

- Businesses are hurt by slowing consumer demand

- Interest expenses make it harder for a debt-laden government to balance the budget

- The value of stock and bond investments tend to be depressed

Despite all the negatives, higher interest rates are necessary because of high inflation. But what can we expect for 2023 interest rates? Just how high could interest rates go? And what’s the best way to prepare your finances for higher interest rates?

What is a normal interest rate rise?

Interest rates rose so high and so fast in 2022 that it’s easy to think of them as being unusually high now. However, history suggests that they are actually below normal.

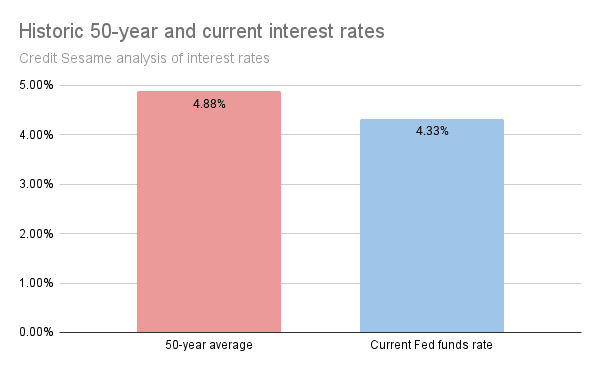

The Fed funds rate is currently 4.33%. Based on Credit Sesame’s calculation of data from the Federal Reserve, over the past 50 years, it has averaged 4.88%. The Fed funds rate would have to rise by a little over half a percent to get back to normal.

This puts things in perspective. Interest rates seem high right now only because they’ve risen a lot recently. However, they started from a low level. The Fed dropped rates to near zero in reaction to the 2008 financial crisis. There they stayed until 2022.

Rates that are even a little above today’s level would be perfectly normal.

What does the Fed expect?

Inflation prompted the Fed to start raising rates toward more typical levels. The past year-and-a-half has seen the highest inflation since the very early 1980s. The Fed uses higher interest rates to try to reduce spending enough to tame inflation. Moreover, regardless of what the Fed does, interest rates are bound to rise when inflation increases. Lenders raise rates to keep up with inflation or risk losing money.

The Fed’s words and deeds over the past year show that it is committed to raising rates until it thinks inflation is under control. The latest example of this came on December 14, following the most recent Fed meeting.

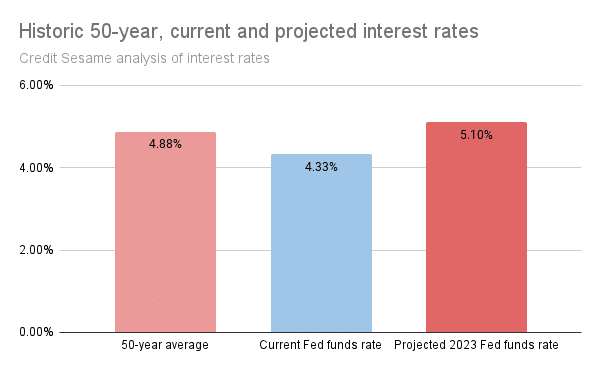

Not only did the Fed raise rates at that meeting, but it released a set of financial projections that show what it expects for the year ahead. The Fed’s projections show that it expects the Fed funds rate to be 5.1% at the end of 2023.

That means the Fed expects to raise rates by another 0.77% by the end of 2023. That year-end projection for 2023 doesn’t exclude the possibility that the Fed could raise rates even more early in the year before lowering them if inflation starts to ease.

The prospect of continued rate increases has set off the prolonged dive in the stock market over the latter half of December. Investors are not thrilled by the outlook for more rate increases. Again, a comparison with historical rates can help put things in perspective.

The Fed’s expected interest rate of 5.1% for next year is slightly higher than the 50-year average. And, while it is 0.77% higher than the current level of rates, this would be a much milder increase than the 4.25% rise seen in 2022.

What if inflation is stubborn?

One possible flaw in the Fed’s rate projection for 2023 is that it assumes inflation will drop by 2.5% in 2023. However, if high inflation proves more stubborn, all bets are off.

Since inflation has a lot to do with the level of interest rates, it’s useful to look at the historical relationship between inflation and interest rates.

As shown previously, over the past 50 years the Fed funds rate has averaged 4.88%. Over the same 50 years, the Consumer Price Index (CPI) has increased by an average of 3.98% a year. That means the Fed funds rate is normally 0.90% higher than inflation.

The most recent CPI release (through the end of November 2022) showed an inflation rate of 7.1% over the previous year. If that does not come down, the Fed may have to keep raising rates to get on top of it. This suggests that the Fed funds rate would have to reach 8.0%.

An 8% Fed funds rate would be bad enough, but that’s a rate used by the Fed and financial institutions. The rates consumers experience would be much higher if inflation does not ease.

For example, based on data from Freddie Mac, Credit Sesame calculates that historically mortgage rates have averaged 2.89% more than the Fed funds rate. This means a Fed funds rate of 8% may mean mortgage rates of nearly 11% for consumers. Let’s hope inflation cools down so this is not even a possibility.

Things would get even more expensive for people with credit card balances. Historically, credit card rates have averaged 12.27% more than the Fed funds rate. So, if inflation were to stay at the current level, average credit card rates above 20% would seem likely in 2023.

The good news is that inflation has already started to ease over the past few months. However, if this doesn’t continue expect interest rates to go much higher next year.

How can you prepare for higher 2023 interest rates?

Looking at history, the Fed’s expectations and current conditions, the conclusion is that rates are likely headed higher next year. The question is, how high? Faced with the likelihood of higher interest rates, here are five things you could consider doing to lessen the impact on your finances:

- Save up for larger down payments. When making a large purchase like a car or a house, saving up for a higher down payment reduces the amount you need to borrow. This saves money on interest.

- More comparison shopping. When rates move quickly, financial companies react differently. Shop around for everything from savings accounts to credit cards to make sure you get the best deal you can on interest rates.

- Create a non-borrowing budget. The 2022 surge in inflation forced many households to borrow to make ends meet. That’s understandable as a temporary solution, but it isn’t sustainable in the long run. Redo your budget so it’s not dependent on continual borrowing.

- Pay down debt. American consumers reached record debt levels in 2022. Unless you want to pay more interest in 2023, start paying some of that debt down.

- Raise your credit score. People with good credit qualify for lower interest rates on loans and credit cards. Improving your credit score could slow down next year’s rise in interest rates on your credit accounts.

Increases in 2023 interest rates should be relatively mild if inflation continues to ease. That does not mean a return to low pre-2022 interest rates. Higher rates are something consumers should get used to and would be wise to manage finances to minimize the impact.

You may also be interested in:

- How Borrowing to Make Ends Meet Adds to the Inflation Problem

- 5 Things to Do as Interest Rates Rise

- What Do Rising Interest Rates Have to Do with Inflation?

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.