Credit Sesame on household budgets and debt strain.

Consumers are aware that inflation is squeezing their household budgets. What may sneak up on them is how growing debt obligations add to that squeeze.

Recently released figures from the Federal Reserve show that household debt service ratios have risen for five quarters. When inflation is already challenging those budgets, households need to adjust their approach to debt before the cost becomes overwhelming. Debt payments are taking up a growing part of people’s budgets.

Debt service ratio

What is it, and why does it matter?

Debt service ratio (DSR) measures the average household’s monthly debt payments as a percentage of their after-tax income.

The debt component of DSR includes scheduled monthly payments on loans and the minimum monthly payments on credit card balances. Those payments are affected by the total size of the debt and the interest payments on that debt.

DSR is a good measure of the debt burden on household budgets. In a nutshell, the higher the DSR, the less money left over for other expenses.

Rising debt service ratios add to the inflation squeeze

The average DSR has grown for five straight quarters, going from 8.38% to 9.58%. Americans are paying 1.2% more every month to service their debts.

DSRs have risen for two reasons. The first is that the total amount of debt owed by U.S. consumers has grown. The second reason is that interest rates have increased. In short, people are borrowing more just as it’s getting more expensive to borrow. The result is that debt payments are eating up more and more of monthly household budgets.

While DSRs are not yet at an all-time high, they add strain at a time when high inflation is already taking a toll on household budgets. Inflation makes it harder to afford things you need today, and more of your spending pays for things you already bought.

Non-mortgage debt adds a growing risk element

Not only are debt payments taking up a more significant share of household budgets, but more of those payments are going towards the wrong kind of debt.

What is the wrong kind of debt? The Federal Reserve breaks DSRs down into two parts:

- Mortgage debt

- Non-mortgage debt

While too much of any kind of debt can be a problem, mortgage debt has positive characteristics. It is used for purchasing an asset with long-term value. Mortgage debt also has relatively low-interest rates, and those rates usually don’t change much over the life of a loan.

Unfortunately, the other part of DSRs has grown to become the lion’s share of monthly debt payments, the non-mortgage consumer debt payments.

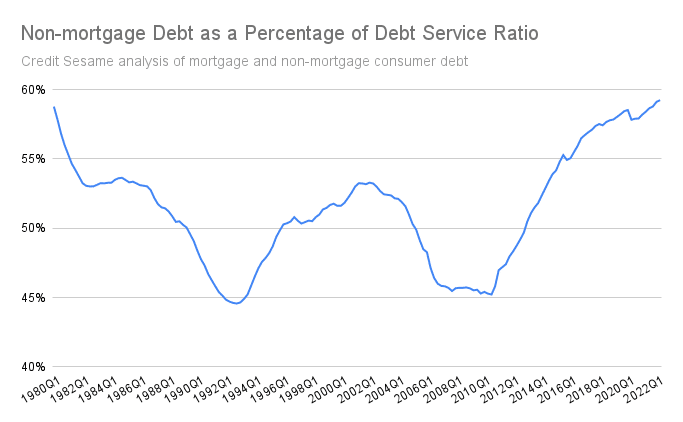

Credit Sesame calculated that in the second quarter of 2022, non-mortgage payments rose to a record percentage of overall DSRs, surpassing the previous record set in the early 1980s. The chart shows that the non-mortgage debt share of DSRs has risen sharply over the past dozen years:

Non-mortgage consumer debt represents a bigger problem than consumer debt because a significant portion is credit card debt. Too much credit card debt can be incredibly unhealthy for a few reasons:

- A rise in credit card debt payments understates the extent to which debt is growing. Monthly credit card payments may be relatively low, resulting in more interest charged over the long run.

- Credit card debt generally carries higher interest rates than other forms of debt.

- Credit card interest rates are variable. As interest rates rise, borrowing becomes more expensive.

- Credit card debt is often used for short-term purchases, unlike mortgage debt, which is used to acquire assets that add to long-term wealth.

Credit risk could compound the problem.

High DSRs could become a bigger problem if the economy worsens. In a recession, income generally falls, so debt payments become a higher portion of household income.

To the extent that more people have trouble making their monthly debt payments, the resulting credit damage would compound the problem.

When credit scores drop, credit card companies often raise their interest rates. Any new loans require higher interest rates. Those higher borrowing costs make debt payments an even more significant burden on household budgets.

Takeaways

Growing DSRs and the higher proportion of non-mortgage debt mean consumers are falling into a trap where debt payments consume more and more of their take-home pay. There are three takeaways for consumers who want to escape that trap:

- This is the wrong time to be increasing debt. Given the shock of sudden price increases, it’s natural that many people’s first response has been to lean more heavily on their credit cards. However, that’s not a sustainable approach. Higher prices require you to rethink your budget, so it’s not dependent on increased borrowing.

- Avoid credit card debt. Sometimes it’s necessary to borrow, but all debt is not the same. Try to minimize credit card debt in favor of other forms of borrowing. Credit card debt is generally more expensive and exposes you to rising interest rates.

- Pay more than the minimum when possible. Low minimum credit card payments keep your debt service payments low now but only prolong your debt and cause you to pay more interest in the long run. The way to pay less for borrowing money is to pay it back as quickly as possible.

DSRs are a good measure of how yesterday’s borrowing eats into today’s and tomorrow’s lifestyles. The way to improve that lifestyle is to limit the burden debt payments place on your budget.

You may also be interested in:

- Rising Credit Card Debt and the Consequences for Consumers

- Pay Down Debt as a Financial Gift to Yourself

Disclaimer: This guide to buying a house and getting a mortgage is for informational purposes only and is not intended as a substitute for professional advice.