One of the most common questions I get from consumers is whether or not paying off or settling old debts will have a positive impact on their credit reports and credit scores. Normally, the question involves charged-off credit card accounts, leftover balances on car loans after a repossession, unpaid collection accounts, tax liens and defaulted student loans.

[Learn More: What Affects Your Credit Score]

Each of these debts can be cleared once they’ve reached delinquency status, which occurs once a certain number of payments have been missed. Delinquent debts can be paid in full or you can attempt to negotiate a settlement with your creditors to pay less than what’s owed. Whether or not you’ll see a change to your credit score right away depends on a few different factors.

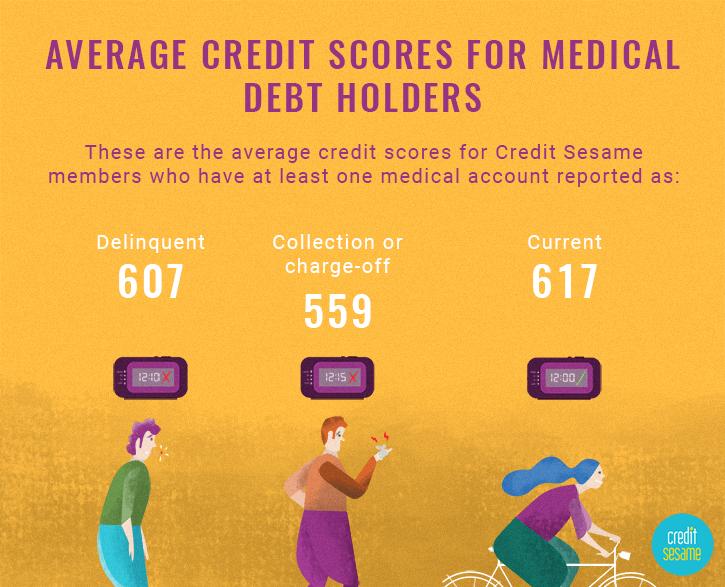

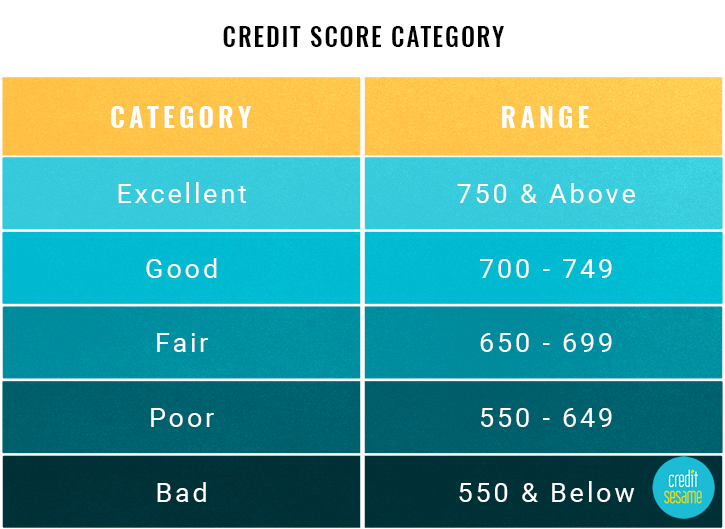

We looked at data from Credit Sesame members who had delinquent or collection accounts, and what their average credit scores looked like. We also examined members who did not have any accounts in collections and found that the average credit score difference was significant. Chances are, if you’re facing collections or delinquent accounts, your credit score has dropped and you need to improve it.

Check your credit score from Credit Sesame and see how you compare.

- The average credit score for Credit Sesame members who have at least one collections account is 570.

- The average credit score for Credit Sesame members who have at least one delinquent account is 551.

- The average credit score for Credit Sesame members who do not have any delinquent or collection accounts is 621.

Reporting delinquent debts

Just paying off a delinquent debt isn’t likely to affect your credit history in the short term. Once a debt has been paid or settled, the next step is making sure that the payoff is reflected on your credit report.

In a perfect credit reporting world, the account would be updated within 30 days to show that the balance has been zeroed out. However, you shouldn’t assume that a creditor or collection agency will do so automatically. The result is that it may be necessary for you to dispute the account with the credit reporting bureaus to make sure it’s updated properly.

[Learn More: Highest Credit Score]

When you initiate a dispute, the reporting bureau is obligated to investigate and resolve your claim but the process can take a few weeks. If you can provide documentation showing that the debt has been paid that can help to speed things up.

How paying off old debts affects your score

Once your account information has been updated on your credit report, your credit score should improve, right? In reality, the answer’s not quite that simple.

While the FICO scoring models are the most popular credit scoring model lenders use, your FICO score isn’t the only credit score you have. There’s also the VantageScore, developed by Equifax, Experian and TransUnion. Older versions of both FICO and VantageScore focused more on the fact that a consumer had a delinquent account, versus how much was owed. Paying off an old debt wouldn’t necessarily do much to soften the blow of the negative mark caused by the delinquency.

In the newest versions of the FICO and VantageScore credit scores, however, paying or settling your delinquent debts, specifically those that have been sent to collections, can result in a higher credit score. Both FICO 9 and VantageScore 3.0 exclude collection accounts from score calculations once they’ve been paid off.

Even if an account hasn’t gone to collections yet, knowing how to pay off collections and actually paying it off or settling has the potential to help your score in another way. (See how this Credit Sesame member removed 12 collections accounts on his own and raised his credit score by 169 points!)

It would also help to understand how to remove collections from credit report, though most commonly it is just a matter of payments and time. Clearing a debt can impact your credit utilization ratio, which is the amount of credit you’re using versus your total credit limit. Ideally, you should be aiming for a utilization ratio of 30% or less.

Prioritizing delinquent debts

If you have multiple delinquent debts, you may be wondering whether paying them off in any particular order will affect your score. In terms of credit reporting, negative items can remain on your report for seven years from the date of the original delinquency. That includes things like late payments, charge-offs and collections.

While the immediate impact of negative items is evidenced by a significant drop in your credit score, they begin to carry less weigh as time goes on. If you have a mix of old and new collection accounts, paying off the ones that occurred most recently is going to be more beneficial to your score.

Once a delinquent debt has passed the seven-year mark, you’ll need to tread carefully when paying it off. At this point, it should fall off your credit report completely but any new activity, including a partial payment, can reactivate the account. If you’re going to tackle a debt that’s aged off your report, be aware that you might create a new account history if you’re not paying in full. In some states, making a partial payment also resets the clock on the statute of limitations (how long the creditor has to sue you for the debt).

Another detail that might be important to you is that medical collection accounts are treated differently than non-medical collection accounts in the newest scoring models. They hurt less. If all else is equal, paying off a non-medical collection account before a medical collection account should result in a greater boost to your score.

[Learn More: How to Fix Your Credit]

Settling vs. paying in full

Considering how FICO and VantageScore’s newest models view paid collection accounts, the goal if you have delinquent debts is to get your balances down to zero. Paying the debts in full is one option but settling those accounts is going to yield the same result with regard to your credit score and potentially save you a ton of money in the process.

When you settle a debt, you’re effectively asking the creditor or collection agency to accept less than the full balance owed to consider the account repaid. Depending on who the creditor is and how long the account has been outstanding, it may be possible to settle for hundreds or even thousands of dollars less than what you owe.

Once the account has a zero balance, it won’t drag down your score anymore. A word of caution about debt settlement, however. Canceled debts generally have to be reported on your taxes as income unless you qualify for an exception or exclusion. If you’re settling large amounts of debt, that could come back to haunt you at tax time.

So how will my score change?

If you’re able to pay or settle a delinquent collection account and you apply for a loan or credit card with a lender that’s using a newer credit scoring system, it’s possible that your scores are going to be higher than if the collection still had a balance. Keep in mind, however, that your score may not change at all, especially if you’ve got other negative information on your credit report.

In terms of how much you could see your score climb, it could be as little as a few points or as much as several dozen points. If you’ve recently paid off a delinquent debt or you’re planning to in the near future, you can check your free credit score right here at Credit Sesame to see whether you’ve gained any points. We use the VantageScore 3.0 model, which is one of the scoring systems that ignores zero dollar collections.

[Learn More: Improve Your Credit Score]

Paying off other delinquent debts

Obviously, collection accounts don’t represent the entire universe of possible delinquent debts. You can be behind on your mortgage, credit cards, student loans and or car loans without any of them being in collection status. Paying past due debts to a zero balance isn’t going to cause FICO and VantageScore to ignore them so you’re less likely to see a significant improvement in your scores as a result. You may earn a few points because scoring systems do consider balances on delinquent accounts, but the fact that you were late in paying in the first place won’t be erased.

Once you’ve gotten caught up on past due accounts and paid off delinquent debts, your focus should be on maintaining the health of your credit score. Paying all of your bills on time, keeping your balances low and limiting how often you apply for new credit are the most important things you can do to keep your score on track.

[Learn More: Good Credit Score Range]