Credit Sesame discusses the rise in consumer access to banking services.

The Federal Deposit Insurance Corporation (FDIC) recently updated a study of access to banking products among American consumers. The news was largely positive. The percentage of households without access to at least one bank account has reached an all-time low.

While greater access to banking is a favorable trend, the study was also a reminder that some households remain outside of the banking system. This leaves them at a financial disadvantage to households with regular access to banking products.

Tracking the unbanked population

The FDIC National Survey of Unbanked and Underbanked Households is conducted every other year since 2009. The FDIC works with the Census Bureau to measure the use of banking products throughout the U.S. population. The goal is to promote access to safe and affordable banking products for all Americans.

The recently-released report is based on a survey of 30,000 households conducted in 2021. It measures how many of those households have access to bank accounts and how they use those accounts.

In addition, the survey looks at the use of alternatives to bank accounts, such as money orders, prepaid cards, payday lenders and online payment services.

Besides measuring trends for the population overall, the study provides insights on how demographic characteristics such as income, race and ethnic identity correlate with use of banking services.

Trends in the unbanked population over time

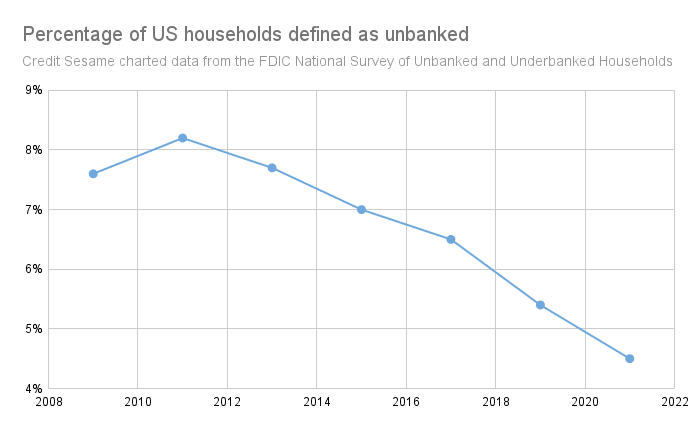

The study defines “unbanked” consumers as those living in a household where no one has a bank account. The following graph shows the trend in the percentage of the population defined as unbanked since the study was first conducted in 2009:

Because this graph is charting the percentage of households that don’t have access to banking, the lower the number the better. In the first survey, 7.6% of the population was defined as unbanked. After rising to a high of 8.2% in the 2011 survey, the percentage of unbanked households has fallen steadily since.

The improvement from the highest unbanked rate set in 2011 to the new low set in the 2021 survey represents roughly 5 million more households that now have access to banking. There remain an estimated 5.9 million U.S. households that are unbanked, compared with a total of 126.6 million households that have access to a bank account.

Why access to banking matters

It’s good for the banking industry if more people open bank accounts, but why should this matter to consumers?

The FDIC tracks this information because it considers it a matter of public policy to promote the use of banking services. The reason is that these services can provide consumers with safe and cost-effective ways of handling their finances.

How consumers can benefit from using banking services

Access to cost-effective payment means

Consumers need ways of making and receiving payments. Banks offer direct deposits from employers and other income sources into accounts. They also offer ways of making payments that include checks, debit cards and electronic transfers.

The cost of services varies from bank to bank, but in many cases can be obtained at no cost. Free checking accounts are easily available, and many process routine transactions at no charge. As long as customers avoid overdrafts and using ATMs that charge transaction fees, they can make and receive payments with little or no cost.

Compare this to some of the alternatives identified by the FDIC report. Check cashing services, prepaid cards, money orders and money transfer services are other ways people can make and receive payments. All typically involve sizeable fees. Those fees represent an added cost to every payment made, and a reduction of every payment received.

Security

Banks give people a safe place to put their money. Not only is a bank account safer than carrying cash around or keeping it at home, but deposit accounts at banks and credit unions are federally insured for up to $250,000 per depositor.

Availability of savings vehicles

Besides giving people a safe place to keep their money, banks offer deposit accounts that can make it easier to budget and build savings.

Keeping money in separate checking and savings accounts can help a person make some money available for spending while setting other money aside for future needs.

Getting into the habit of saving is one way to start working towards financial goals rather than simply living paycheck to paycheck.

Access to credit

Having a relationship with a bank can help consumers get access to relatively low-cost credit products like credit cards and loans. These bank products are typically much less expensive than non-bank alternatives like rent-to-own programs, payday lenders, pawn shops, tax refund anticipation loans or auto title loans.

The FDIC study found that using expensive credit alternatives is more than twice as common among unbanked households as among those with bank accounts.

Digital banking services

Why have so many more households gained access to banking over the past decade?

The growth of online and mobile banking appears to be the reason.

During the last four years, the percentage of bank customers who access their accounts primarily online or through their mobile devices has risen from 52.1% to 65.5%. Meanwhile, the percentage of customers who primarily access their accounts at physical locations like bank branches or ATMs has dropped from 44.3% to 31%.

This transition away from dependence on physical locations is important because some rural and inner-city areas are underserved by banking locations. Also, the number of bank branches has declined by 15% over the past ten years. Without digital banking, it’s possible that access to banking would have dwindled even further.

Online bank accounts typically have lower fees and minimums than traditional, branch-based accounts. This lowers the banking barrier for people with less money.

The FDIC’s report is a reminder that using a bank account can be a cheaper and more secure way to handle your finances than many non-bank alternatives. The report also shows that access to banking has improved over the past decade, making this a good time for anyone still without a bank account to take a fresh look at the possibilities.

You may also be interested in:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.